Leadership Transition and FY25 Guidance Could Be a Game Changer for CAR Group (ASX:CAR)

Reviewed by Simply Wall St

- CAR Group recently announced that long-serving Managing Director and CEO Cameron McIntyre will step down after 18 years, with CFO William Elliott set to take over as CEO from August 2025 and Stephen Wong filling in as acting CFO during the interim period.

- This leadership transition coincided with the release of unaudited earnings guidance for fiscal year 2025, where the company projected reported revenue of approximately A$1.18 billion and NPAT of A$273 million to A$277 million.

- We'll examine how the transition to a new CEO with deep company experience shapes CAR Group's investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is CAR Group's Investment Narrative?

For anyone looking at CAR Group, it really comes down to believing in the company’s ability to maintain momentum even as it cycles through big executive changes and recent moves to streamline its operations. The business sets out clear revenue and NPAT targets for FY2025, and the handover from Cameron McIntyre to William Elliott, both familiar faces internally, does not appear to have rattled investors, as reflected by the minimal change in the share price around the announcement. Importantly, this leadership transition seems unlikely to materially disrupt near-term catalysts, such as the integration of the Tyres business sale or the execution of the group’s M&A ambitions. Key risks still revolve around premium valuation multiples, the sustainability of profit margins following recent declines, and a board structure that some may see as lacking independence. For now, the succession plan seems smooth, but the board’s composition and margin pressures demand ongoing attention.

On the flipside, board independence is still a risk many investors might be underestimating.

Exploring Other Perspectives

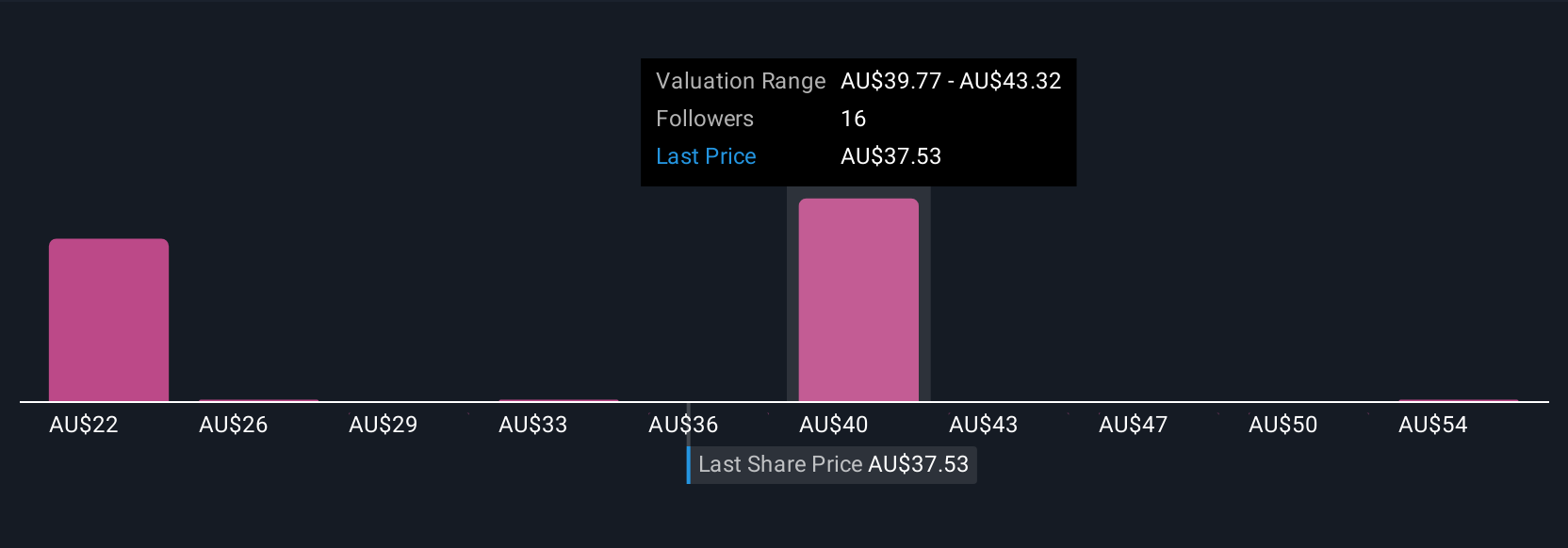

Explore 6 other fair value estimates on CAR Group - why the stock might be worth as much as 52% more than the current price!

Build Your Own CAR Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CAR Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free CAR Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CAR Group's overall financial health at a glance.

No Opportunity In CAR Group?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CAR

CAR Group

Engages in the operation of online automotive, motorcycle, and marine classifieds business in Australia, New Zealand, Brazil, South Korea, Malaysia, Indonesia, Thailand, Chile, China, the United States, and Mexico.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives