- Australia

- /

- Oil and Gas

- /

- ASX:STO

Top ASX Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has experienced a 1.5% decline, but it has risen by 19% over the past year with earnings forecasted to grow by 12% annually. In this context, selecting dividend stocks that offer both stability and growth potential can be a prudent strategy for investors seeking reliable income amidst fluctuating market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.96% | ★★★★★☆ |

| Perenti (ASX:PRN) | 6.72% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.62% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.10% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.33% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.60% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.26% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.40% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.45% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.45% | ★★★★☆☆ |

Click here to see the full list of 37 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

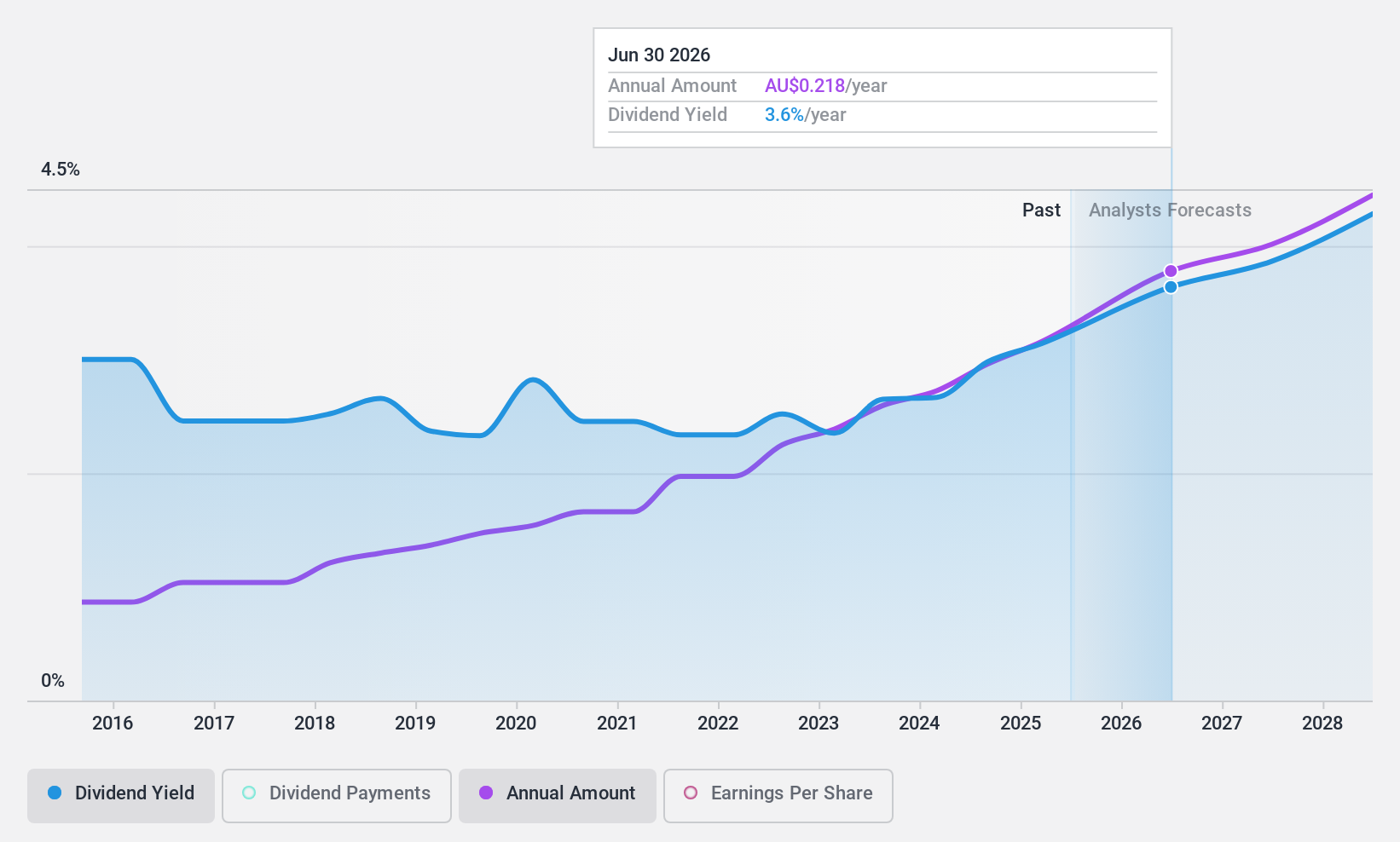

Jumbo Interactive (ASX:JIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates in the retail of lottery tickets via internet and mobile platforms across Australia, the United Kingdom, Canada, Fiji, and other international markets with a market cap of A$799.41 million.

Operations: Jumbo Interactive Limited's revenue segments include Managed Services generating A$25.84 million, Lottery Retailing contributing A$123.40 million, and Software-As-A-Service (SaaS) providing A$50.73 million.

Dividend Yield: 4.3%

Jumbo Interactive's dividend payments have increased over the past decade, though they remain volatile and unreliable. The company's dividends are currently well-covered by earnings and cash flows, with a payout ratio of 79.1% and a cash payout ratio of 63.2%. Despite trading at good value compared to its peers, its dividend yield of 4.27% is lower than the top quartile in Australia. Recent strategic moves include seeking bolt-on acquisitions to enhance growth potential.

- Get an in-depth perspective on Jumbo Interactive's performance by reading our dividend report here.

- Our valuation report unveils the possibility Jumbo Interactive's shares may be trading at a discount.

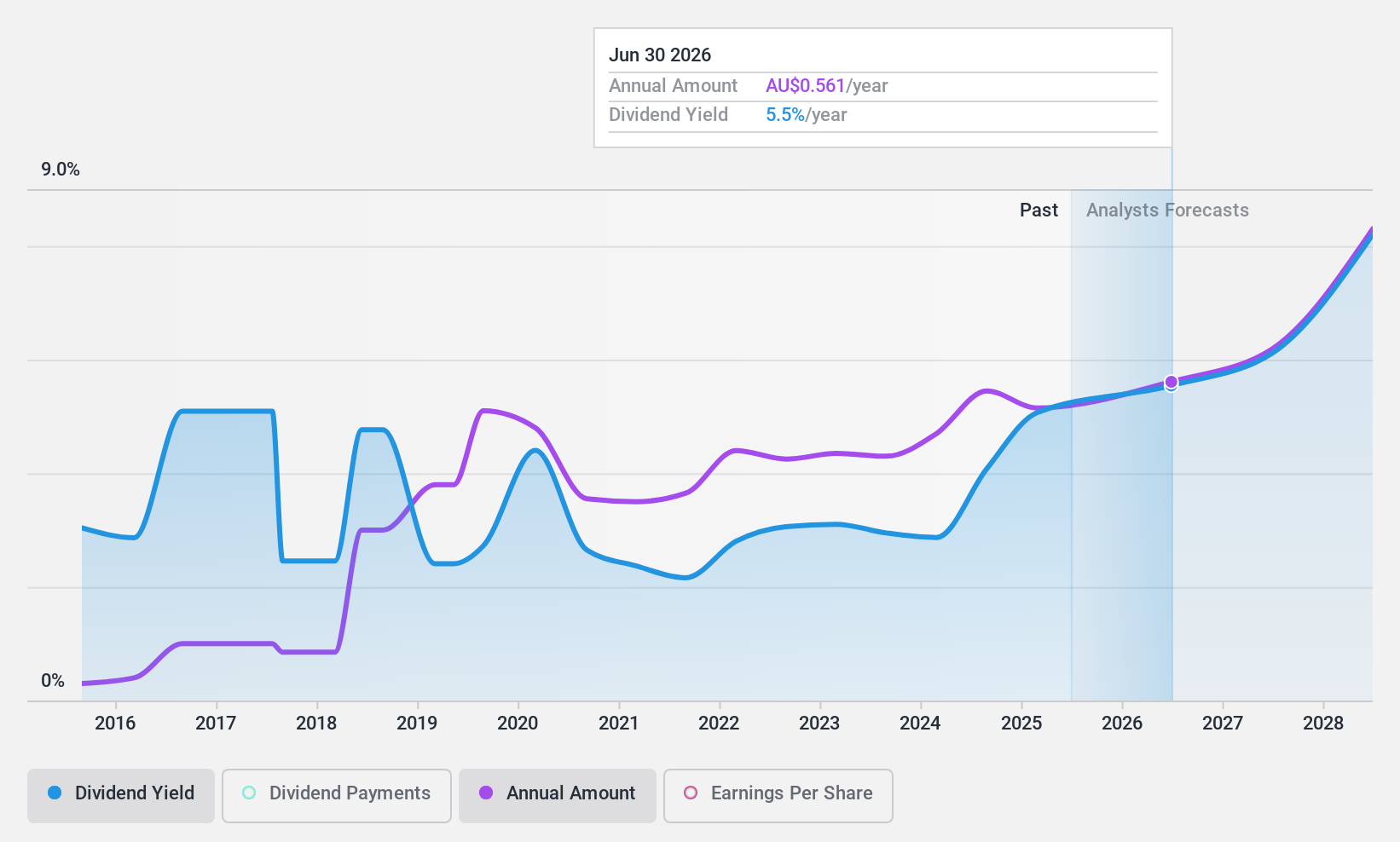

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Steadfast Group Limited offers general insurance brokerage services across Australasia, Asia, and Europe, with a market cap of A$6.12 billion.

Operations: Steadfast Group Limited generates revenue from its Insurance Intermediary segment, which accounts for A$1.55 billion, and its Premium Funding segment, contributing A$113 million.

Dividend Yield: 3.1%

Steadfast Group's dividend payments have increased over the past decade, yet they remain volatile and unreliable. The company's dividends are supported by earnings and cash flows, with payout ratios of 80.7% and 65.6%, respectively. Despite trading at a discount to estimated fair value, its dividend yield of 3.08% is below the top quartile in Australia. Recent financial results show net income growth to A$228 million for FY2024, supporting a final franked dividend of 10.35 cents per share.

- Take a closer look at Steadfast Group's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Steadfast Group is priced lower than what may be justified by its financials.

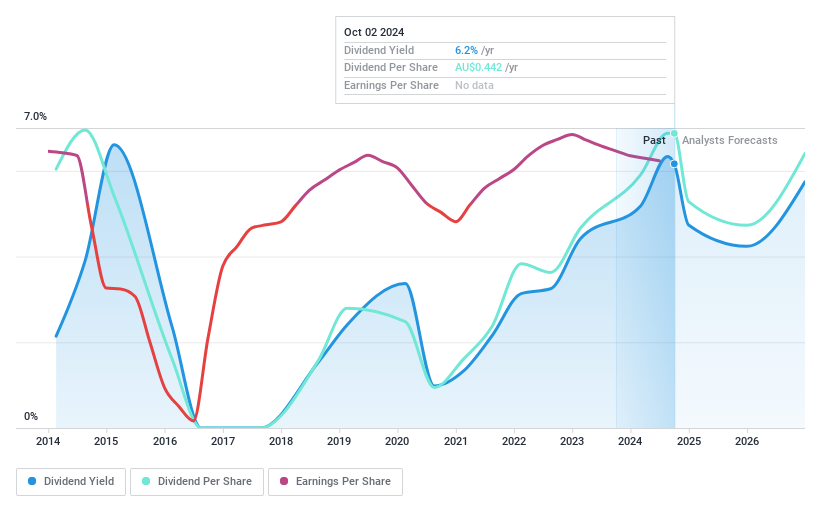

Santos (ASX:STO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Santos Limited is involved in the exploration, development, production, transportation, and marketing of hydrocarbons in Australia and Papua New Guinea with a market cap of A$22.48 billion.

Operations: Santos Limited generates revenue from several key segments, including Cooper Basin ($612 million), Queensland & NSW ($1.31 billion), Western Australia ($881 million), Papua New Guinea (PNG) ($2.71 billion), and Northern Australia & Timor-Leste ($84 million).

Dividend Yield: 6.6%

Santos Limited's dividend yield of 6.61% is among the top 25% in Australia, but its sustainability is questionable due to a high cash payout ratio of 164.4%. Despite an increase in dividends over the past decade, payments have been volatile and unreliable. Recent earnings results showed a decline in net income to US$636 million for H1 2024. The company announced a dividend of US$0.13 per share, payable on September 25, 2024.

- Unlock comprehensive insights into our analysis of Santos stock in this dividend report.

- The analysis detailed in our Santos valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 34 Top ASX Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STO

Santos

Explores for, develops, produces, transports, and markets hydrocarbons in Australia and Papua New Guinea.

Excellent balance sheet, good value and pays a dividend.