- Australia

- /

- Consumer Finance

- /

- ASX:WZR

3 ASX Penny Stocks Under A$100M Market Cap To Watch

Reviewed by Simply Wall St

As Australian shares brace for potential shifts ahead of the Reserve Bank's first interest rate decision of the year, market participants are keeping a close eye on how these developments might influence investment strategies. In such conditions, penny stocks—despite their outdated name—remain an intriguing segment of the market, often representing smaller or newer companies with opportunities for growth at lower price points. When these stocks exhibit strong balance sheets and solid fundamentals, they can offer investors a chance to uncover hidden value and potential returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.88M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.98 | A$247.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.21 | A$342.3M | ★★★★☆☆ |

| GTN (ASX:GTN) | A$0.53 | A$104.08M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.08 | A$338.66M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.02 | A$95.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.875 | A$103.72M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.33 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Frontier Digital Ventures (ASX:FDV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Frontier Digital Ventures Limited is a private equity firm focused on investing in and developing online classifieds businesses in emerging markets, with a market cap of A$99.72 million.

Operations: The company's revenue is primarily derived from its online classifieds platforms across various emerging markets, with significant contributions from Infocasas (A$23.49 million), Fincaraiz (A$13.26 million), Encuentra24 (A$11.30 million), and other regional ventures such as Avito, Yapo, and Autodeal.

Market Cap: A$99.72M

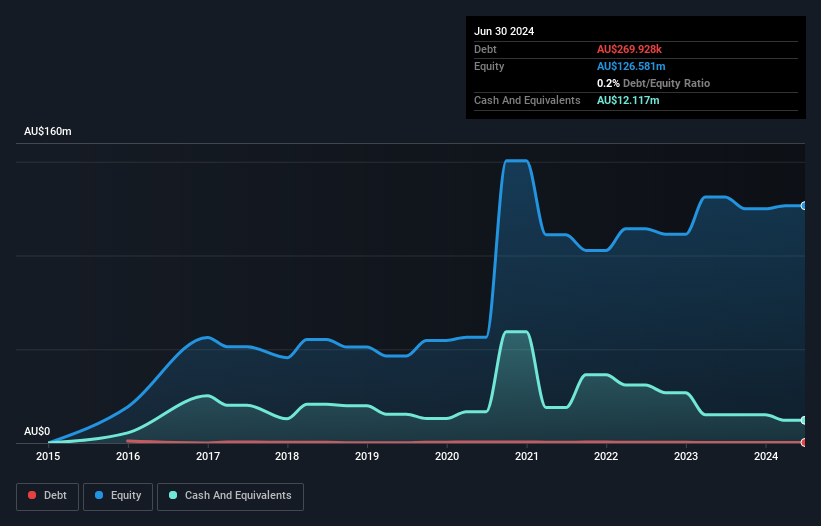

Frontier Digital Ventures, with a market cap of A$99.72 million, focuses on online classifieds in emerging markets. Despite its unprofitability and increasing losses over the past five years, FDV's revenue streams include significant contributions from Infocasas (A$23.49 million) and Fincaraiz (A$13.26 million). The company has more cash than debt and a sufficient cash runway for over a year based on current free cash flow. However, challenges remain with an inexperienced management team averaging 1.5 years in tenure and negative return on equity at -1.82%. Earnings are forecasted to grow significantly at 113.22% annually.

- Dive into the specifics of Frontier Digital Ventures here with our thorough balance sheet health report.

- Explore Frontier Digital Ventures' analyst forecasts in our growth report.

Global Lithium Resources (ASX:GL1)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Lithium Resources Limited focuses on the evaluation, exploration, and development of lithium resources in Australia with a market cap of A$60.20 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$60.2M

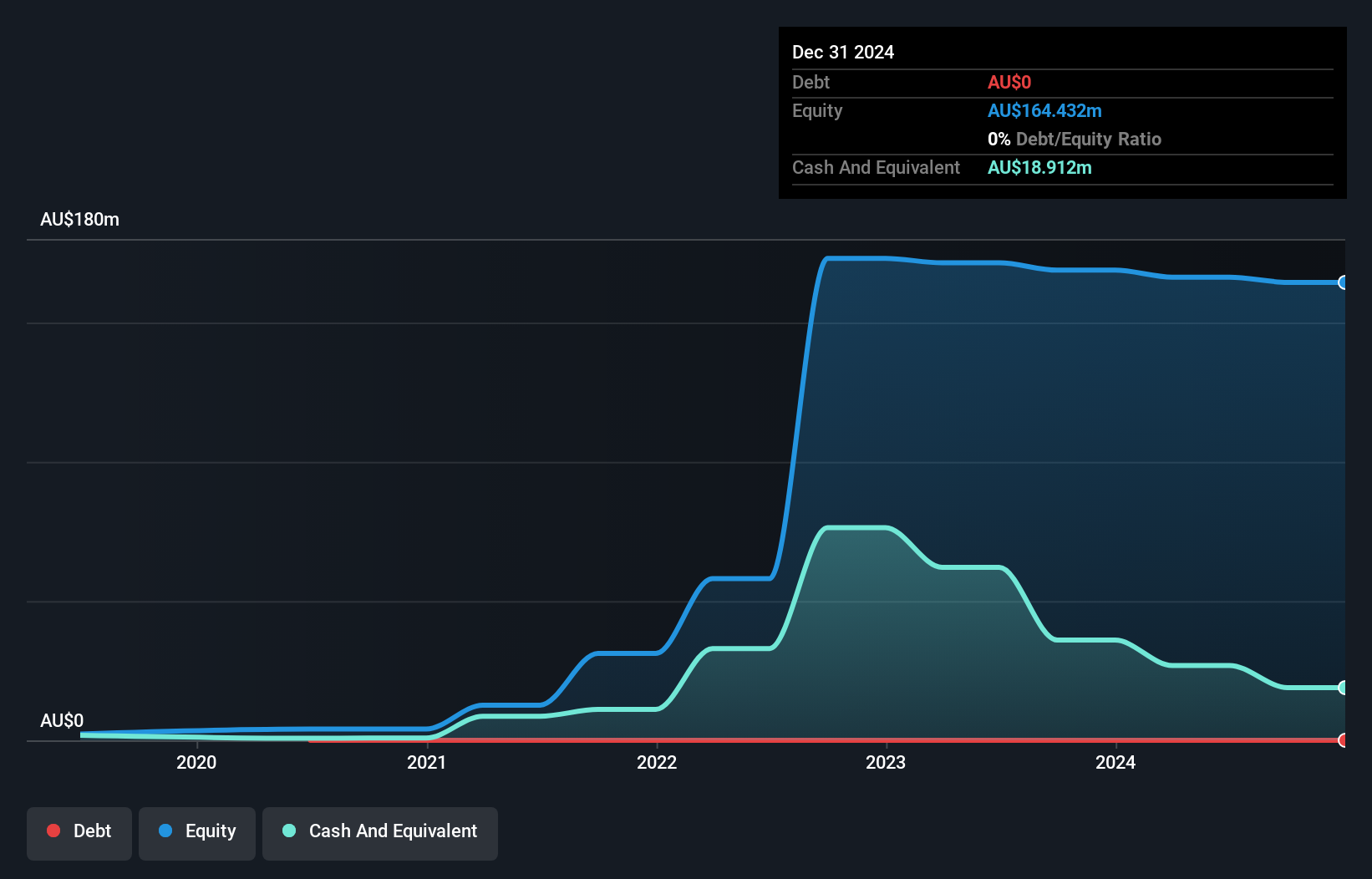

Global Lithium Resources, with a market cap of A$60.20 million, is pre-revenue and debt-free, supported by short-term assets of A$27.5 million exceeding both its long-term liabilities and short-term obligations. The company recently appointed Dr. Dianmin Chen as CEO, bringing over 35 years of mining experience to the role following executive changes. Despite having no significant revenue streams and being unprofitable with increasing losses over five years at a very large rate annually, it maintains a cash runway for less than a year under stable conditions but extends to two years if cash flow reductions continue historically.

- Get an in-depth perspective on Global Lithium Resources' performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Global Lithium Resources' future.

Wisr (ASX:WZR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wisr Limited operates in the lending industry in Australia with a market capitalization of A$50.11 million.

Operations: The company generates revenue primarily from the provision of personal loans to consumers, amounting to A$21.78 million.

Market Cap: A$50.11M

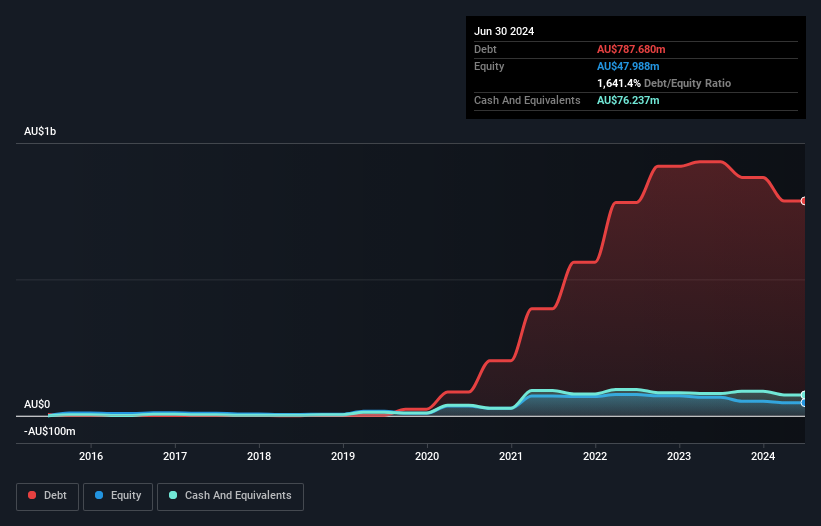

Wisr Limited, with a market cap of A$50.11 million, generates A$21.78 million in revenue from personal loans but remains unprofitable. Despite this, it has a robust cash runway exceeding three years due to positive free cash flow growth. However, its debt-to-equity ratio is exceptionally high at 1641.4%, indicating significant leverage concerns. The company's short-term assets comfortably cover both short and long-term liabilities, suggesting liquidity strength despite financial volatility and an inexperienced management team averaging 1.5 years of tenure. While earnings have improved over five years by reducing losses annually by 8.3%, profitability remains elusive in the near term.

- Click to explore a detailed breakdown of our findings in Wisr's financial health report.

- Learn about Wisr's future growth trajectory here.

Next Steps

- Jump into our full catalog of 1,032 ASX Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wisr might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WZR

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives