- Australia

- /

- Metals and Mining

- /

- ASX:VSR

3 Promising ASX Penny Stocks With Under A$200M Market Cap

Reviewed by Simply Wall St

A late rebound saw the Australian market close slightly up, with most sectors contributing to the gains despite some losses in technology stocks. In this climate, identifying promising investment opportunities requires a focus on companies with strong financials and clear growth potential. While the term "penny stocks" may seem outdated, these smaller or less-established firms can still offer significant value and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$114.64M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$69.82M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$47.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.83 | A$434.94M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.11 | A$229.71M | ✅ 4 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.26B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.945 | A$136.02M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.27 | A$124.98M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.45 | A$642.58M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 434 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

EcoGraf (ASX:EGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EcoGraf Limited focuses on the exploration and production of graphite products for lithium-ion batteries and advanced manufacturing markets in Tanzania and Australia, with a market cap of A$169.16 million.

Operations: The company generates revenue of A$3.72 million from its operations in Australia.

Market Cap: A$169.16M

EcoGraf Limited, with a market cap of A$169.16 million, is focused on graphite production for battery markets in Tanzania and Australia. Recent announcements highlight the potential expansion at its Epanko Graphite Project, aiming to ramp up production to 390,000 tpa over ten years. Despite generating A$3.72 million in revenue from Australian operations, EcoGraf remains pre-revenue and unprofitable with a negative return on equity of -10.85%. The company has no debt but faces financial constraints with less than a year of cash runway if current free cash flow trends continue. Management changes aim to support strategic financing initiatives for project development.

- Take a closer look at EcoGraf's potential here in our financial health report.

- Explore historical data to track EcoGraf's performance over time in our past results report.

Lefroy Exploration (ASX:LEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lefroy Exploration Limited is involved in the exploration and evaluation of mineral properties in Western Australia, with a market cap of A$55.38 million.

Operations: The company generates revenue primarily from exploration activities, amounting to A$0.001 million.

Market Cap: A$55.38M

Lefroy Exploration, with a market cap of A$55.38 million, remains pre-revenue and faces financial challenges, including a cash runway of less than a year. Despite reducing its net loss from A$3.19 million to A$2.57 million over the past year, the company is still unprofitable with negative equity returns and increasing losses over five years at 28.6% annually. The management team is relatively new with an average tenure of 1.9 years, while the board has more experience at 3.4 years on average. Recent auditor concerns highlight doubts about its ability to continue as a going concern without significant changes or financing.

- Unlock comprehensive insights into our analysis of Lefroy Exploration stock in this financial health report.

- Examine Lefroy Exploration's past performance report to understand how it has performed in prior years.

Voltaic Strategic Resources (ASX:VSR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Voltaic Strategic Resources Limited is a mineral exploration company engaged in battery and precious metals projects in Western Australia and Nevada, with a market cap of A$24.97 million.

Operations: Currently, Voltaic Strategic Resources Limited does not report any revenue segments.

Market Cap: A$24.97M

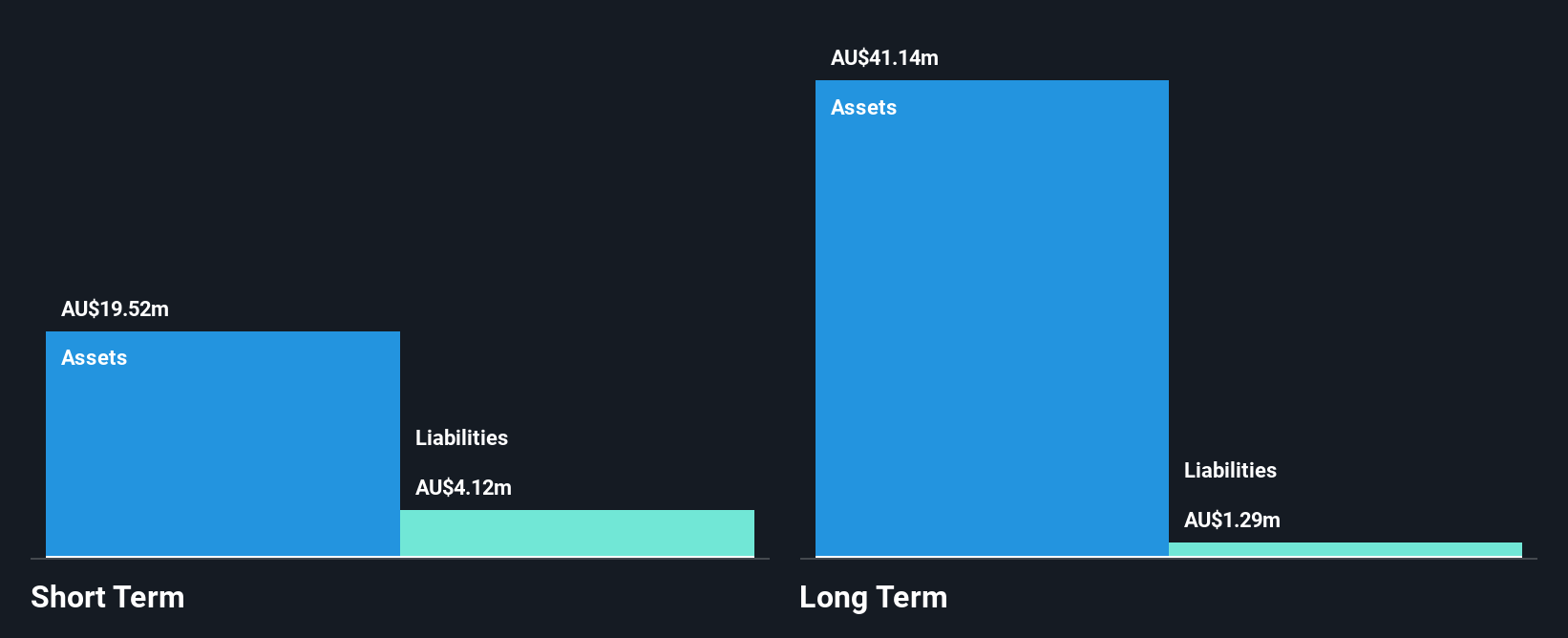

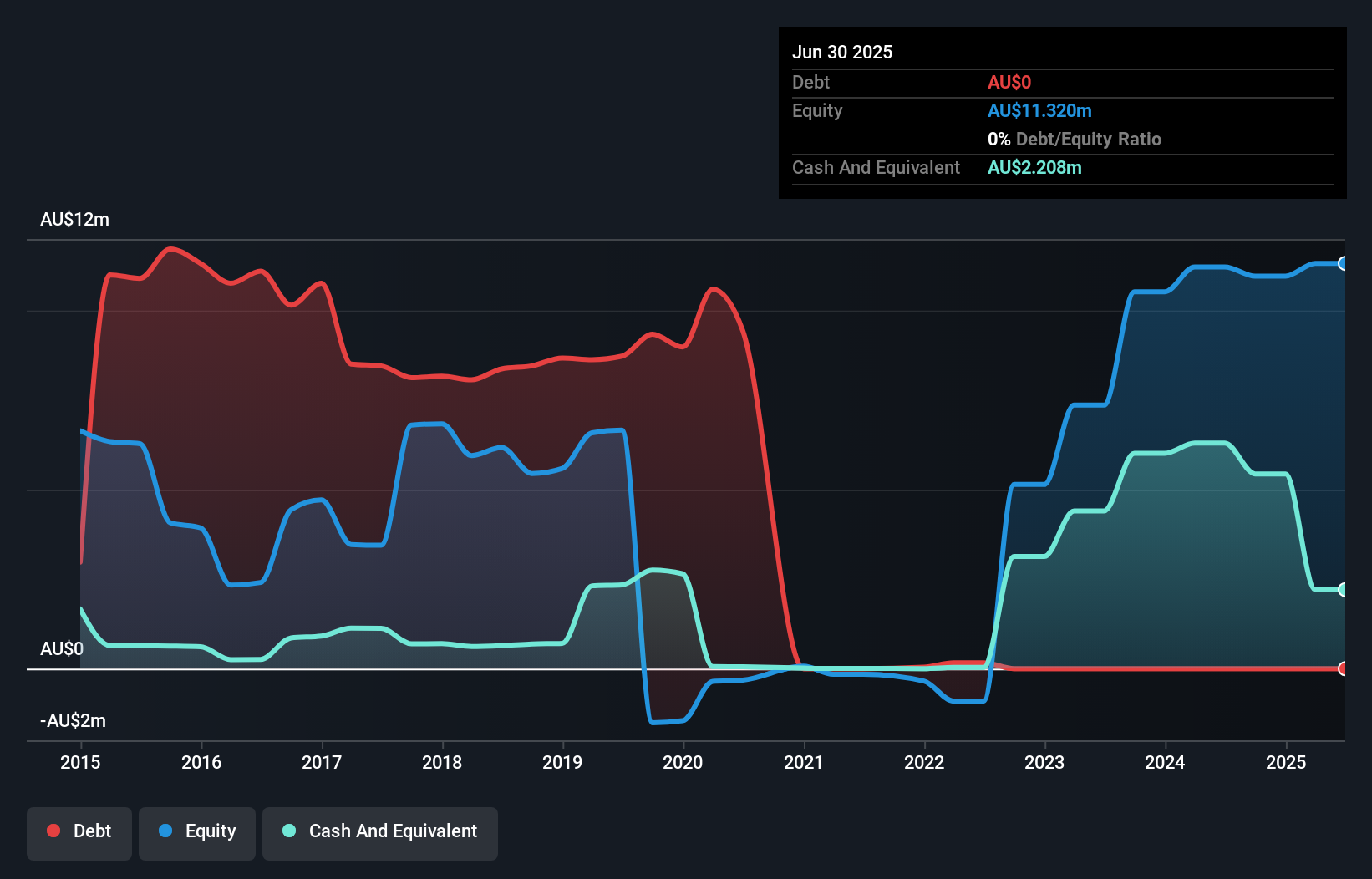

Voltaic Strategic Resources, with a market cap of A$24.97 million, is pre-revenue and debt-free, offering a potentially stable financial base despite its unprofitability. The company has reduced losses at a significant rate over the past five years and maintains sufficient cash runway for over a year under current conditions. However, its share price remains highly volatile compared to most Australian stocks. Recent changes in governance include the appointment of Gabriel Chiappini as Head of Governance and Company Secretary, bringing extensive experience in ASX-listed companies which may enhance strategic oversight amidst ongoing operational challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Voltaic Strategic Resources.

- Gain insights into Voltaic Strategic Resources' past trends and performance with our report on the company's historical track record.

Where To Now?

- Discover the full array of 434 ASX Penny Stocks right here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VSR

Voltaic Strategic Resources

A mineral exploration company that focuses on a portfolio of battery and precious metals exploration projects in Western Australia and Nevada.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion