We're Hopeful That Spacetalk (ASX:SPA) Will Use Its Cash Wisely

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Spacetalk (ASX:SPA) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Spacetalk

How Long Is Spacetalk's Cash Runway?

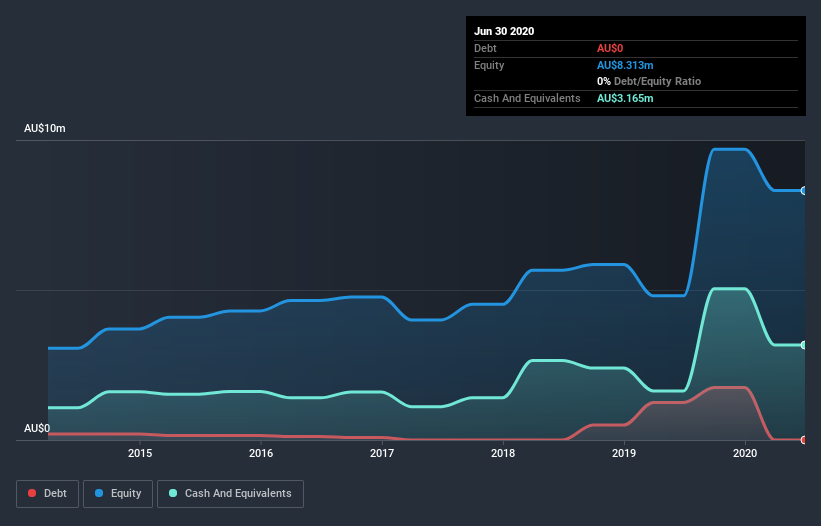

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at June 2020, Spacetalk had cash of AU$3.2m and such minimal debt that we can ignore it for the purposes of this analysis. Importantly, its cash burn was AU$2.2m over the trailing twelve months. That means it had a cash runway of around 17 months as of June 2020. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Spacetalk Growing?

It was fairly positive to see that Spacetalk reduced its cash burn by 20% during the last year. And considering that its operating revenue gained 47% during that period, that's great to see. We think it is growing rather well, upon reflection. In reality, this article only makes a short study of the company's growth data. This graph of historic revenue growth shows how Spacetalk is building its business over time.

How Easily Can Spacetalk Raise Cash?

Spacetalk seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Spacetalk has a market capitalisation of AU$26m and burnt through AU$2.2m last year, which is 8.3% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Spacetalk's Cash Burn Situation?

Spacetalk appears to be in pretty good health when it comes to its cash burn situation. Not only was its cash burn relative to its market cap quite good, but its revenue growth was a real positive. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Taking a deeper dive, we've spotted 5 warning signs for Spacetalk you should be aware of, and 2 of them are a bit concerning.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you’re looking to trade Spacetalk, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SPA

Spacetalk

A technology company, provides wearables, mobile devices, software, and services in Australia, the United States, New Zealand, and the United Kingdom.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.