The ASX200 is set to open virtually flat, reflecting a cautious mood influenced by the Federal Reserve's recent decision and ongoing trade tensions. In this context, penny stocks—though an outdated term—remain a relevant investment area, often representing smaller or newer companies with potential for growth. By focusing on those with robust financials and clear growth prospects, investors can uncover opportunities in these lesser-known stocks that may offer both stability and upside potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.70 | A$136.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.90 | A$1.08B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.46 | A$68.87M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.64 | A$407.04M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.58M | ✅ 3 ⚠️ 2 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.77 | A$463.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.30 | A$156.59M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.16 | A$726.11M | ✅ 4 ⚠️ 3 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.56 | A$764.52M | ✅ 5 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.76 | A$1.26B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 993 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Brisbane Broncos (ASX:BBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brisbane Broncos Limited, with a market cap of A$101.47 million, manages and operates the Brisbane Broncos Rugby League Football Team in Australia.

Operations: The company generates revenue primarily through its Sports Management and Entertainment segment, which brought in A$60.58 million.

Market Cap: A$101.47M

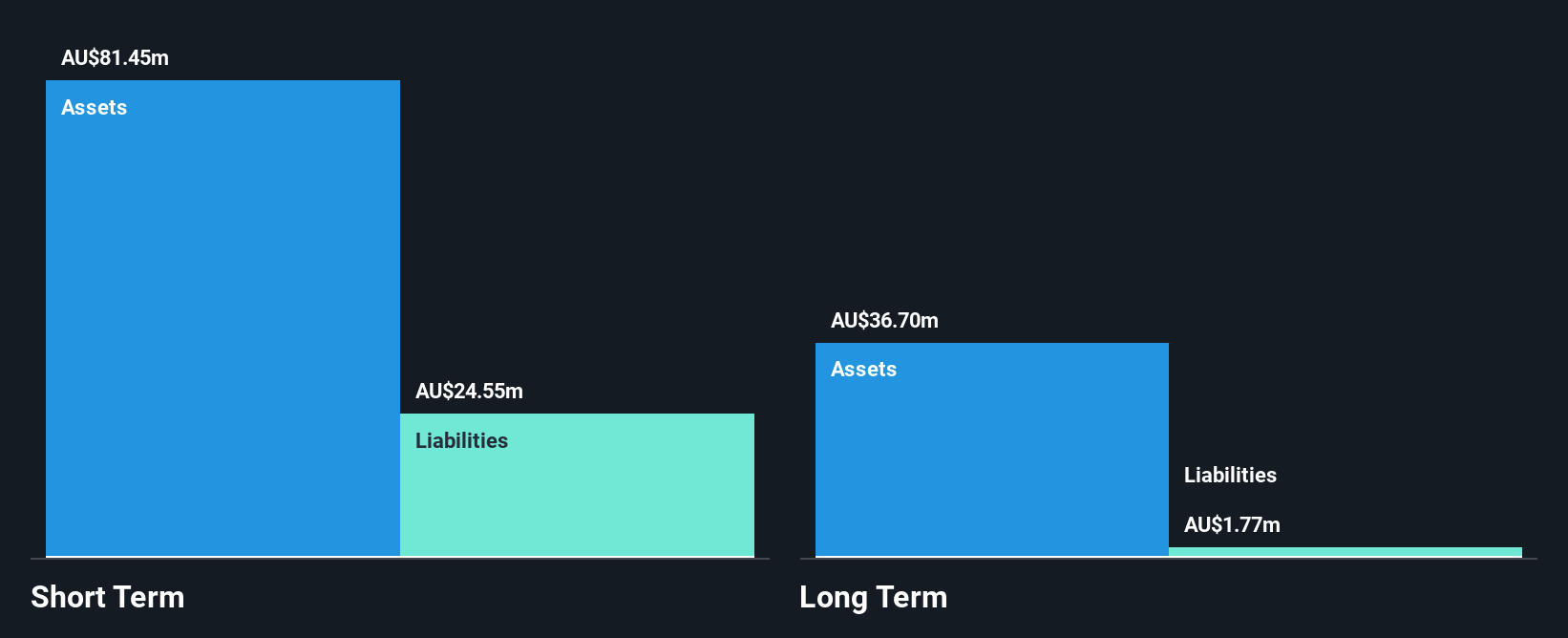

Brisbane Broncos Limited, with a market cap of A$101.47 million, operates without debt and has stable financials, with short-term assets exceeding both short- and long-term liabilities. The management team is considered experienced with an average tenure of four years. Despite a modest earnings growth of 1.6% over the past year, the company has achieved significant annual profit growth of 34.6% over five years and maintains high-quality earnings. Recently, it declared a dividend increase to A$0.02 per share for 2024, reflecting consistent revenue growth from A$75.21 million to A$81.57 million year-on-year.

- Dive into the specifics of Brisbane Broncos here with our thorough balance sheet health report.

- Gain insights into Brisbane Broncos' historical outcomes by reviewing our past performance report.

Hazer Group (ASX:HZR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hazer Group Limited is a clean technology development company based in Australia, with a market capitalization of A$103.74 million.

Operations: The company generates revenue primarily from the research and development of novel graphite-and-hydrogen-production technology, amounting to A$4.06 million.

Market Cap: A$103.74M

Hazer Group Limited, with a market cap of A$103.74 million, focuses on clean technology development and remains pre-revenue despite generating A$4.06 million from research activities. The company is debt-free and its short-term assets of A$12.5 million surpass both short- and long-term liabilities of A$2.3 million each, indicating solid financial management in the near term. However, Hazer faces challenges with a negative return on equity at -161.95% due to ongoing unprofitability and has less than a year of cash runway based on current free cash flow trends, raising concerns about its financial sustainability without additional funding or revenue growth.

- Unlock comprehensive insights into our analysis of Hazer Group stock in this financial health report.

- Evaluate Hazer Group's historical performance by accessing our past performance report.

Integrated Research (ASX:IRI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Integrated Research Limited designs, develops, implements, and sells systems and applications management computer software for business-critical computing and unified communication and payment networks, with a market cap of A$84.24 million.

Operations: The company's revenue is derived from its Software & Programming segment, which generated A$71.29 million.

Market Cap: A$84.24M

Integrated Research Limited, with a market cap of A$84.24 million, operates in the software sector and has recently turned profitable. Despite a 29% decline in half-year revenue to A$28.84 million compared to last year, the company maintains high-quality earnings and boasts a strong return on equity at 22.3%. It is debt-free and trades at an attractive price-to-earnings ratio of 4.1x against the broader Australian market average of 17.7x, suggesting good relative value. However, its management team lacks experience with an average tenure of one year, which may impact strategic execution moving forward.

- Click to explore a detailed breakdown of our findings in Integrated Research's financial health report.

- Gain insights into Integrated Research's future direction by reviewing our growth report.

Taking Advantage

- Access the full spectrum of 993 ASX Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? Outshine the giants: these 29 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hazer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HZR

Hazer Group

Operates as a clean technology development company in Australia.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)