- Australia

- /

- Metals and Mining

- /

- ASX:WA1

WA1 Resources (ASX:WA1) Is Down 9.2% After US–Australia Critical Minerals Pact—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, Prime Minister Anthony Albanese and US President Donald Trump announced a landmark US–Australia critical-minerals pact worth US$8.5 billion to advance key rare-earths projects and enhance bilateral government support for critical minerals supply chains.

- This high-profile international agreement highlights rising government interest in boosting domestic development for companies operating in Australia’s critical minerals sector, including WA1 Resources.

- We'll explore how increased government focus on rare-earths supply chains shapes the investment narrative for WA1 Resources.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is WA1 Resources' Investment Narrative?

To take a position in WA1 Resources today, you really have to believe in the long-term opportunity for critical minerals in Australia and the company's ability to eventually generate cash flow from high-grade discoveries like its Luni niobium project. The new US–Australia critical-minerals pact, with its US$8.5 billion push for local processing, shines a global spotlight on rare earths and should support positive sentiment for Australian developers generally, though near-term catalysts for WA1 may see only limited material change based on this announcement. The core challenges remain: the company is still pre-revenue, unprofitable, and has funded itself through frequent share issuances, most recently A$100,000,000 in equity at a discount. Risks like continued operating losses, lack of revenue, and recent equity dilution are still front of mind, but government backing could open future funding doors or partnerships if WA1 advances a qualifying project. While the sector boost is real, the immediate impact on WA1’s core risks and project timelines may be more muted until further specific developments unfold. On the flip side, share dilution and ongoing losses are concerns investors should watch closely.

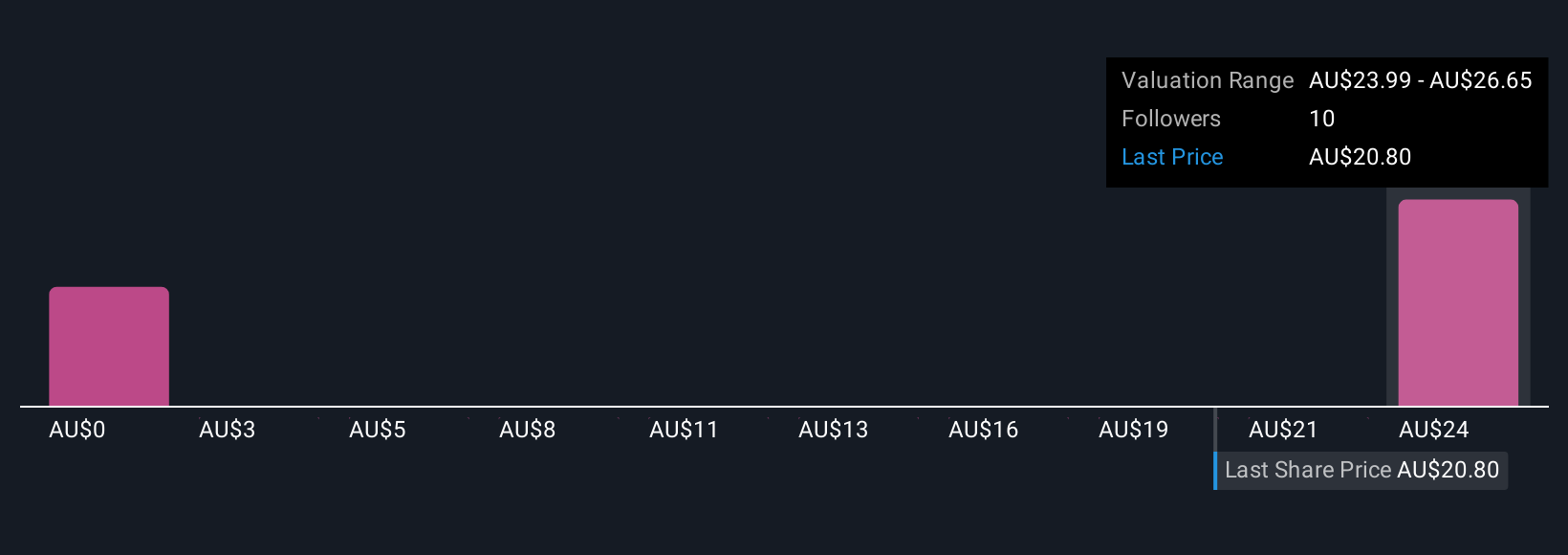

The analysis detailed in our WA1 Resources valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 7 other fair value estimates on WA1 Resources - why the stock might be worth as much as 35% more than the current price!

Build Your Own WA1 Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WA1 Resources research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free WA1 Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WA1 Resources' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WA1 Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WA1

WA1 Resources

Engages in the exploration and development of mineral resources in Western Australia and Northern territory.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives