- Australia

- /

- Metals and Mining

- /

- ASX:GNG

3 ASX Dividend Stocks Offering Up To 7.2% Yield

Reviewed by Simply Wall St

As the ASX200 hovers near the 8,000 points mark despite recent tariff announcements impacting various sectors, investors are reminded of the importance of cautious market navigation. In this environment, dividend stocks can offer a stable income stream and potential hedge against volatility, making them an attractive consideration for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Bisalloy Steel Group (ASX:BIS) | 9.62% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.78% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.20% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.22% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 9.30% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.95% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.91% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.52% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.06% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.54% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Diversified United Investment (ASX:DUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market cap of A$1.10 billion.

Operations: Diversified United Investment Limited generates revenue primarily from its investment company operations, amounting to A$46.41 million.

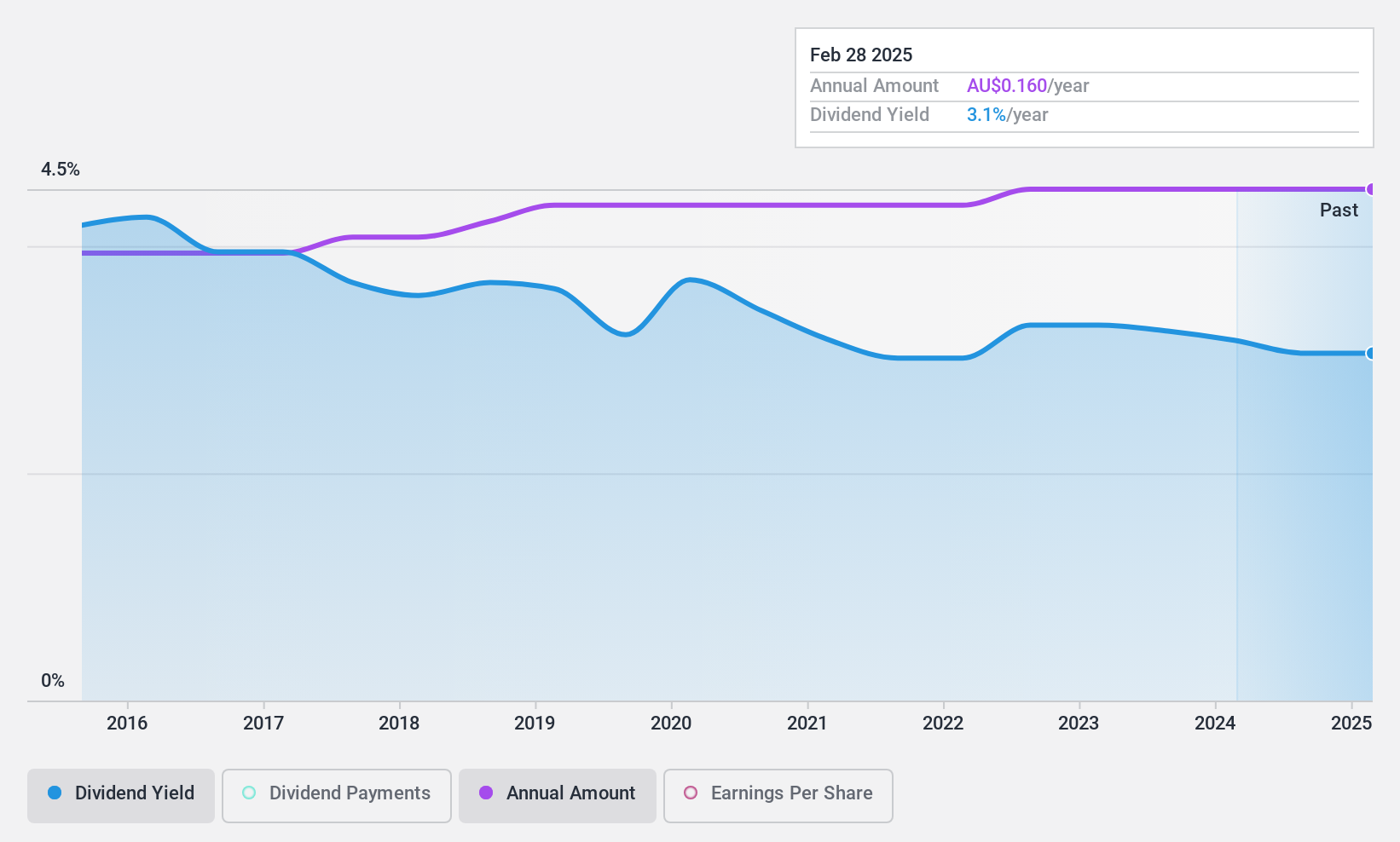

Dividend Yield: 3.1%

Diversified United Investment's dividend yield of 3.15% is modest compared to top Australian dividend payers, and its high payout ratio (94.2%) indicates dividends are not well covered by earnings but are supported by cash flows with an 89.6% cash payout ratio. Despite this, DUI has consistently grown its dividends over the past decade with stability and reliability, recently affirming a franked dividend of A$0.07 per share for the six months ending December 2025.

- Click here to discover the nuances of Diversified United Investment with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Diversified United Investment shares in the market.

GR Engineering Services (ASX:GNG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing sectors both in Australia and internationally, with a market cap of A$470.26 million.

Operations: GR Engineering Services Limited generates revenue from two primary segments: Oil and Gas, contributing A$96.61 million, and Mineral Processing, which accounts for A$412.30 million.

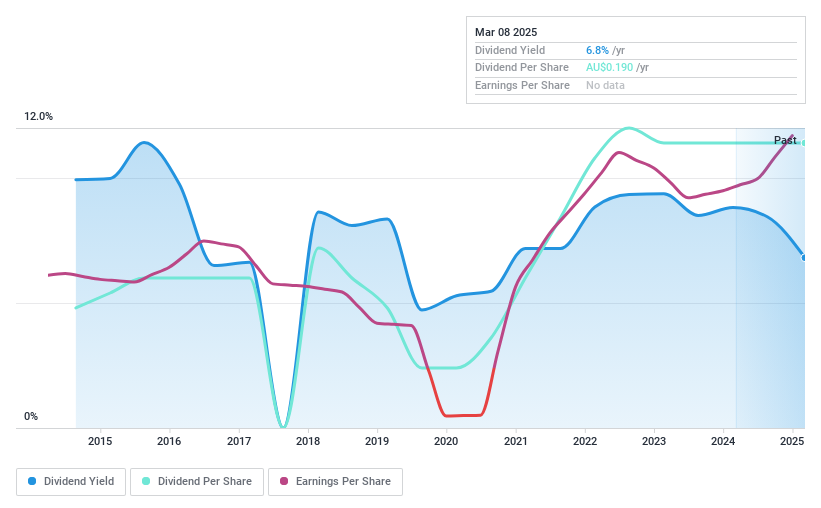

Dividend Yield: 6.8%

GR Engineering Services' dividend yield of 6.76% ranks it among the top 25% of Australian dividend payers. While its dividends are well-covered by cash flows, with a cash payout ratio of 35.7%, they have been volatile and unreliable over the past decade. Despite this, recent earnings growth and a declared increase in fully franked dividends to A$0.10 per share suggest potential for improved stability if current trends continue.

- Take a closer look at GR Engineering Services' potential here in our dividend report.

- Our expertly prepared valuation report GR Engineering Services implies its share price may be lower than expected.

IVE Group (ASX:IGL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVE Group Limited operates in the marketing sector in Australia and has a market capitalization of A$380.83 million.

Operations: IVE Group Limited generates revenue primarily from its advertising segment, which amounts to A$975.43 million.

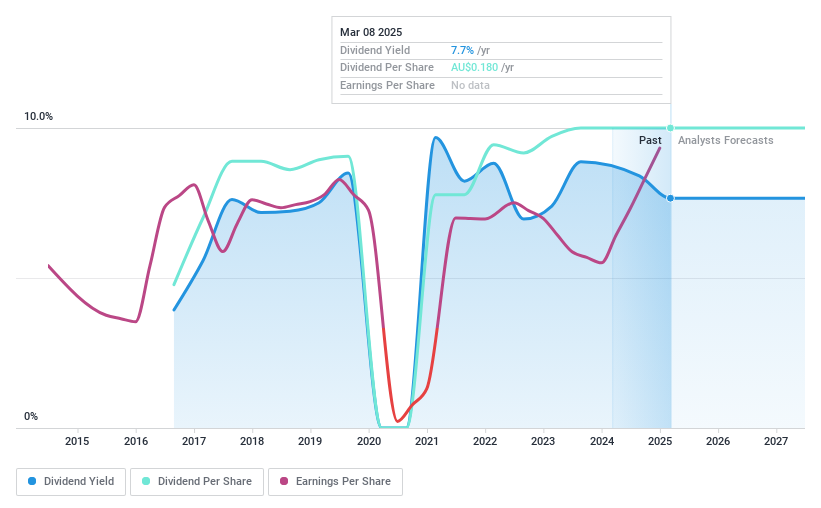

Dividend Yield: 7.3%

IVE Group's dividend yield of 7.29% places it in the top quartile of Australian dividend payers. The dividends are supported by a 66.7% payout ratio and a low cash payout ratio of 26.7%, indicating strong coverage by earnings and cash flows. However, its dividend history has been volatile over the past nine years, with inconsistent payments despite recent earnings growth to A$27.09 million for the half-year ending December 2024.

- Navigate through the intricacies of IVE Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that IVE Group's share price might be on the cheaper side.

Summing It All Up

- Reveal the 32 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GNG

GR Engineering Services

Provides engineering, process control, automation, and construction services to the mining and mineral processing industries in Australia and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives