Did Changing Sentiment Drive Rent.com.au's (ASX:RNT) Share Price Down A Painful 77%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Rent.com.au Limited (ASX:RNT); the share price is down a whopping 77% in the last three years. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 53% in the last year. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days.

Check out our latest analysis for Rent.com.au

Because Rent.com.au is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

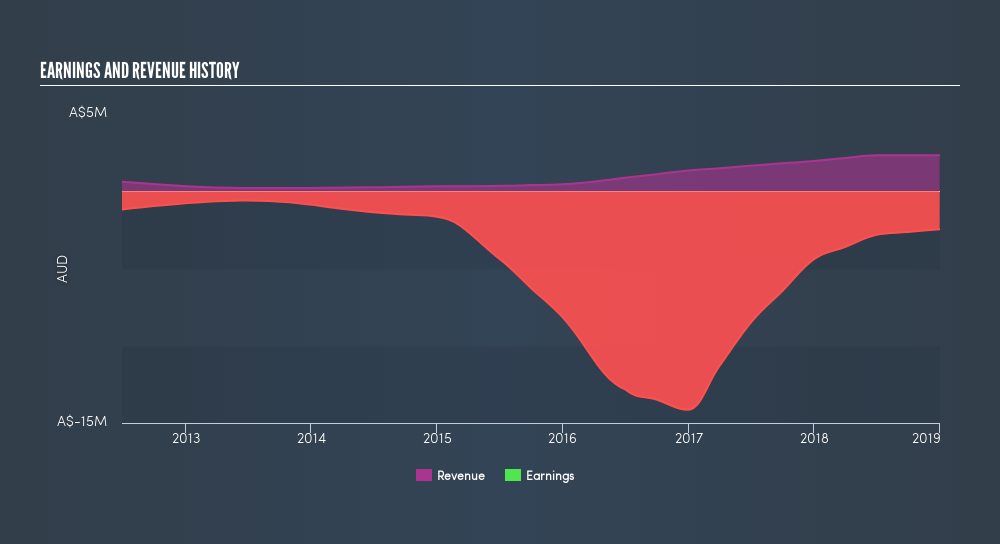

In the last three years, Rent.com.au saw its revenue grow by 39% per year, compound. That's well above most other pre-profit companies. So why has the share priced crashed 39% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Rent.com.au's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for Rent.com.au shares, which cost holders 53%, while the market was up about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 38% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:RNT

Rent.com.au

Operates a website and technology applications that focuses on rental property market in Australia.

Flawless balance sheet moderate.

Market Insights

Community Narratives