Revenues Not Telling The Story For SEEK Limited (ASX:SEK)

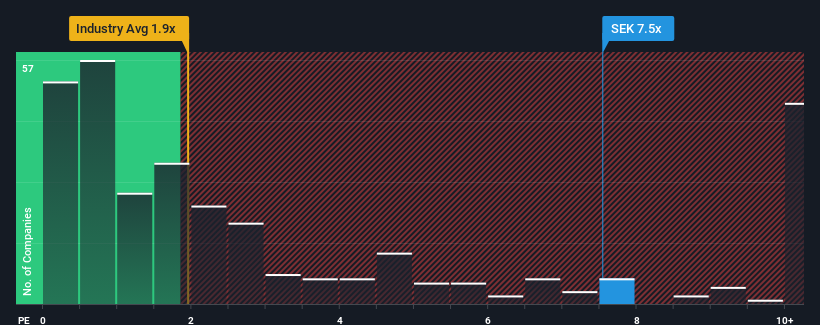

When you see that almost half of the companies in the Interactive Media and Services industry in Australia have price-to-sales ratios (or "P/S") below 2.7x, SEEK Limited (ASX:SEK) looks to be giving off strong sell signals with its 7.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for SEEK

How Has SEEK Performed Recently?

SEEK could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SEEK.Is There Enough Revenue Growth Forecasted For SEEK?

SEEK's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.5%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Looking ahead now, revenue is anticipated to climb by 7.7% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 9.2% per year, which is not materially different.

In light of this, it's curious that SEEK's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting SEEK's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with SEEK, and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SEK

SEEK

Engages in the provision of online employment marketplace services in Australia, South East Asia, New Zealand, the United Kingdom, Europe, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives