After Leaping 27% Frontier Digital Ventures Limited (ASX:FDV) Shares Are Not Flying Under The Radar

Frontier Digital Ventures Limited (ASX:FDV) shares have continued their recent momentum with a 27% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

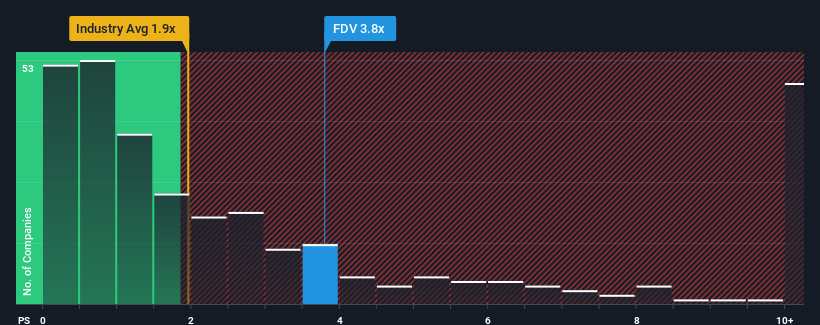

After such a large jump in price, given close to half the companies operating in Australia's Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Frontier Digital Ventures as a stock to potentially avoid with its 3.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Frontier Digital Ventures

What Does Frontier Digital Ventures' Recent Performance Look Like?

Recent times haven't been great for Frontier Digital Ventures as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Frontier Digital Ventures will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Frontier Digital Ventures' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.7% last year. Pleasingly, revenue has also lifted 274% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 16% over the next year. With the industry only predicted to deliver 10%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Frontier Digital Ventures' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Frontier Digital Ventures shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Frontier Digital Ventures' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Frontier Digital Ventures that you need to be mindful of.

If you're unsure about the strength of Frontier Digital Ventures' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FDV

Frontier Digital Ventures

A private equity firm specializing in investing and developing online classifieds business in emerging markets.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives