- Australia

- /

- Metals and Mining

- /

- ASX:WTM

Waratah Minerals' Insiders' Timely Sale May Have Helped Mitigate 13% Dip in Share Price

Insiders at Waratah Minerals Limited (ASX:WTM) sold AU$2.5m worth of stock at an average price of AU$0.58 a share over the past year, making the most of their investment. The company's market worth decreased by AU$29m over the past week after the stock price dropped 13%, although insiders were able to minimize their losses

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

The Last 12 Months Of Insider Transactions At Waratah Minerals

Over the last year, we can see that the biggest insider sale was by the MD & Director, Peter Duerden, for AU$2.5m worth of shares, at about AU$0.58 per share. That means that even when the share price was below the current price of AU$0.69, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 38% of Peter Duerden's stake. Peter Duerden was the only individual insider to sell over the last year.

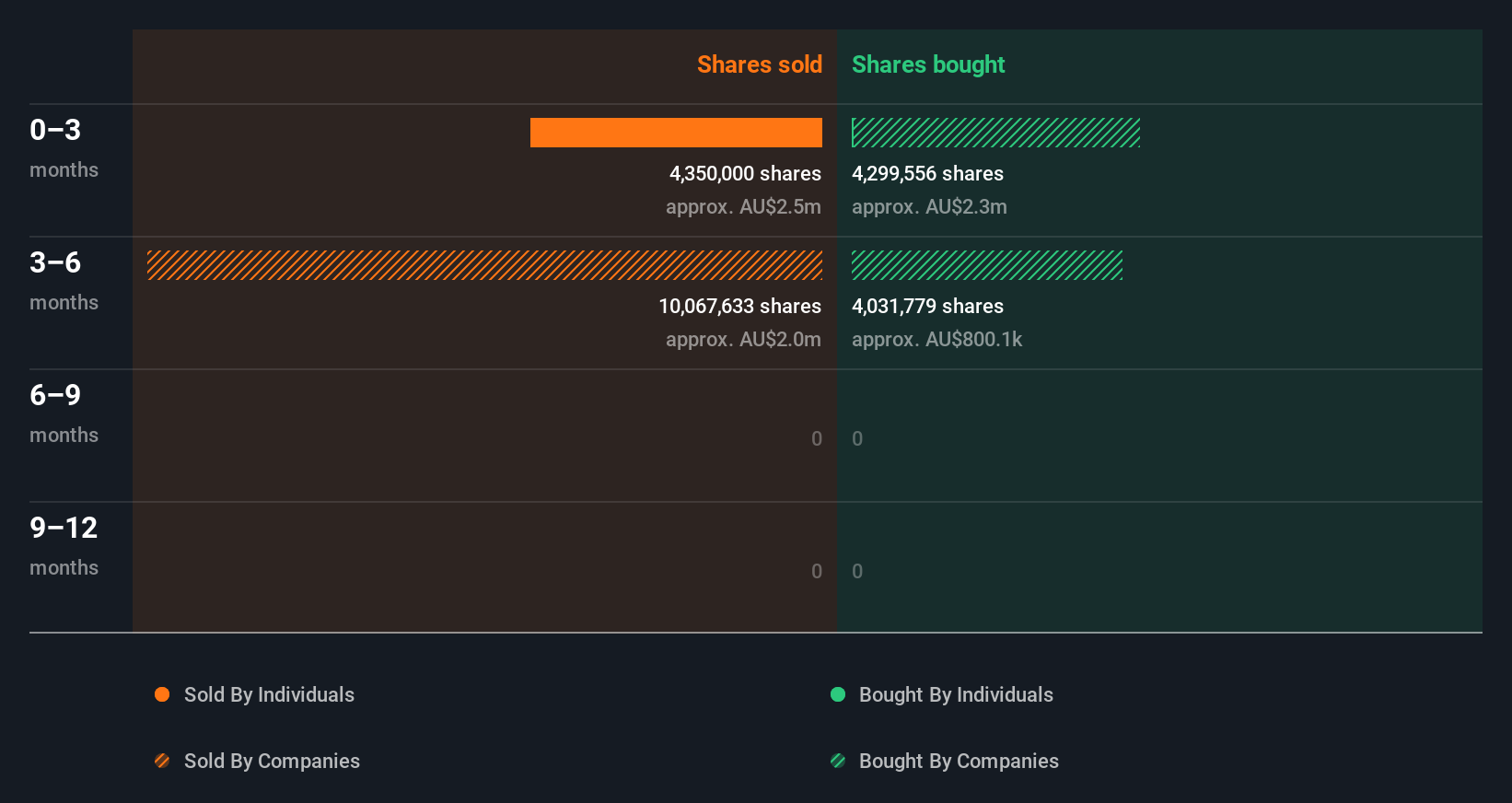

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Check out our latest analysis for Waratah Minerals

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Waratah Minerals Insiders Are Selling The Stock

Over the last three months, we've seen notably more insider selling, than insider buying, at Waratah Minerals. In that time, MD & Director Peter Duerden dumped AU$2.5m worth of shares. On the flip side, Non-Executive Chairman Andrew Stewart spent AU$20k on purchasing shares (as mentioned above) . We don't view these transactions as a positive sign.

Does Waratah Minerals Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. From our data, it seems that Waratah Minerals insiders own 6.9% of the company, worth about AU$13m. However, it's possible that insiders might have an indirect interest through a more complex structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Does This Data Suggest About Waratah Minerals Insiders?

The stark truth for Waratah Minerals is that there has been more insider selling than insider buying in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. While insiders do own shares, they don't own a heap, and they have been selling. We'd practice some caution before buying! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Waratah Minerals. When we did our research, we found 5 warning signs for Waratah Minerals (3 shouldn't be ignored!) that we believe deserve your full attention.

Of course Waratah Minerals may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Waratah Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WTM

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion