- Australia

- /

- Metals and Mining

- /

- ASX:PRN

Top ASX Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As the Australian market navigates a period of uncertainty, with key indices like the ASX struggling to maintain momentum amid mixed signals from global markets, investors are keenly watching for opportunities that offer stability and income. In such conditions, dividend stocks can be an attractive option, providing regular income streams and potential resilience against market volatility.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Sugar Terminals (NSX:SUG) | 8.04% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.13% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 5.56% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.15% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.80% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.59% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.43% | ★★★★★☆ |

| IVE Group (ASX:IGL) | 6.29% | ★★★★☆☆ |

| Fiducian Group (ASX:FID) | 3.96% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 3.96% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

IVE Group (ASX:IGL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVE Group Limited operates in the marketing sector in Australia, with a market capitalization of A$442.23 million.

Operations: IVE Group Limited generates revenue primarily from its advertising segment, amounting to A$959.25 million.

Dividend Yield: 6.3%

IVE Group's dividend yield is among the top 25% in Australia, supported by a low cash payout ratio of 35.1%, indicating strong coverage by cash flows. Despite a high debt level, earnings have grown significantly, enhancing dividend sustainability with a payout ratio of 59.6%. However, its dividend history is unstable and volatile over nine years. Recent earnings show net income rose to A$46.71 million, supporting future payouts amidst acquisition plans for growth areas like 3PL and merchandise.

- Click to explore a detailed breakdown of our findings in IVE Group's dividend report.

- In light of our recent valuation report, it seems possible that IVE Group is trading behind its estimated value.

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.78 billion.

Operations: MFF Capital Investments Limited generates revenue primarily through its equity investments, amounting to A$631.43 million.

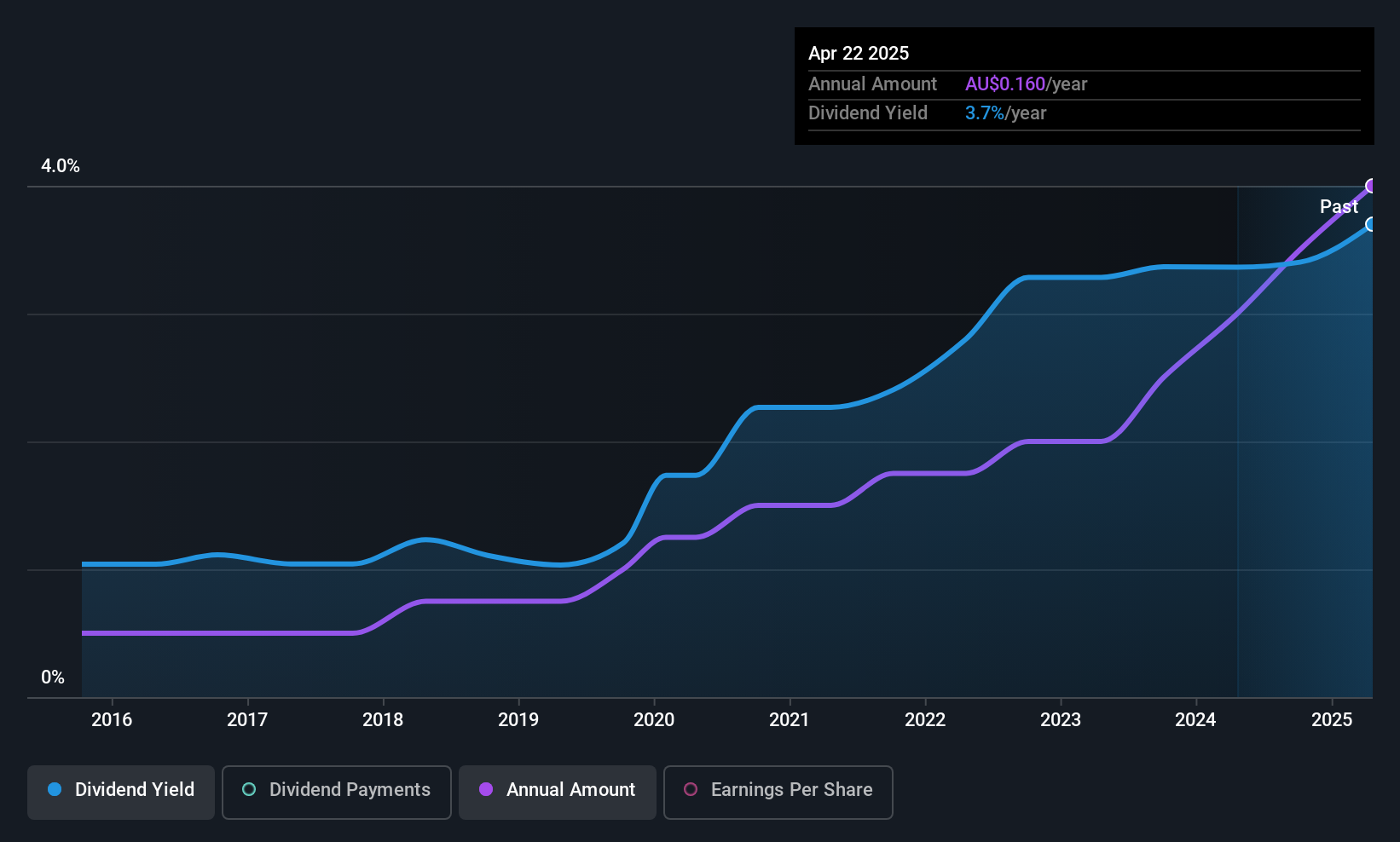

Dividend Yield: 3.8%

MFF Capital Investments offers a stable dividend profile with a reliable history over the past decade. The dividends are well-covered by earnings, reflected in a low payout ratio of 22.9%, and supported by cash flows with a cash payout ratio of 31.3%. Recent announcements include an increased dividend of A$0.09 for the six months ending June 2025, highlighting consistent growth despite slightly decreased revenue and net income compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of MFF Capital Investments.

- The analysis detailed in our MFF Capital Investments valuation report hints at an deflated share price compared to its estimated value.

Perenti (ASX:PRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Perenti Limited is a global mining services company with a market capitalization of A$2.18 billion.

Operations: Perenti Limited generates its revenue from three main segments: Drilling Services (A$778.13 million), Contract Mining Services (A$2.52 billion), and Mining and Technology Services (A$225.71 million).

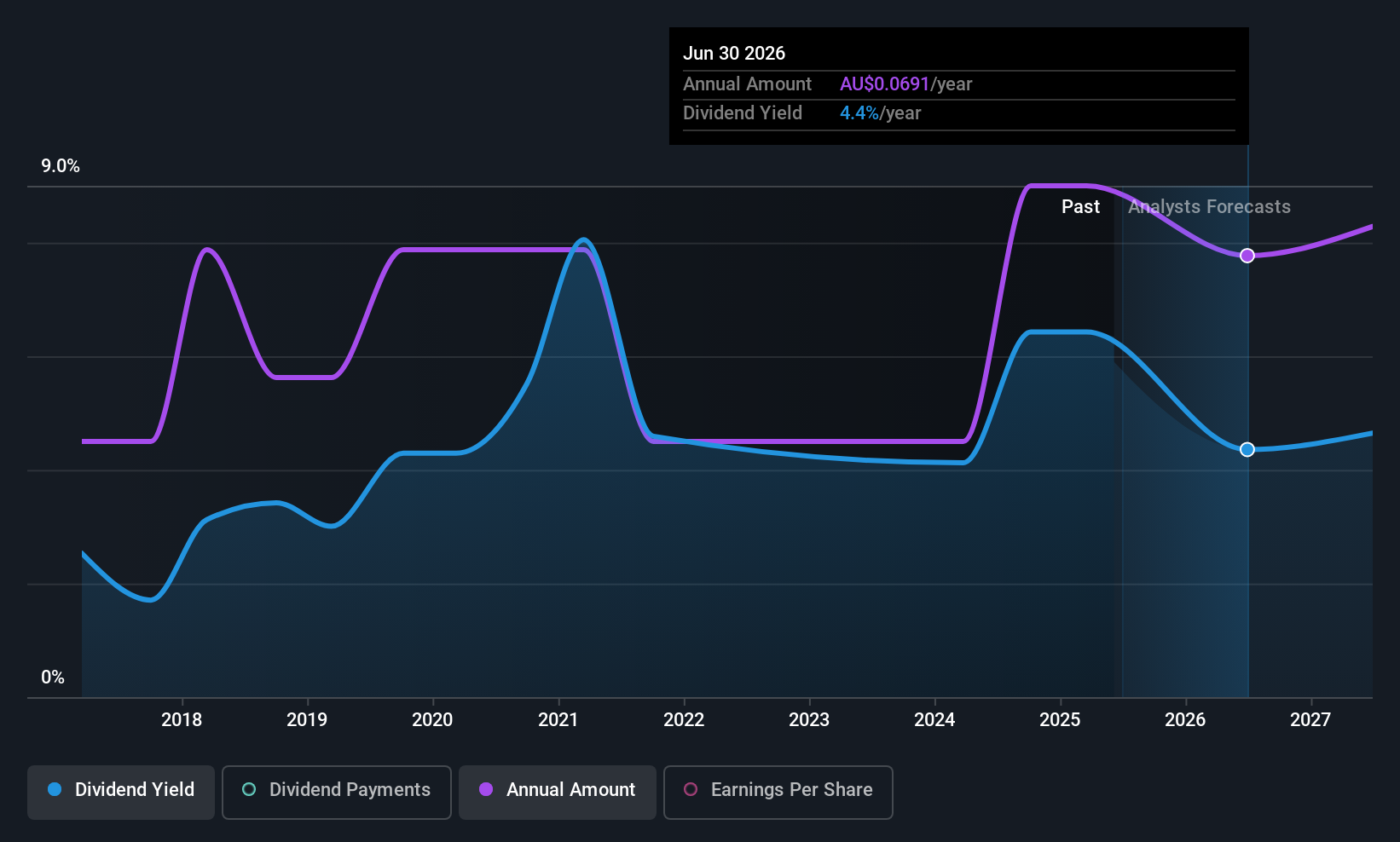

Dividend Yield: 3.1%

Perenti's dividends are supported by earnings, with a payout ratio of 56.1%, and cash flows, with a cash payout ratio of 33.7%. The dividend yield is modest at 3.09%, lower than the top quartile in Australia. Despite recent increases, dividends have been volatile over the past decade. Recent earnings showed revenue growth to A$3.49 billion; however, net income decreased to A$120.62 million from last year’s A$166 million, indicating potential challenges ahead for dividend stability.

- Take a closer look at Perenti's potential here in our dividend report.

- Our valuation report here indicates Perenti may be overvalued.

Key Takeaways

- Gain an insight into the universe of 33 Top ASX Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRN

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives