It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Wagners Holding Company Limited (ASX:WGN) share price slid 50% over twelve months. That falls noticeably short of the market return of around 11%. Because Wagners Holding hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 29% in about a quarter. That's not much fun for holders.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Wagners Holding

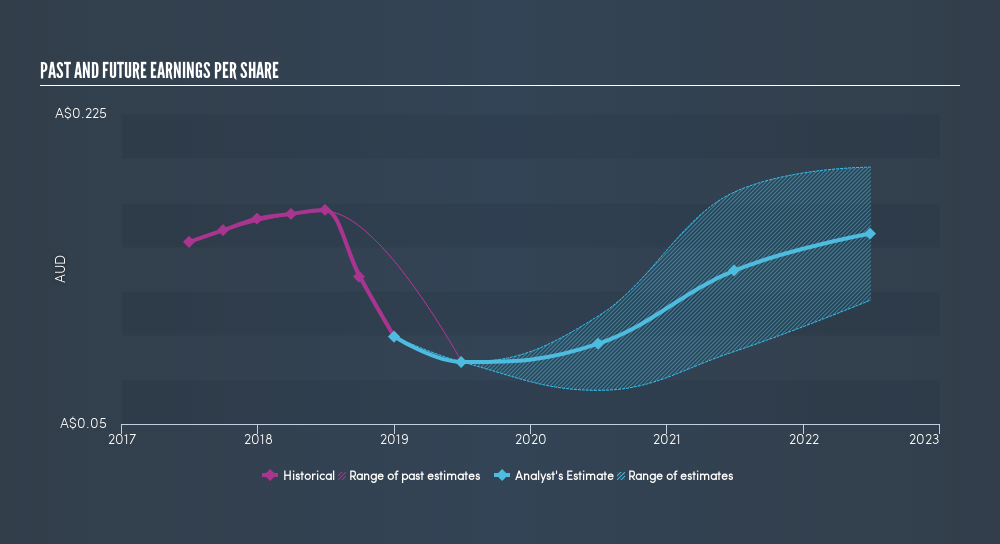

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Wagners Holding reported an EPS drop of 40% for the last year. This proportional reduction in earnings per share isn't far from the 50% decrease in the share price. Given the lower EPS we might have expected investors to lose confidence in the stock, but that doesn't seemed to have happened. Rather, the share price is remains a similar multiple of the EPS, suggesting the outlook remains the same.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Wagners Holding has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Wagners Holding's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 11% in the last year, Wagners Holding shareholders might be miffed that they lost 49% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 29%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Before forming an opinion on Wagners Holding you might want to consider these 3 valuation metrics.

Of course Wagners Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials in Australia, the United States, New Zealand, the United Kingdom, and PNG & Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives