Audinate Group And 2 Other High Growth Tech Stocks In Australia

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 1.5% but remains up by 19% over the past year, with earnings anticipated to grow by 12% annually in the coming years. In this environment, a good high-growth tech stock is one that demonstrates strong potential for revenue expansion and innovation, aligning well with these positive long-term growth expectations despite short-term fluctuations.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 21.54% | 38.44% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.65% | 60.64% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Audinate Group (ASX:AD8)

Simply Wall St Growth Rating: ★★★★☆☆

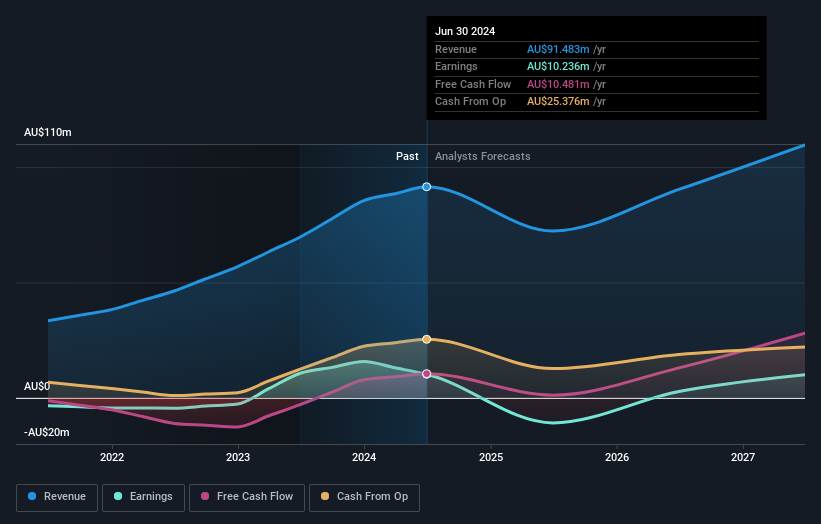

Overview: Audinate Group Limited develops and sells digital audio visual networking solutions in Australia and internationally, with a market capitalization of A$714.24 million.

Operations: The company generates revenue primarily through its Contract Electronics Manufacturing Services, which accounted for A$91.48 million.

Audinate Group, navigating through a volatile market, has demonstrated resilience with a projected revenue growth of 10.8% annually, outpacing the Australian market's 5.5%. This growth is bolstered by significant R&D investment, aligning with its strategic focus on innovation in digital audio networking technologies. The recent appointment of CFO Chris Rollinson adds robust financial expertise, potentially enhancing corporate governance and strategic financial planning. With earnings expected to surge by 20.5% per year, Audinate is poised to capitalize on expanding digital media solutions demand despite its past year's earnings dip of -3.8%.

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

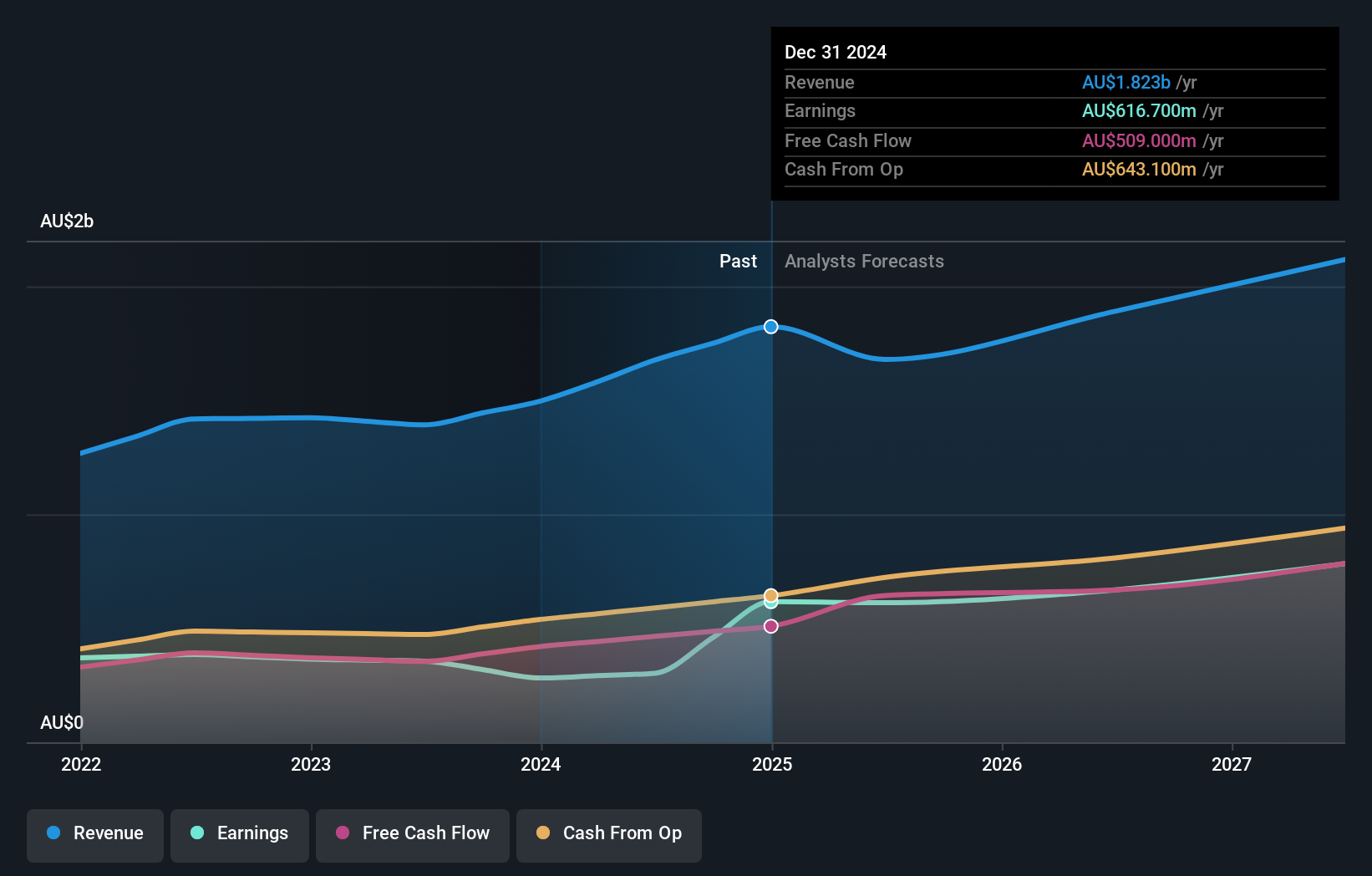

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market cap of approximately A$29.96 billion.

Operations: REA Group generates revenue primarily from its property and online advertising segment in Australia, contributing A$1.25 billion, followed by financial services in Australia at A$320.6 million, and operations in India at A$103.1 million. The company's net profit margin is a key indicator of its profitability dynamics across these diverse markets.

REA Group, despite a challenging year with net income dropping to AUD 302.8 million from AUD 356.1 million, is poised for recovery with an ambitious R&D focus that aligns with its growth trajectory in the digital real estate sector. The company has increased its dividend by 23%, reflecting confidence in future cash flows, supported by a robust forecast of earnings growth at 17.5% annually, outstripping the broader Australian market's expectation of 12.3%. This strategic emphasis on innovation and shareholder return underpins REA's resilience and potential in a competitive landscape, even as it navigates past financial setbacks marked by significant one-off losses of AUD 153.6 million last fiscal year.

- Take a closer look at REA Group's potential here in our health report.

Understand REA Group's track record by examining our Past report.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited is an Australian company that develops and provides mining software solutions across various regions, including Asia, the Americas, Africa, and Europe, with a market capitalization of A$671 million.

Operations: RPMGlobal Holdings generates revenue primarily from its Software segment, contributing A$72.67 million, and its Advisory services, bringing in A$31.41 million. The company focuses on providing specialized software solutions to the mining industry across multiple continents.

RPMGlobal Holdings has demonstrated a robust growth trajectory, with revenue surging by 10.4% annually, outpacing the broader Australian market's 5.5% growth rate. This performance is underlined by a significant leap in net income from AUD 3.69 million to AUD 8.66 million within a year, reflecting an earnings growth of over 134%. The company's commitment to innovation is evident from its recent reconfirmation of an ambitious revenue target ranging between AUD 120 million and AUD 125 million for 2025, highlighting its potential in the evolving tech landscape. Moreover, RPMGlobal's inclusion in the S&P/ASX Small Ordinaries and ASX 300 Indexes underscores its rising prominence within the industry, complemented by expected annual profit growth of approximately 22.6%, which notably exceeds market expectations.

- Delve into the full analysis health report here for a deeper understanding of RPMGlobal Holdings.

Assess RPMGlobal Holdings' past performance with our detailed historical performance reports.

Taking Advantage

- Reveal the 64 hidden gems among our ASX High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RUL

RPMGlobal Holdings

Develops and provides mining software solutions in Australia, Asia, the Americas, Africa, and Europe.

Flawless balance sheet with solid track record.