Market Cool On Pureprofile Ltd's (ASX:PPL) Revenues Pushing Shares 26% Lower

To the annoyance of some shareholders, Pureprofile Ltd (ASX:PPL) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 39% share price drop.

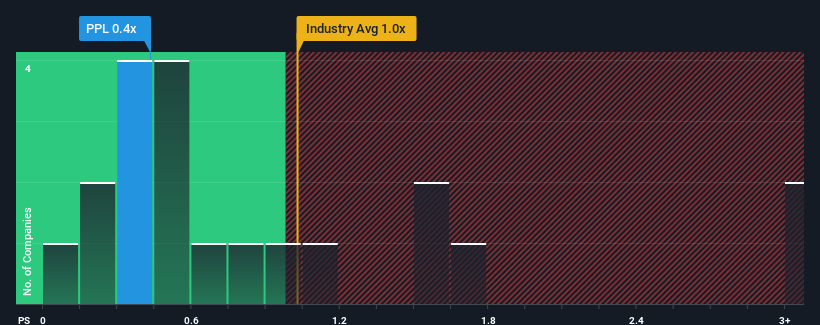

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Pureprofile's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Media industry in Australia is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Pureprofile

What Does Pureprofile's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Pureprofile has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Pureprofile will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Pureprofile's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 79% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 15% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 0.3%, which is noticeably less attractive.

With this information, we find it interesting that Pureprofile is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Pureprofile's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Pureprofile's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Pureprofile you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PPL

Pureprofile

A data and insights organization, engages in the provision of online research solutions for agencies, marketers, researchers, brands and businesses in Australasia, Europe, and the United States.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives