Discovering Hidden Opportunities in Australian Stocks October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has experienced a slight dip of 1.5%, yet it remains robust with a 19% increase over the past year and an optimistic forecast of 12% annual earnings growth. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover hidden opportunities for investors seeking to capitalize on Australia's economic momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Hancock & Gore | NA | -70.20% | 38.14% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

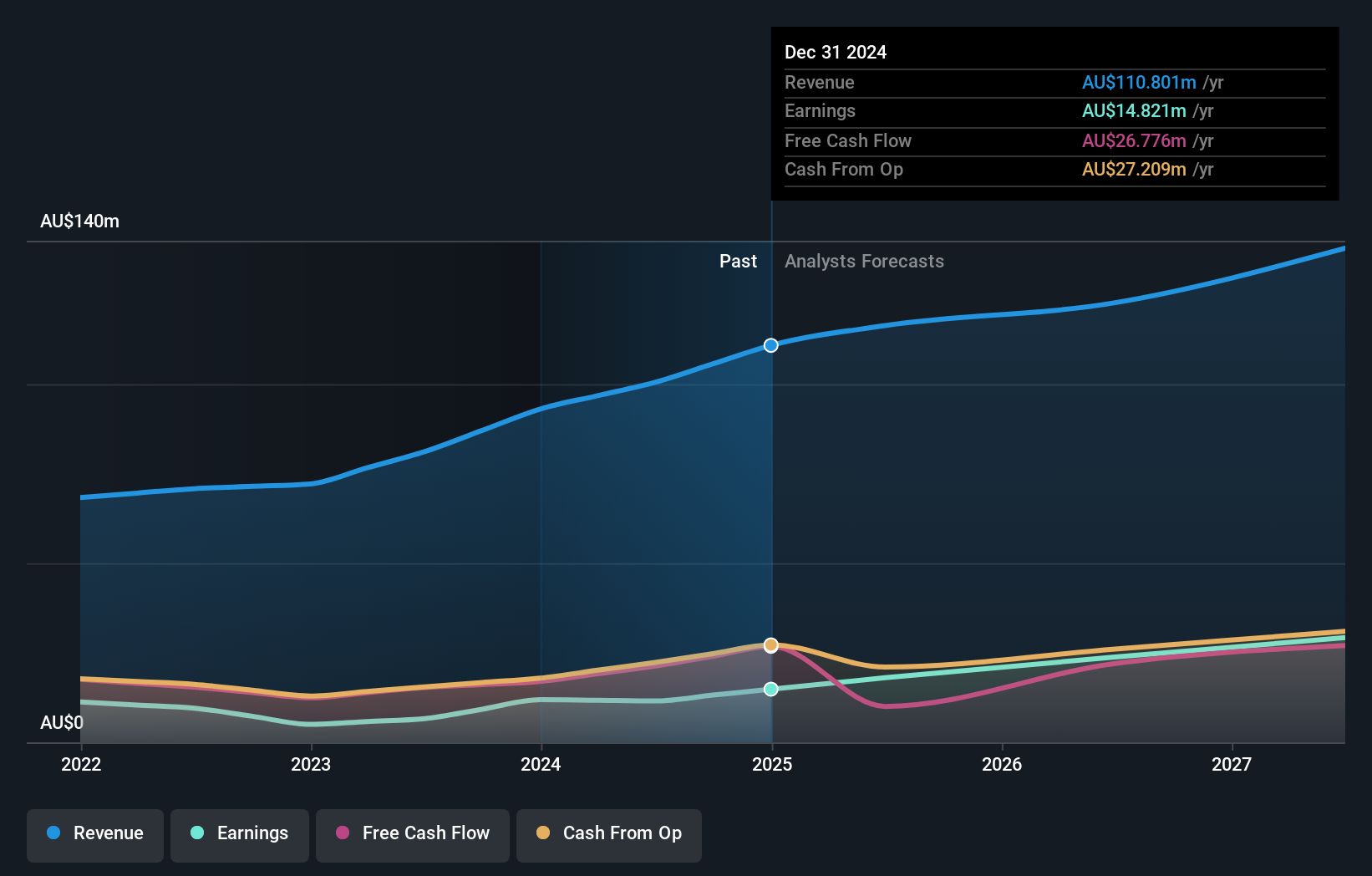

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$461.28 million.

Operations: The primary revenue stream for Australian Ethical Investment Ltd is funds management, generating A$100.49 million.

Australian Ethical Investment, a nimble player in the market, showcases impressive growth with earnings soaring by 75.3% over the past year, outpacing the Capital Markets industry's 15.6%. Despite a hefty A$8.6 million one-off loss impacting recent financials, its net income climbed to A$11.53 million from A$6.58 million last year. The company remains debt-free for five years and continues to generate positive free cash flow, recently reaching A$21.27 million as of June 2024. With a full-year dividend increase of 29%, Australian Ethical appears committed to rewarding shareholders while navigating industry challenges effectively.

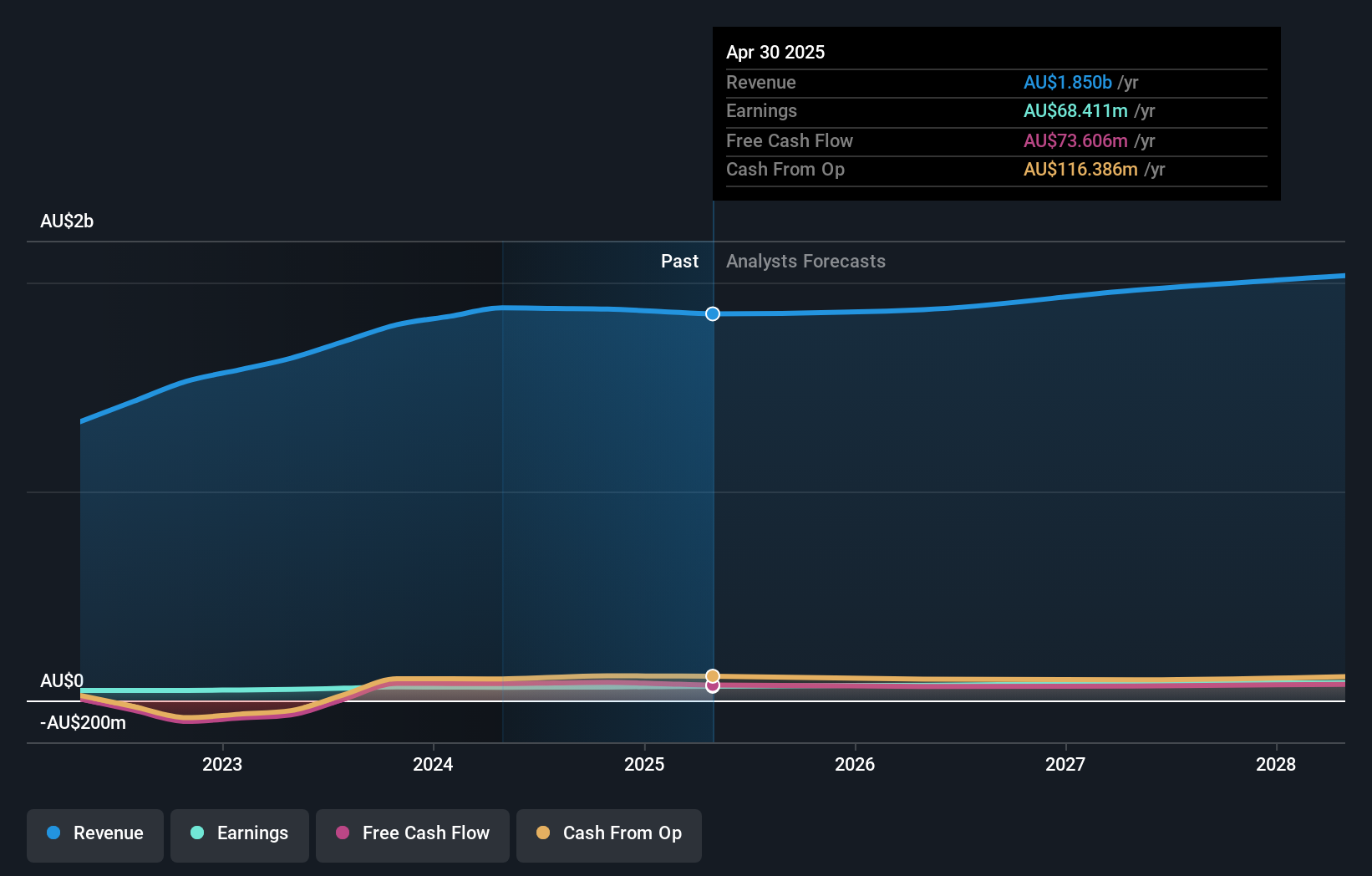

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations spanning Australia, New Zealand, the Pacific Islands, the Middle East, the United States, and other international markets, with a market capitalization of A$595.98 million.

Operations: Ricegrowers generates revenue primarily through its International Rice segment, contributing A$894.03 million, and the Rice Pool segment with A$498.11 million. The Cop Rice and Riviana segments also add significant revenue at A$252.75 million and A$222.01 million, respectively.

Ricegrowers, a notable player in the food industry, is trading at 63.5% below its estimated fair value, presenting an attractive proposition compared to peers. This company has achieved impressive earnings growth of 20.1% over the past year, outpacing the broader food sector. Despite a rise in debt to equity from 28.5% to 39.4% over five years, its net debt to equity ratio remains satisfactory at 34%. With high-quality past earnings and free cash flow positivity, Ricegrowers seems well-positioned for continued performance improvement as it anticipates a forecasted annual earnings growth of nearly 9.8%.

- Click here and access our complete health analysis report to understand the dynamics of Ricegrowers.

Understand Ricegrowers' track record by examining our Past report.

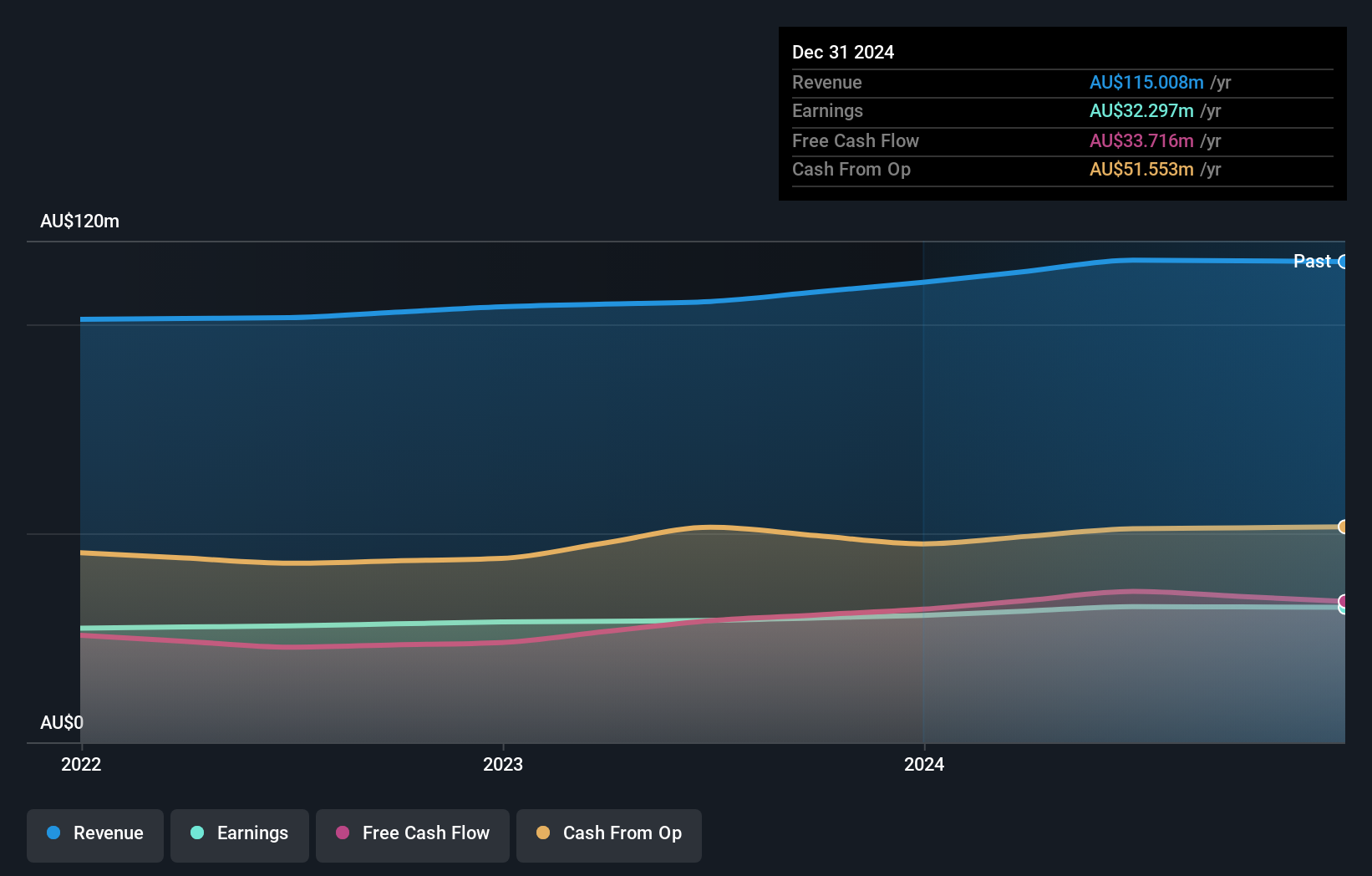

Sugar Terminals (NSX:SUG)

Simply Wall St Value Rating: ★★★★★★

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$396 million.

Operations: The primary revenue stream for Sugar Terminals Limited is derived from the sugar industry, generating A$115.38 million. The company's financial performance can be evaluated through its market capitalization of A$396 million.

Sugar Terminals, a small yet promising player in Australia, has demonstrated consistent earnings growth of 3.5% annually over the past five years. Trading at 45.2% below its estimated fair value, it appears undervalued with high-quality earnings and no debt on its books for the last five years. The company reported an increase in sales to A$115.38 million and net income of A$32.47 million for the year ending June 2024, reflecting solid financial health despite not outpacing industry growth rates recently. Additionally, a fully franked dividend of A$14.76 million was declared in September 2024, enhancing shareholder value.

Where To Now?

- Get an in-depth perspective on all 56 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGLLV

Ricegrowers

Operates as a rice food company in Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives