The Australian market has been experiencing fluctuations, with the ASX futures showing positive signs despite foreign direct investment outflows as investors shift focus back to the US. For those looking beyond established names, penny stocks—though an outdated term—still represent a viable investment area, especially when they exhibit strong financial resilience. This article highlights three such stocks that could offer hidden value and potential for significant returns amidst current market dynamics.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.83 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.71 | A$417.98M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.31 | A$244.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.041 | A$47.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.31M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$4.94 | A$406.78M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.765 | A$365.45M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.32 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Brisbane Broncos (ASX:BBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brisbane Broncos Limited, with a market cap of A$129.41 million, manages and operates the Brisbane Broncos Rugby League Football teams in Australia.

Operations: The company generates revenue of A$65.79 million from its sports management and entertainment segment.

Market Cap: A$129.41M

Brisbane Broncos Limited, with a market cap of A$129.41 million, showcases stability with no debt and experienced management. Its earnings growth of 21.2% over the past year surpasses industry averages, although it trails its five-year average of 36.3%. The company reported half-year revenue of A$49.62 million and net income of A$6.01 million, reflecting improved profit margins from last year. With a price-to-earnings ratio below the Australian market average and no significant shareholder dilution recently, Brisbane Broncos presents a solid financial position within the penny stock landscape in Australia despite having a low return on equity at 14.4%.

- Unlock comprehensive insights into our analysis of Brisbane Broncos stock in this financial health report.

- Review our historical performance report to gain insights into Brisbane Broncos' track record.

Murray Cod Australia (ASX:MCA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Murray Cod Australia Limited, with a market cap of A$114.47 million, breeds, grows, and markets freshwater and table fish in Australia.

Operations: The company generates revenue from its wholesale segment in machinery and industrial equipment, amounting to A$10.85 million.

Market Cap: A$114.47M

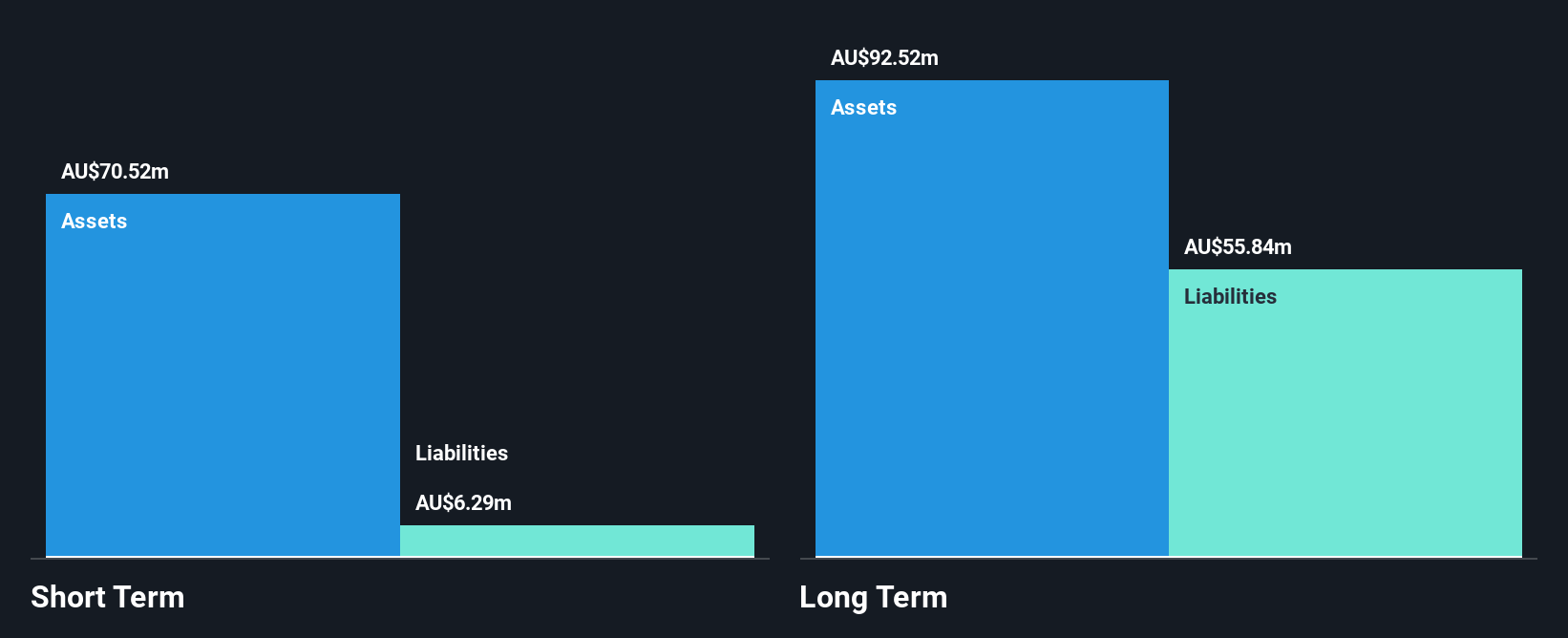

Murray Cod Australia Limited, with a market cap of A$114.47 million, has recently turned profitable, reporting a net income of A$8.56 million for the year ending June 30, 2025. Its short-term assets (A$70.5M) comfortably cover both short and long-term liabilities, reflecting financial stability despite negative operating cash flow affecting debt coverage. The company’s price-to-earnings ratio of 13.4x is below the Australian market average, indicating potential value for investors while maintaining satisfactory debt levels with a net debt to equity ratio at 25.7%. Recent equity offerings aim to raise A$17 million through common stock issuance at A$0.95 per share.

- Take a closer look at Murray Cod Australia's potential here in our financial health report.

- Understand Murray Cod Australia's track record by examining our performance history report.

Stellar Resources (ASX:SRZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Stellar Resources Limited, along with its subsidiaries, is involved in the exploration of mineral properties in Australia and has a market capitalization of A$62.72 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$62.72M

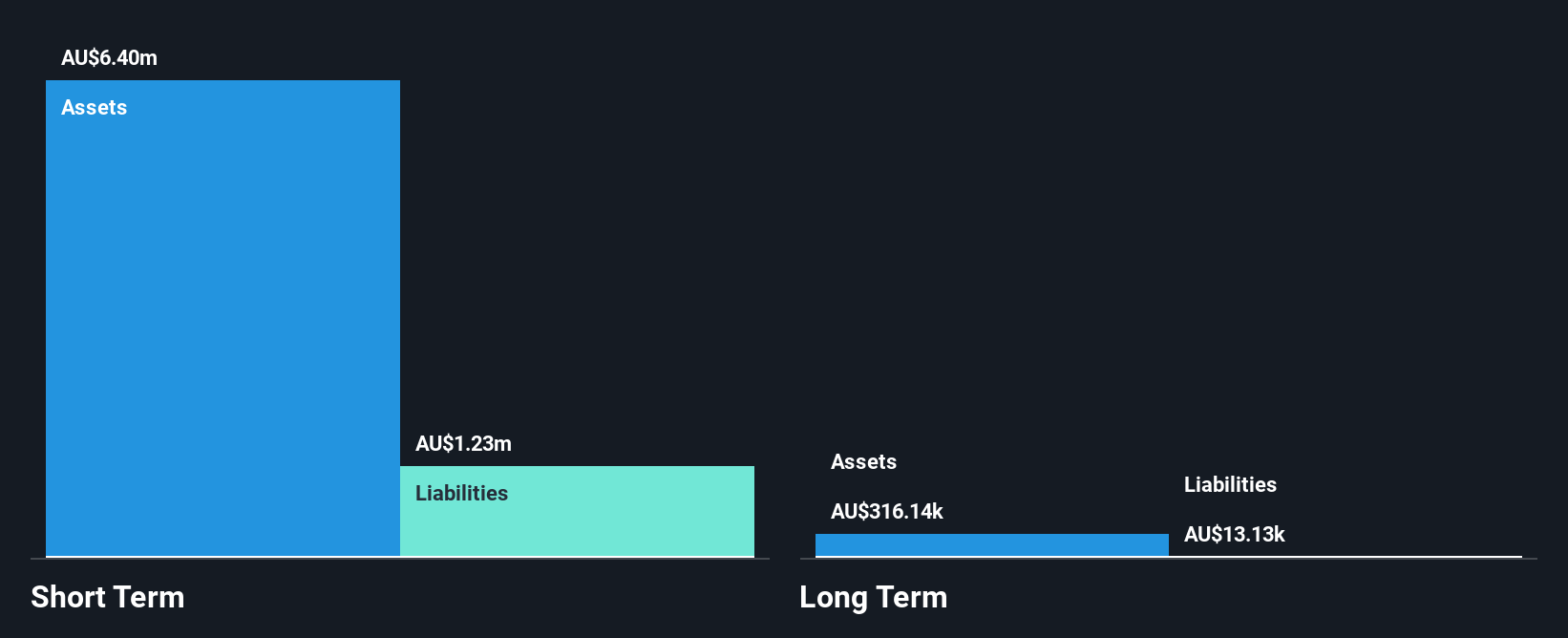

Stellar Resources Limited, with a market cap of A$62.72 million, remains pre-revenue and reported an increased net loss of A$8.04 million for the year ending June 30, 2025. The company has less than a year of cash runway and no debt over the past five years. Its short-term assets (A$6.4M) exceed both short-term liabilities (A$1.2M) and long-term liabilities (A$13.1K), indicating some financial stability despite ongoing losses which have grown significantly over the past five years at a rate of 39.1% annually. The management team is relatively new with an average tenure of 1.4 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Stellar Resources.

- Evaluate Stellar Resources' historical performance by accessing our past performance report.

Next Steps

- Click this link to deep-dive into the 423 companies within our ASX Penny Stocks screener.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MCA

Murray Cod Australia

Murray Cod Australia Limited, together with its subsidiaries, breeds, grows, and markets freshwater and table fish in Australia.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives