Market Participants Recognise Nine Entertainment Co. Holdings Limited's (ASX:NEC) Earnings

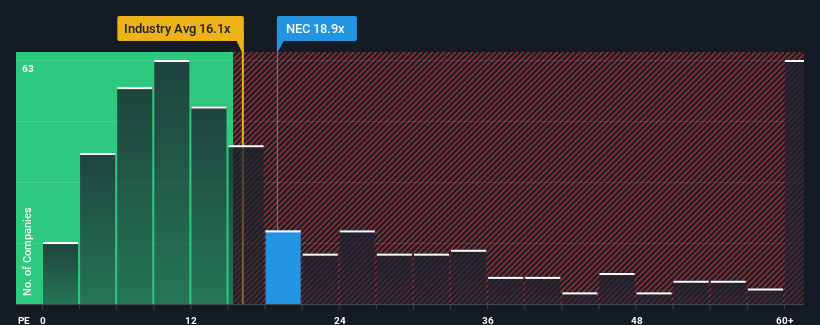

There wouldn't be many who think Nine Entertainment Co. Holdings Limited's (ASX:NEC) price-to-earnings (or "P/E") ratio of 18.9x is worth a mention when the median P/E in Australia is similar at about 20x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, Nine Entertainment Holdings' earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Nine Entertainment Holdings

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Nine Entertainment Holdings' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 30% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 19% each year as estimated by the ten analysts watching the company. That's shaping up to be similar to the 18% each year growth forecast for the broader market.

In light of this, it's understandable that Nine Entertainment Holdings' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Nine Entertainment Holdings' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Nine Entertainment Holdings maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You always need to take note of risks, for example - Nine Entertainment Holdings has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Nine Entertainment Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nine Entertainment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NEC

Nine Entertainment Holdings

Engages in the broadcasting and program production businesses across free to air television, video on demand, and metropolitan radio networks in Australia.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives