Will REA Group’s (ASX:REA) Video Push Unlock a New Era of User Engagement?

Reviewed by Sasha Jovanovic

- REA Group recently launched a video discovery feature on the realestate.com.au iOS app home screen, aiming to engage early-stage property seekers through short-form vertical video content as part of its broader digital strategy.

- The initiative reflects REA Group's intent to embed video throughout its platform ecosystem, potentially setting a new benchmark for interactive property search experiences globally.

- We'll explore how the introduction of immersive video content could influence REA Group's user engagement narrative and growth prospects.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

REA Group Investment Narrative Recap

To own shares in REA Group, an investor needs to believe that digital transformation and product innovation will continue to drive above-market engagement and revenue in property search. The new video feature strengthens REA’s position as an interactive industry leader, but has little near-term impact on the most important catalyst: sustained audience and ARPU growth in Australia. Key risks remain from intensifying competition and regulatory scrutiny, neither of which are meaningfully altered by this update.

Among recent announcements, the upcoming CEO transition to Cameron McIntyre stands out. As REA Group pivots deeper into product innovation and new media, stable executive leadership will be crucial in translating digital features like immersive video into improved user metrics and long-term growth, especially with ongoing challenges in the local market.

Yet, in contrast to the upbeat momentum, investors should also pay close attention to developments around regulatory scrutiny and what this might mean for future pricing power and premium revenue growth...

Read the full narrative on REA Group (it's free!)

REA Group's outlook anticipates A$2.3 billion in revenue and A$905.3 million in earnings by 2028. This is based on a 7.1% annual revenue growth rate and an increase in earnings of A$227.4 million from current earnings of A$677.9 million.

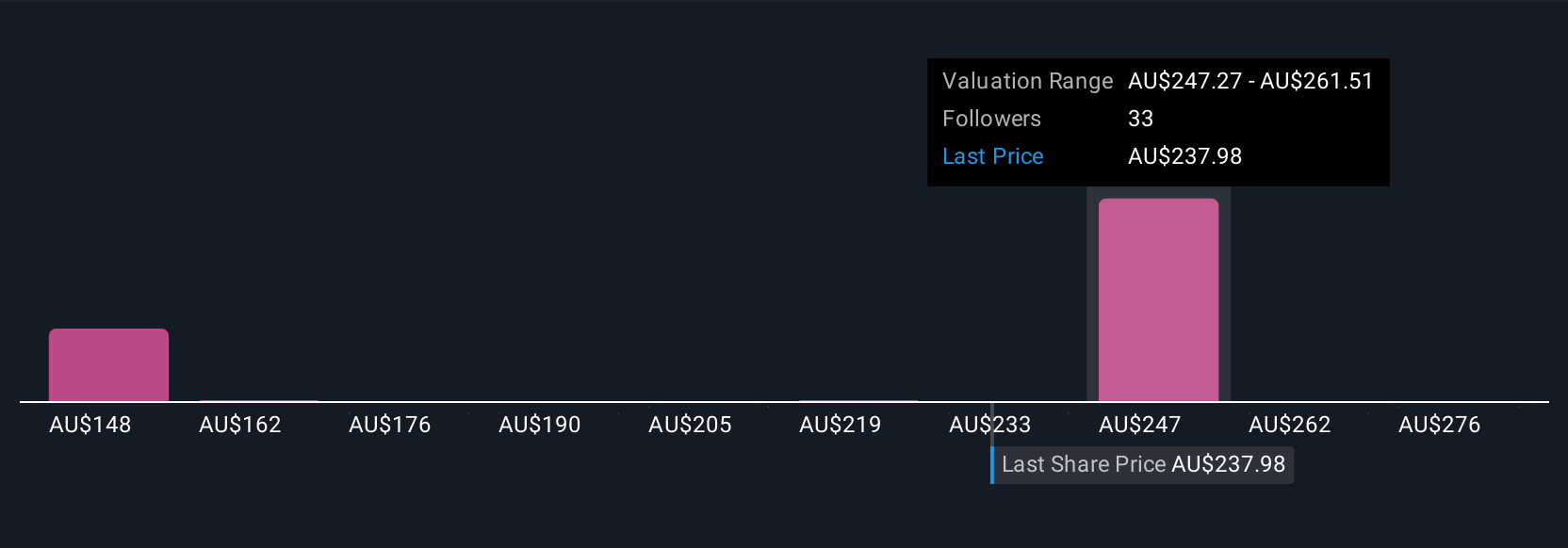

Uncover how REA Group's forecasts yield a A$251.95 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community members estimate REA Group’s fair value spans A$156.97 to A$300, showing wide disagreement. With concerns about mounting competition and regulatory headwinds, you can explore several sharply different opinions on REA’s outlook.

Explore 6 other fair value estimates on REA Group - why the stock might be worth as much as 54% more than the current price!

Build Your Own REA Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your REA Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free REA Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate REA Group's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REA

REA Group

Engages in online property advertising business in Australia, Asia, and North America It provides property and property-related services on websites and mobile applications.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives