The Australian market has shown cautious optimism recently, buoyed by positive trade talks between the US and China, though investors remain wary until concrete actions are taken. For those exploring beyond the large-cap stocks, penny stocks—often smaller or newer companies—can present intriguing opportunities. Despite being an outdated term, these stocks continue to offer potential for growth at lower price points with strong financial foundations that can provide stability amidst market fluctuations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.75 | A$140.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.925 | A$1.09B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.45 | A$68.4M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.70 | A$416.29M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.665 | A$127.1M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.42 | A$2.76B | ✅ 4 ⚠️ 1 View Analysis > |

| GR Engineering Services (ASX:GNG) | A$2.80 | A$468.59M | ✅ 2 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.35 | A$158.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.30 | A$773.18M | ✅ 4 ⚠️ 4 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.83 | A$1.29B | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 993 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Airtasker (ASX:ART)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtasker Limited operates a technology-enabled online marketplace for local services in Australia, with a market cap of A$149.86 million.

Operations: The company's revenue is derived from New Marketplaces, generating A$2.09 million, and Established Marketplaces, contributing A$46.89 million.

Market Cap: A$149.86M

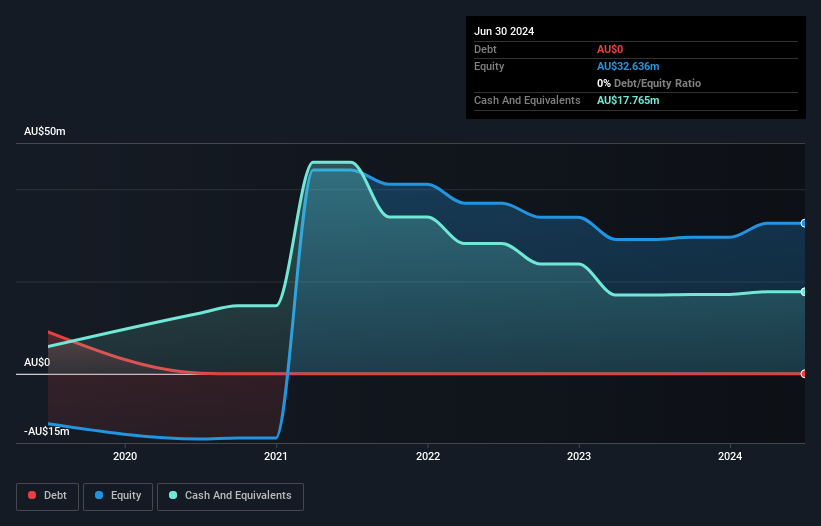

Airtasker Limited, with a market cap of A$149.86 million, operates an online marketplace for local services and is currently unprofitable. Despite reporting sales of A$25.66 million for the half-year ending December 2024, it incurred a net loss of A$15.96 million compared to a small profit the previous year. The company has no debt and maintains sufficient cash runway for over three years due to positive free cash flow growth. While trading below its estimated fair value, Airtasker's revenue is forecasted to grow by 16.52% annually, though profitability remains elusive in the near term.

- Take a closer look at Airtasker's potential here in our financial health report.

- Assess Airtasker's future earnings estimates with our detailed growth reports.

GTN (ASX:GTN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GTN Limited operates broadcast media advertising platforms providing traffic and news information to radio stations across Australia, Canada, the United Kingdom, and Brazil, with a market cap of A$127.10 million.

Operations: The company's revenue is primarily derived from advertising, totaling A$186.15 million.

Market Cap: A$127.1M

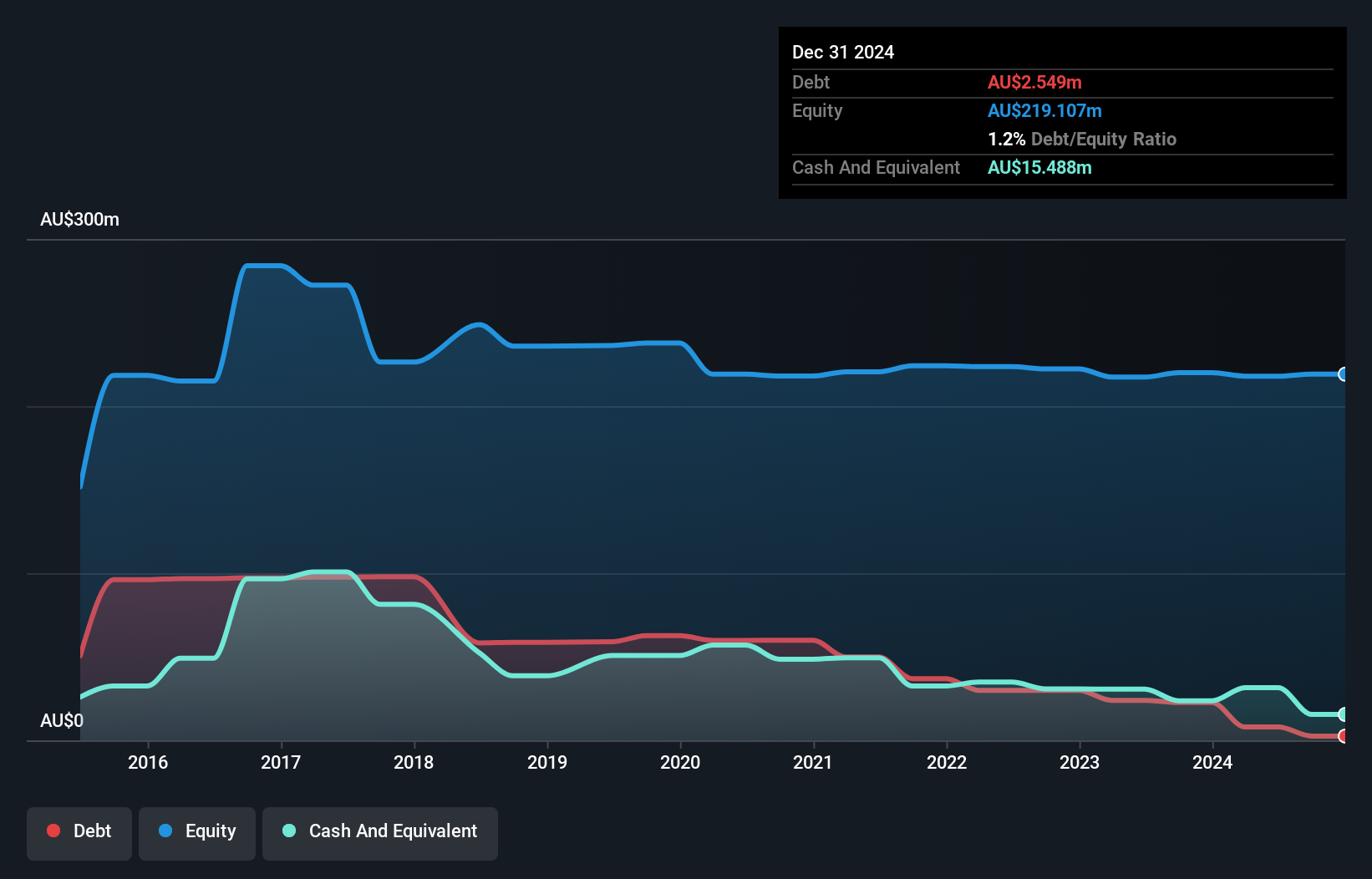

GTN Limited, with a market cap of A$127.10 million, has demonstrated robust earnings growth, with a 52.6% increase over the past year and a five-year average growth rate of 19.2%. Despite its low return on equity at 2.8%, GTN's debt management is strong, as it holds more cash than total debt and covers interest payments effectively. Recent executive changes include the appointment of Ben Brooks as CFO, bringing extensive media experience to the team. The company completed a share buyback program and increased its dividend payout to A$0.0247 for the half-year ending December 2024.

- Get an in-depth perspective on GTN's performance by reading our balance sheet health report here.

- Learn about GTN's future growth trajectory here.

XRF Scientific (ASX:XRF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: XRF Scientific Limited manufactures and markets precious metal products, specialized chemicals, and instruments for the scientific, analytical, construction material, and mining industries across Australia, Canada, and Europe with a market cap of A$222.05 million.

Operations: The company's revenue is derived from three main segments: Consumables (A$18.86 million), Precious Metals (A$21.48 million), and Capital Equipment (A$22.20 million).

Market Cap: A$222.05M

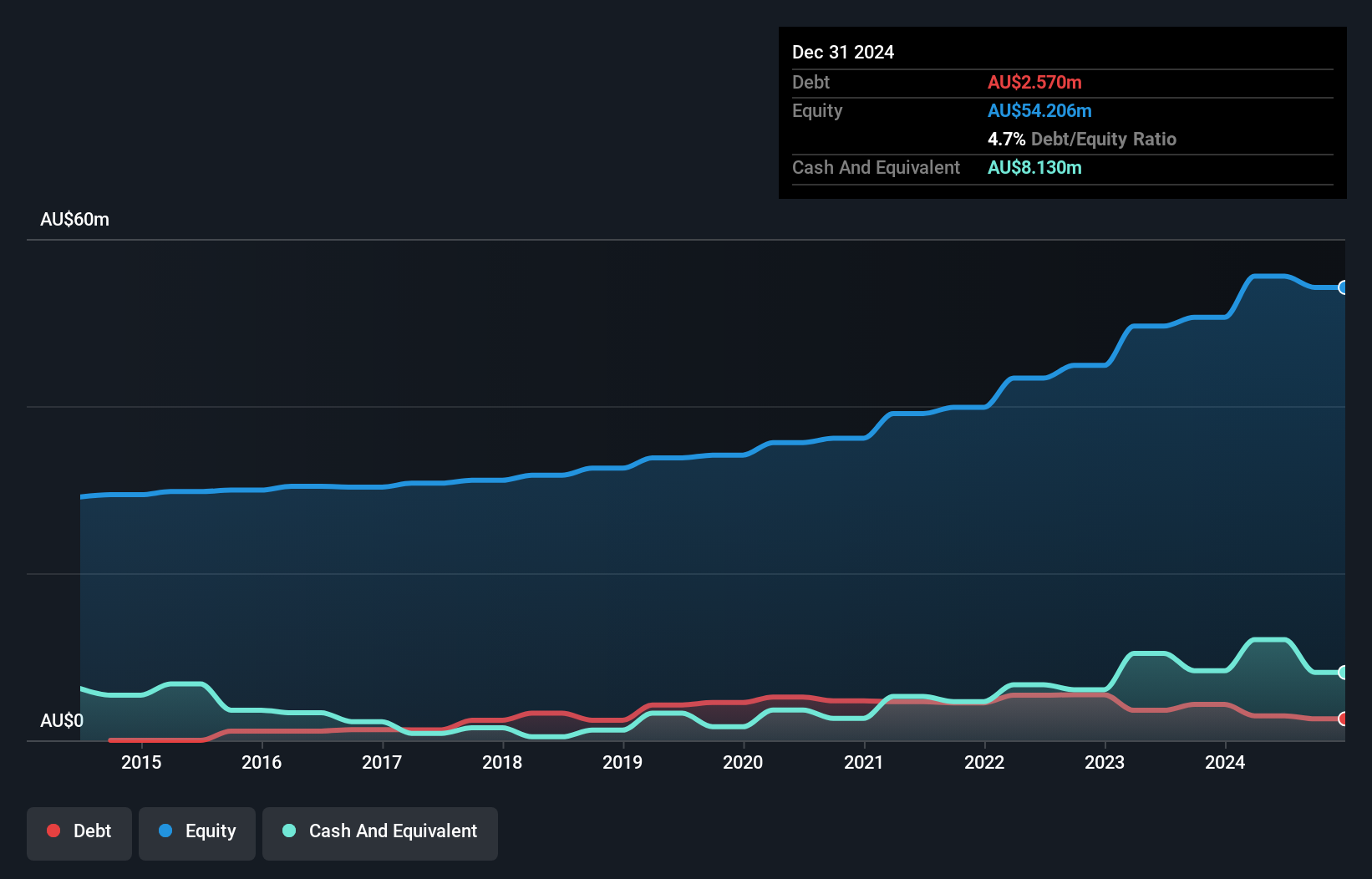

XRF Scientific Limited, with a market cap of A$222.05 million, shows potential in the penny stock segment due to its diversified revenue streams across Consumables, Precious Metals, and Capital Equipment. The company trades at 19.1% below its estimated fair value and maintains strong financial health with short-term assets exceeding liabilities and debt well covered by operating cash flow. Despite significant insider selling recently, XRF's earnings have grown steadily by 22.8% annually over five years but slowed to 11.7% last year. Notably, it was added to the S&P/ASX All Ordinaries Index in March 2025, reflecting increased market recognition.

- Jump into the full analysis health report here for a deeper understanding of XRF Scientific.

- Understand XRF Scientific's earnings outlook by examining our growth report.

Where To Now?

- Click through to start exploring the rest of the 990 ASX Penny Stocks now.

- Curious About Other Options? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ART

Airtasker

Engages in the provision of technology-enabled online marketplaces for local services in Australia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives