- Australia

- /

- Metals and Mining

- /

- ASX:WSI

Here's Why I Think WestStar Industrial (ASX:WSI) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like WestStar Industrial (ASX:WSI). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for WestStar Industrial

How Fast Is WestStar Industrial Growing Its Earnings Per Share?

In the last three years WestStar Industrial's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, WestStar Industrial's EPS shot from AU$0.0019 to AU$0.0046, over the last year. You don't see 142% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

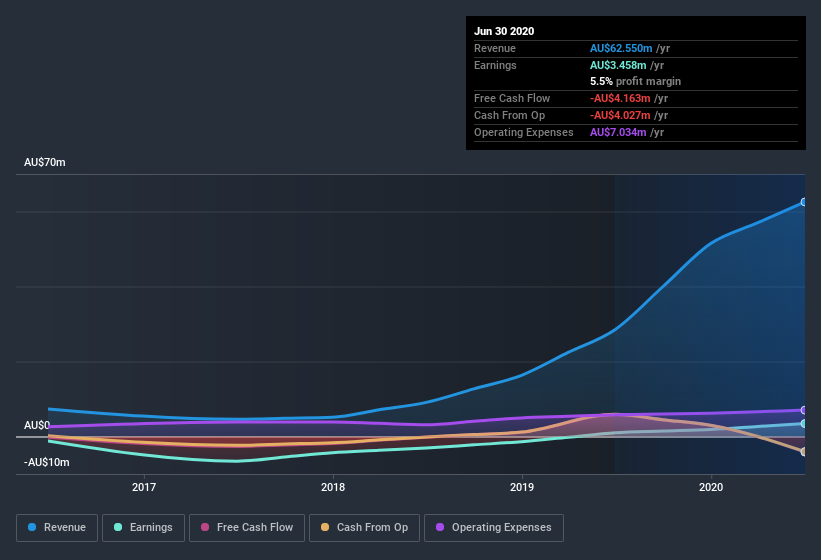

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that WestStar Industrial is growing revenues, and EBIT margins improved by 5.1 percentage points to 5.9%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

WestStar Industrial isn't a huge company, given its market capitalization of AU$23m. That makes it extra important to check on its balance sheet strength.

Are WestStar Industrial Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that WestStar Industrial insiders own a meaningful share of the business. In fact, they own 47% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only AU$23m WestStar Industrial is really small for a listed company. That means insiders only have AU$11m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like WestStar Industrial with market caps under AU$265m is about AU$381k.

The WestStar Industrial CEO received AU$201k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does WestStar Industrial Deserve A Spot On Your Watchlist?

WestStar Industrial's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. WestStar Industrial certainly ticks a few of my boxes, so I think it's probably well worth further consideration. Before you take the next step you should know about the 3 warning signs for WestStar Industrial that we have uncovered.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade WestStar Industrial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WestStar Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:WSI

WestStar Industrial

An industrial services company, provides engineering, fabrication, construction, and maintenance services to resources, energy, oil and gas, petrochemical, water, defence, and infrastructure sectors in Australia.

Adequate balance sheet low.

Market Insights

Community Narratives