- Australia

- /

- Basic Materials

- /

- ASX:WGN

Here's Why We Think Wagners Holding (ASX:WGN) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Wagners Holding (ASX:WGN). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Quickly Is Wagners Holding Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Wagners Holding grew its EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Despite consistency in EBIT margins year on year, Wagners Holding has actually recorded a dip in revenue. Suffice it to say that is not a great sign of growth.

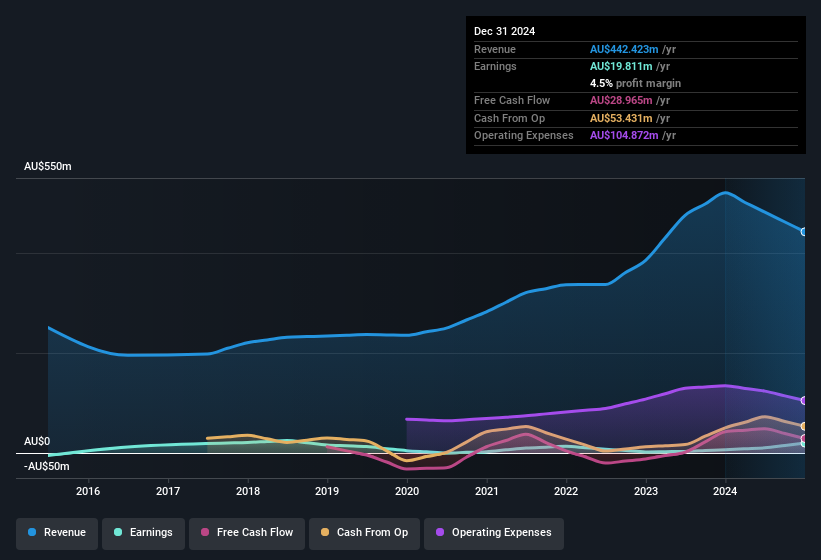

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

View our latest analysis for Wagners Holding

Wagners Holding isn't a huge company, given its market capitalisation of AU$403m. That makes it extra important to check on its balance sheet strength.

Are Wagners Holding Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Wagners Holding top brass are certainly in sync, not having sold any shares, over the last year. But more importantly, Independent Non-Executive Director Allan Brackin spent AU$153k acquiring shares, doing so at an average price of AU$1.53. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Wagners Holding will reveal that insiders own a significant piece of the pie. In fact, they own 50% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about AU$200m riding on the stock, at current prices. That's nothing to sneeze at!

Is Wagners Holding Worth Keeping An Eye On?

One positive for Wagners Holding is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Wagners Holding. You might benefit from giving it a glance today.

The good news is that Wagners Holding is not the only stock with insider buying. Here's a list of small cap, undervalued companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wagners Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WGN

Wagners Holding

Engages in the production and sale of construction materials and related building materials in Australia, the United States, New Zealand, the United Kingdom, Papua New Guinea, and Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives