- Australia

- /

- Metals and Mining

- /

- ASX:WWI

Those Who Purchased West Wits Mining (ASX:WWI) Shares Three Years Ago Have A 57% Loss To Show For It

West Wits Mining Limited (ASX:WWI) shareholders will doubtless be very grateful to see the share price up 100% in the last quarter. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 57%. So it is really good to see an improvement. The rise has some hopeful, but turnarounds are often precarious.

Check out our latest analysis for West Wits Mining

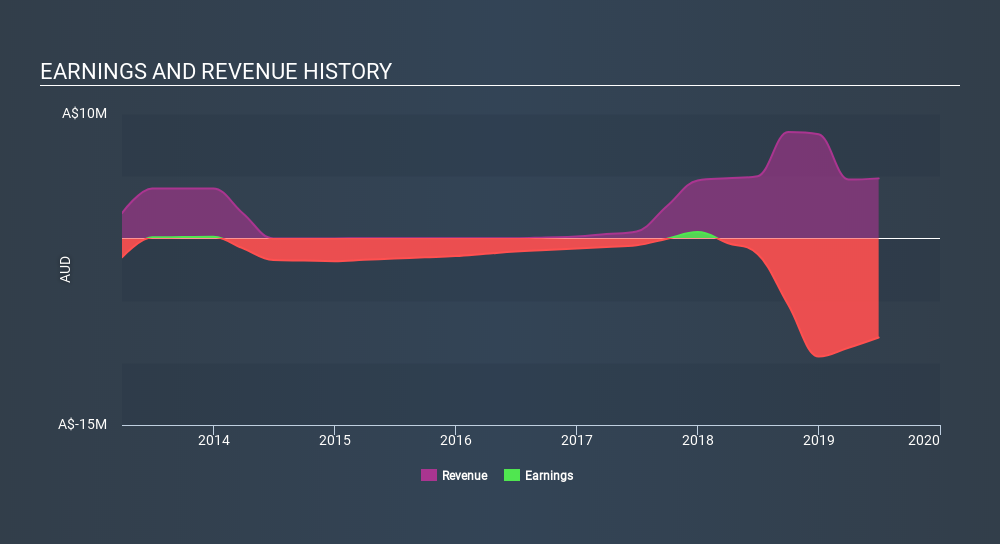

Given that West Wits Mining didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, West Wits Mining grew revenue at 77% per year. That is faster than most pre-profit companies. In contrast, the share price is down 25% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between West Wits Mining's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that West Wits Mining's TSR, at -57% is higher than its share price return of -57%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

West Wits Mining shareholders have received returns of 20% over twelve months, which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 4.2%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 7 warning signs for West Wits Mining (3 are a bit unpleasant) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:WWI

West Wits Mining

Engages in the exploration, evaluation, extraction, development, and production of mineral properties in South Africa and Australia.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives