- Australia

- /

- Metals and Mining

- /

- ASX:WWI

Introducing West Wits Mining, The Stock That Dropped 45% In The Last Year

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

West Wits Mining Limited (ASX:WWI) shareholders will doubtless be very grateful to see the share price up 38% in the last week. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact, the price has declined 45% in a year, falling short of the returns you could get by investing in an index fund.

See our latest analysis for West Wits Mining

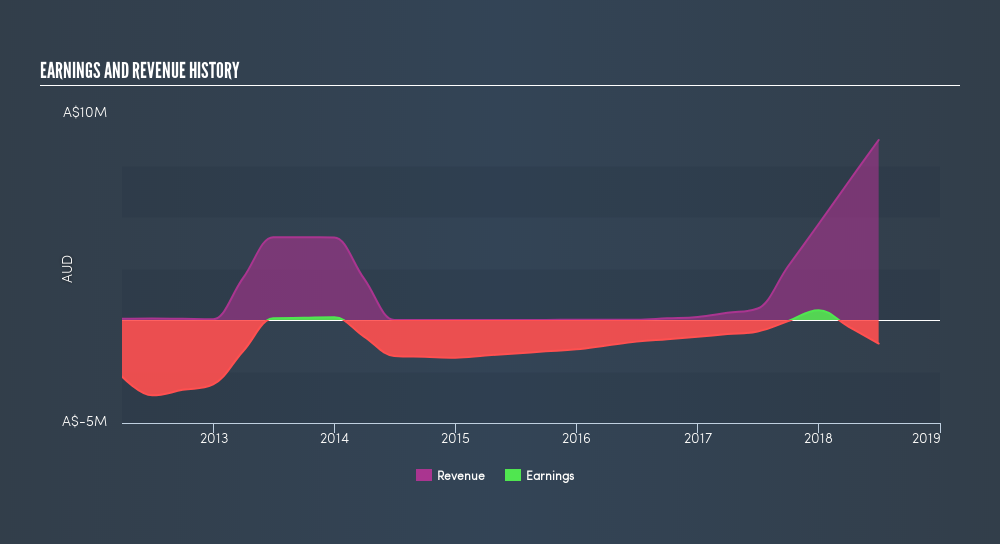

Because West Wits Mining is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year West Wits Mining saw its revenue grow by 1463%. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 45% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Take a more thorough look at West Wits Mining's financial health with this freereport on its balance sheet.

A Different Perspective

West Wits Mining shareholders are down 45% for the year, but the market itself is up 7.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research West Wits Mining in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:WWI

West Wits Mining

Engages in the exploration, evaluation, extraction, development, and production of mineral properties in South Africa and Australia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion