- Australia

- /

- Metals and Mining

- /

- ASX:WGX

Could Exploration Setbacks Shape Westgold Resources’ (ASX:WGX) Approach to Growth and Resource Definition?

Reviewed by Simply Wall St

- Earlier this quarter, Westgold Resources Limited provided updates on its exploration and drilling activities, including the completion of multiple drill holes and the conclusion of the Spargo’s RC drilling program in the Higginsville region.

- Assay results from the Greater Spargo’s RC drill program did not support further follow-up work, highlighting the ongoing challenge of exploration risk and resource definition in greenfield regions.

- We’ll assess how these recent drilling outcomes and project updates could influence Westgold’s investment narrative and future production trajectory.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Westgold Resources Investment Narrative Recap

Owning Westgold Resources often means believing in the company’s ability to deliver production and earnings growth through successful mine upgrades, cost discipline, and resource expansion, even as results from greenfield exploration like the recent Higginsville drill program can be mixed. The latest drilling update is not a material catalyst in the near term, as no further follow-up work is planned at Greater Spargo’s, while the key catalysts and risks remain centered on integration and productivity at core operations and the Karora transaction.

Of recent announcements, the upcoming Mason Target underground drill program stands out: preparation has just finished, and results in early fiscal 2026 could influence views on Westgold’s reserve growth and long-term production outlook, a factor closely watched by market participants after the underwhelming results at Greater Spargo’s. The contrasting progress at other sites keeps investor focus on whether operational improvements can balance setbacks in early-stage exploration.

Yet, in contrast, persistent lower ore grades at core sites remain a risk investors should be aware of, as...

Read the full narrative on Westgold Resources (it's free!)

Westgold Resources' outlook anticipates A$2.0 billion in revenue and A$876.0 million in earnings by 2028. This scenario assumes a 19.6% annual revenue growth rate and a substantial increase in earnings of A$772.7 million from the current A$103.3 million.

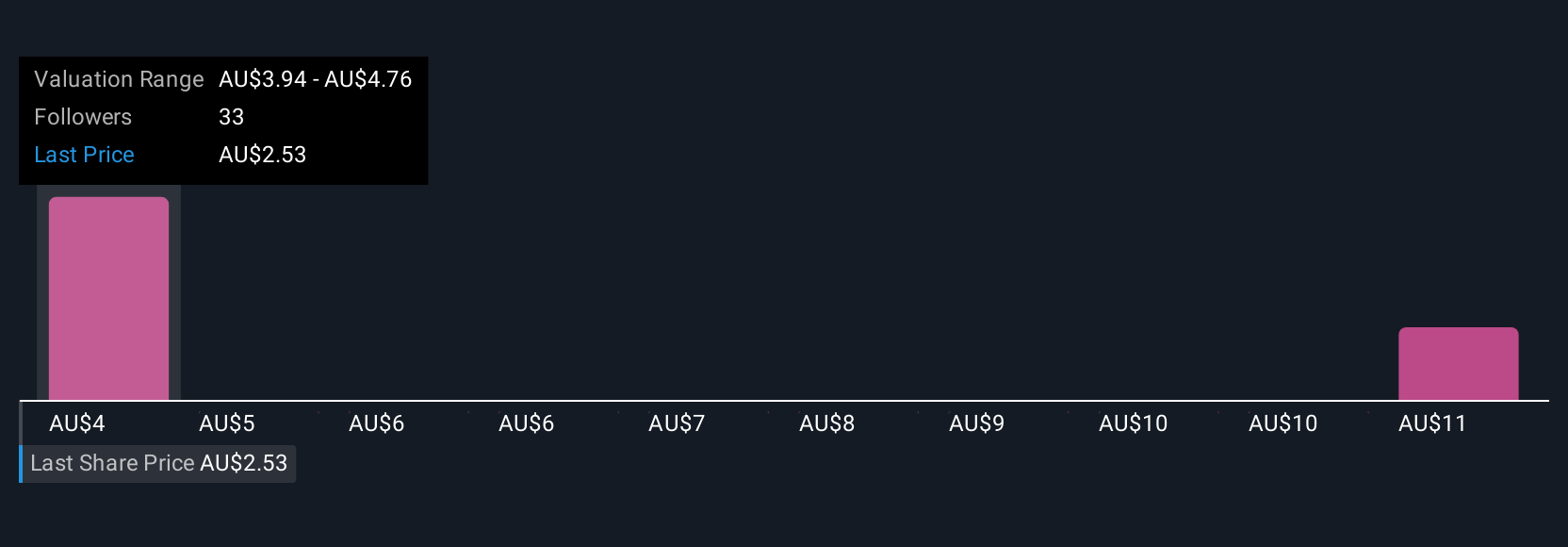

Uncover how Westgold Resources' forecasts yield a A$3.94 fair value, a 54% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Westgold ranging from A$3.94 to A$12.04 per share. While these opinions differ widely, ongoing challenges in new resource definition highlight why market sentiment can shift quickly, compare several viewpoints before forming an opinion.

Explore 2 other fair value estimates on Westgold Resources - why the stock might be worth just A$3.94!

Build Your Own Westgold Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westgold Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Westgold Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westgold Resources' overall financial health at a glance.

No Opportunity In Westgold Resources?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westgold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WGX

Westgold Resources

Engages in the exploration, operation, development, mining, and treatment of gold and other assets primarily in Western Australia.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives