Is Now The Time To Put Nine Entertainment Holdings (ASX:NEC) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Nine Entertainment Holdings (ASX:NEC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Nine Entertainment Holdings

How Quickly Is Nine Entertainment Holdings Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Nine Entertainment Holdings' EPS has grown 32% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

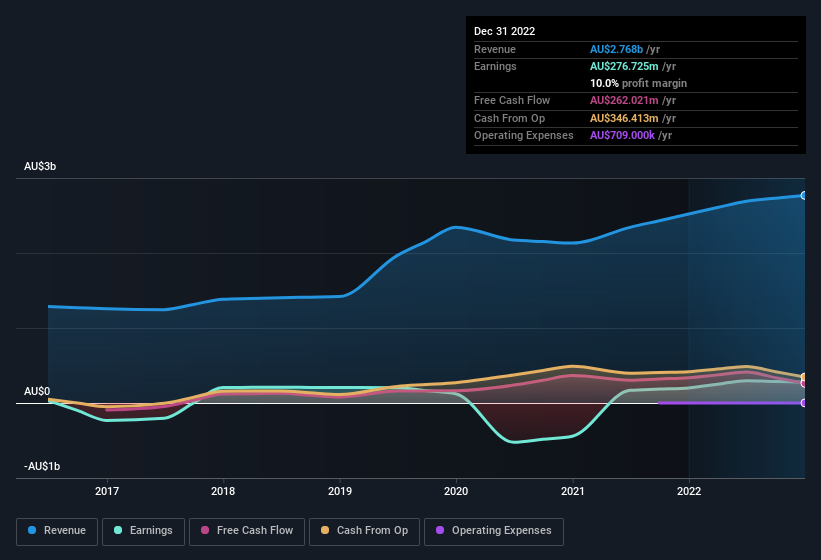

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Nine Entertainment Holdings achieved similar EBIT margins to last year, revenue grew by a solid 9.8% to AU$2.8b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Nine Entertainment Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Nine Entertainment Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Nine Entertainment Holdings insiders spent AU$126k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic.

Should You Add Nine Entertainment Holdings To Your Watchlist?

You can't deny that Nine Entertainment Holdings has grown its earnings per share at a very impressive rate. That's attractive. Not only is that growth rate rather juicy, but the insider buying adds fuel to the fire. So on this analysis, Nine Entertainment Holdings is probably worth spending some time on. You still need to take note of risks, for example - Nine Entertainment Holdings has 1 warning sign we think you should be aware of.

The good news is that Nine Entertainment Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nine Entertainment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NEC

Nine Entertainment Holdings

Engages in the broadcasting and program production businesses across free to air television, video on demand, and metropolitan radio networks in Australia.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives