- Australia

- /

- Metals and Mining

- /

- NSX:PRL

ASX Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As the ASX 200 mirrors Wall Street's recent dip, investors are keenly watching economic indicators like the upcoming CPI data, which could influence future interest rate decisions by Australia's Reserve Bank. In such a fluctuating market, penny stocks—though an old term—remain relevant for those seeking potential value in smaller or newer companies. This article will explore three penny stocks that stand out for their financial strength and potential to offer compelling opportunities despite broader market uncertainties.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.50 | A$143.29M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.20 | A$103.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$49.19M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.69 | A$415.34M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.35 | A$247.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.044 | A$51.47M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.072 | A$37.28M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.755 | A$360.67M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.32 | A$1.42B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 425 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Champion Iron (ASX:CIA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Champion Iron Limited is involved in the acquisition, exploration, development, and production of iron ore properties in Canada with a market cap of A$2.50 billion.

Operations: The company's revenue is derived entirely from its Iron Ore Concentrate segment, amounting to CA$1.53 billion.

Market Cap: A$2.5B

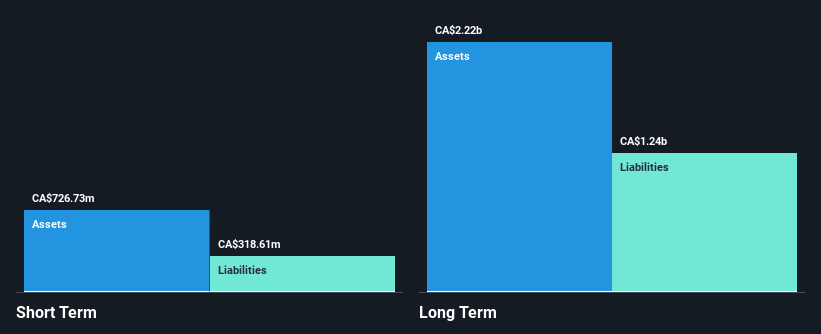

Champion Iron's financial performance has been under pressure with a decline in net income to CA$23.78 million for Q1 2025, compared to CA$81.36 million the previous year, and a drop in sales from CA$467.08 million to CA$390.03 million. Despite these challenges, the company maintains satisfactory debt levels with a net debt to equity ratio of 39.3% and well-covered interest payments by EBIT (6.2x). Recent executive changes include the departure of CFO Donald Tremblay, which may impact short-term operational stability as they search for his successor amidst ongoing production adjustments.

- Click here and access our complete financial health analysis report to understand the dynamics of Champion Iron.

- Review our growth performance report to gain insights into Champion Iron's future.

SRG Global (ASX:SRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SRG Global Limited operates in engineering, mining, maintenance and construction contracting across Australia and New Zealand with a market cap of A$1.23 billion.

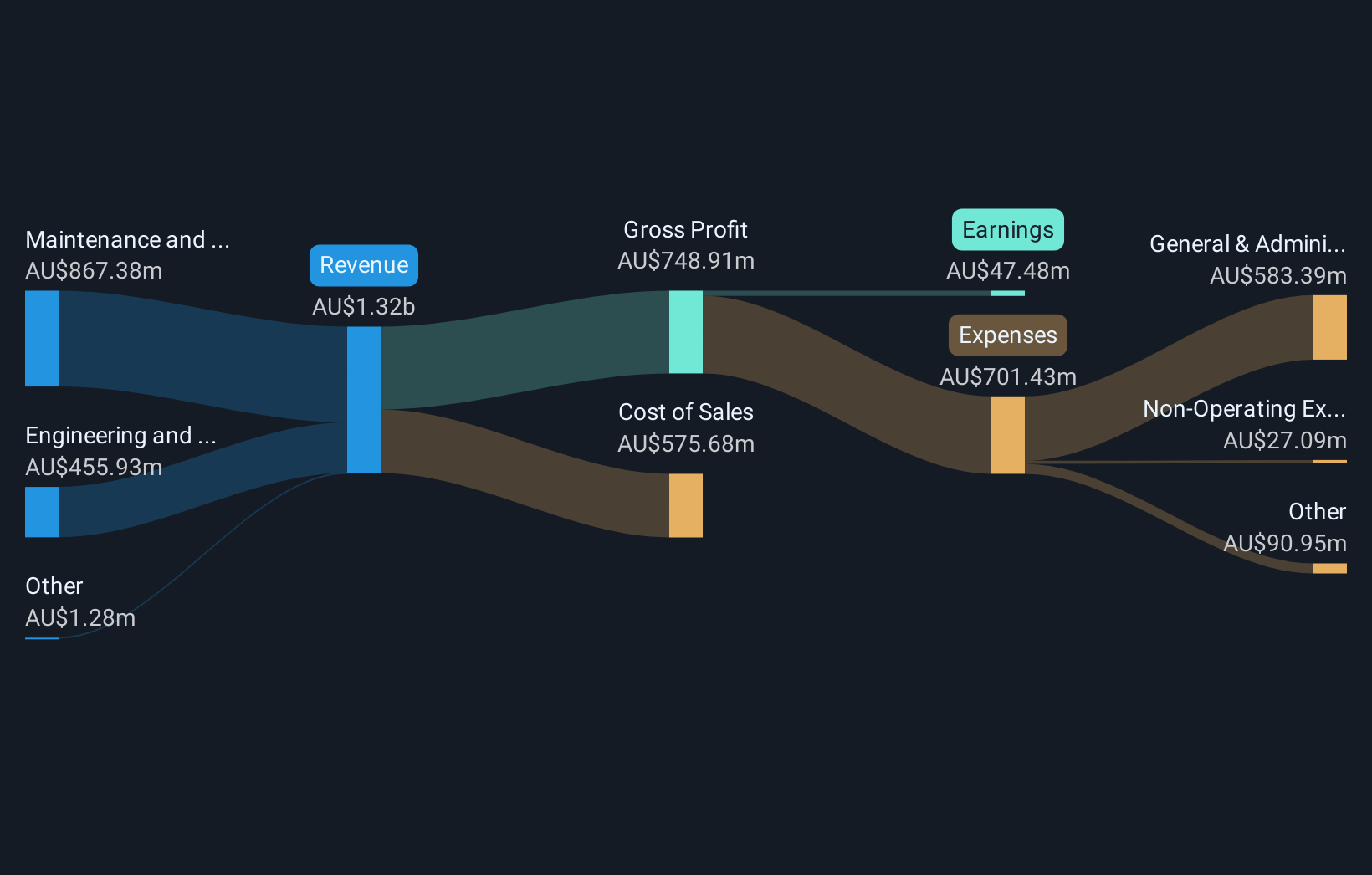

Operations: The company's revenue is derived from its Engineering and Construction segment, which generated A$455.93 million, and its Maintenance and Industrial Services segment, contributing A$867.38 million.

Market Cap: A$1.23B

SRG Global's recent performance highlights its robust financial position, with full-year sales reaching A$1.32 billion, up from A$1.07 billion the previous year. The company reported a net income of A$47.48 million, reflecting strong earnings growth. SRG's debt is well-managed with cash exceeding total debt and operating cash flow covering 155% of it. The board and management team are experienced, contributing to strategic decisions like seeking acquisitions to enhance capabilities and footprint. Despite low return on equity at 12.1%, SRG trades below estimated fair value, offering potential for investors mindful of its stable weekly volatility at 5%.

- Unlock comprehensive insights into our analysis of SRG Global stock in this financial health report.

- Explore SRG Global's analyst forecasts in our growth report.

Province Resources (NSX:PRL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Province Resources Limited focuses on the exploration and evaluation of green energy and mineral resources in Australia with a market cap of A$15.36 million.

Operations: Currently, no revenue segments are reported for Province Resources Limited.

Market Cap: A$15.36M

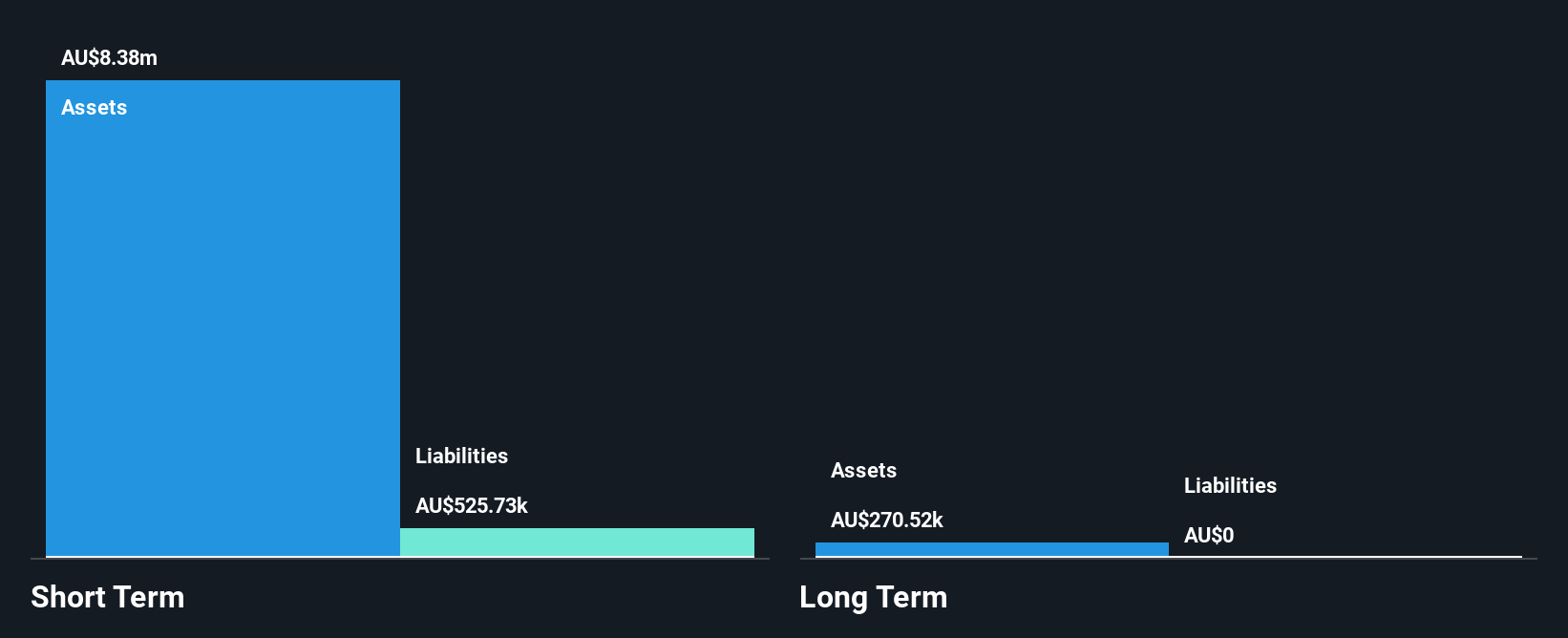

Province Resources Limited, with a market cap of A$15.36 million, is pre-revenue and debt-free, focusing on green energy exploration. Its short-term assets of A$8.4 million comfortably cover liabilities of A$525.7K, providing financial stability despite ongoing losses reduced by 15% annually over five years. The company has a cash runway exceeding three years at current burn rates. Province's HyEnergy Project could significantly impact Australia's renewable sector by proposing a large-scale HVDC transmission link from Western Australia to the East Coast, supported by more than $12 million in studies and strong community backing for its strategic clean energy vision.

- Click to explore a detailed breakdown of our findings in Province Resources' financial health report.

- Learn about Province Resources' historical performance here.

Seize The Opportunity

- Click this link to deep-dive into the 425 companies within our ASX Penny Stocks screener.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSX:PRL

Province Resources

Engages in the exploration and evaluation of green energy and mineral resources in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives