Enero Group's (ASX:EGG) Shareholders Will Receive A Bigger Dividend Than Last Year

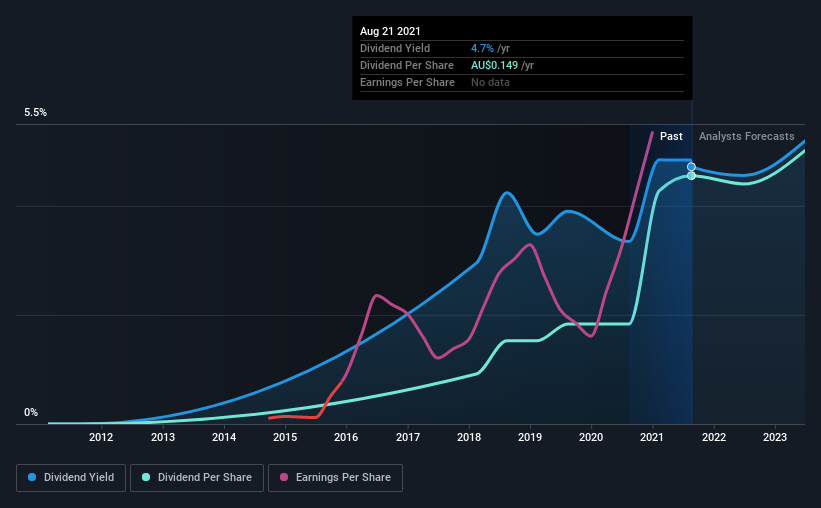

Enero Group Limited's (ASX:EGG) dividend will be increasing to AU$0.044 on 6th of October. This will take the dividend yield from 4.7% to 4.7%, providing a nice boost to shareholder returns.

View our latest analysis for Enero Group

Enero Group's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Enero Group's dividend was comfortably covered by both cash flow and earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Earnings per share is forecast to rise by 22.7% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 79% which is a bit high but can definitely be sustainable.

Enero Group Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The first annual payment during the last 4 years was AU$0.03 in 2017, and the most recent fiscal year payment was AU$0.15. This works out to be a compound annual growth rate (CAGR) of approximately 49% a year over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Enero Group has impressed us by growing EPS at 105% per year over the past five years. The company's earnings per share has grown rapidly in recent years, and it has a good balance between reinvesting and paying dividends to shareholders, so we think that Enero Group could prove to be a strong dividend payer.

Enero Group Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Earnings are easily covering distributions, and the company is generating plenty of cash. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 3 warning signs for Enero Group that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading Enero Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Enero Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:EGG

Enero Group

Engages in the provision of integrated marketing and communication services in Australia, Asia, the United States, the United Kingdom, and Europe.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026