We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Xanadu Mines ( ASX:XAM ) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Xanadu Mines

Does Xanadu Mines Have A Long Cash Runway?

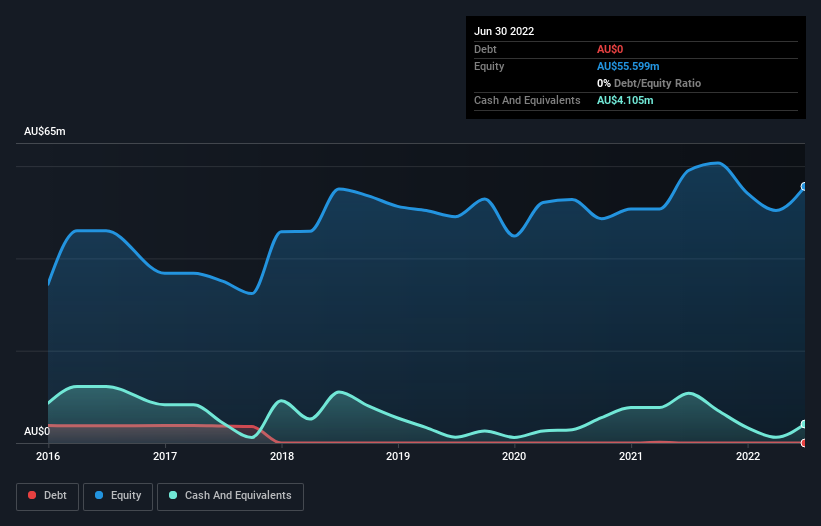

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2022, Xanadu Mines had AU$4.1m in cash, and was debt-free. Looking at the last year, the company burnt through AU$4.2m. So it had a cash runway of approximately 12 months from June 2022. However, the good news is that Xanadu Mines had entered into a strategic partnership with Zijin Mining Group Co., where Zijin will be purchasing equity in Xanadu Mines (approximately AU$5.7 worth) and also paying Xanadu Mines US$35M for a 50/50 stake in their Khuiten Metals Pte. Ltd. joint venture, which is currently 100% owned by Xanadu Mines.

You can see how its cash balance has changed over time in the image below.

How Is Xanadu Mines' Cash Burn Changing Over Time?

Xanadu Mines didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. As it happens, the company's cash burn reduced by 6.4% over the last year, which suggests that management may be mindful of the risks of their depleting cash reserves. Admittedly, we're a bit cautious of Xanadu Mines due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow .

How Risky Is Xanadu Mines' Cash Burn Situation?

On this analysis of Xanadu Mines' cash burn, we think its cash burn relative to its market cap was reassuring, and with its cash runway extended by its deal with Zijin Mining, the numbers are reassuring. Despite this, the analysis we've done in this article does suggest that shareholders should conduct usual due diligence in investing in a company. To help with this, we conducted an in-depth investigation of the company, and identified 5 warning signs for Xanadu Mines (3 are a bit unpleasant!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:XAM

Xanadu Mines

Engages in the exploration and development of various mineral projects in Mongolia.

Flawless balance sheet moderate.

Market Insights

Community Narratives