- Australia

- /

- Basic Materials

- /

- ASX:WGN

The Market Lifts Wagners Holding Company Limited (ASX:WGN) Shares 29% But It Can Do More

Wagners Holding Company Limited (ASX:WGN) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 2.2% isn't as impressive.

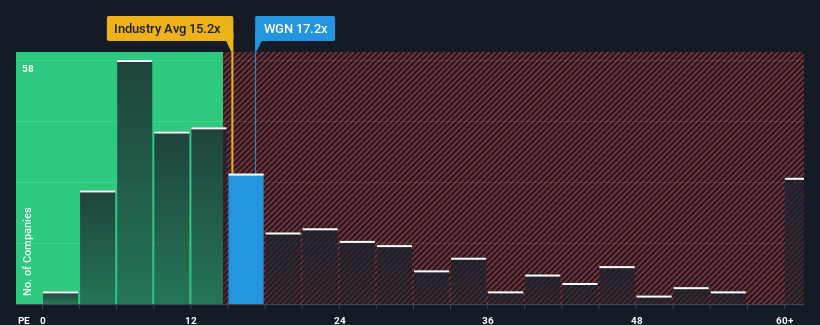

Although its price has surged higher, given about half the companies in Australia have price-to-earnings ratios (or "P/E's") above 21x, you may still consider Wagners Holding as an attractive investment with its 17.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Wagners Holding has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Wagners Holding

Is There Any Growth For Wagners Holding?

There's an inherent assumption that a company should underperform the market for P/E ratios like Wagners Holding's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 230% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 20% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 18% each year, which is noticeably less attractive.

With this information, we find it odd that Wagners Holding is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Wagners Holding's P/E?

Despite Wagners Holding's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Wagners Holding currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Wagners Holding you should be aware of.

If these risks are making you reconsider your opinion on Wagners Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Wagners Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials in Australia, the United States, New Zealand, the United Kingdom, and PNG & Malaysia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives