Australian shares are experiencing a period of volatility, with the ASX 200 futures indicating a slight upward movement amidst global uncertainties such as impending EU tariffs from the U.S. Penny stocks, though often seen as an outdated term, continue to present intriguing opportunities for investors willing to explore smaller or newer companies with solid financial foundations. In this context, we examine three Australian penny stocks that combine financial strength with potential growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Bisalloy Steel Group (ASX:BIS) | A$3.14 | A$150.42M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.66 | A$270.28M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.465 | A$288.37M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.34 | A$362.44M | ★★★★★☆ |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.745 | A$461.15M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.24 | A$1.16B | ★★★★★★ |

| GTN (ASX:GTN) | A$0.535 | A$105.06M | ★★★★★★ |

| MotorCycle Holdings (ASX:MTO) | A$1.81 | A$133.59M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.14 | A$259.8M | ★★★★★★ |

| Accent Group (ASX:AX1) | A$2.02 | A$1.14B | ★★★★☆☆ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Cobram Estate Olives (ASX:CBO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is involved in olive farming and the production and marketing of olive oil across Australia, the United States, and internationally, with a market cap of A$854.64 million.

Operations: The company's revenue segments include its US operation, which generated A$67.16 million.

Market Cap: A$854.64M

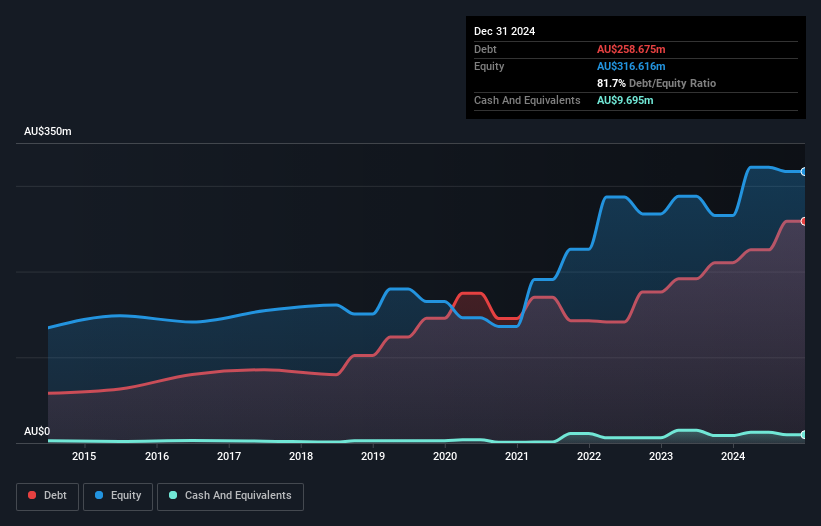

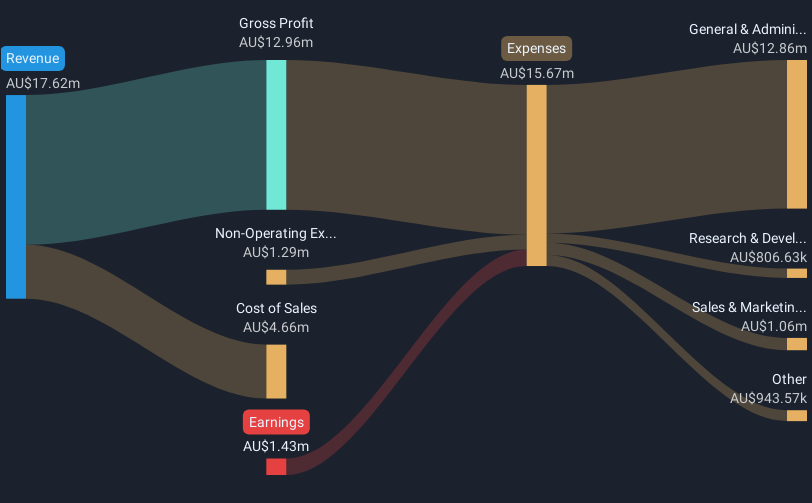

Cobram Estate Olives Limited, with a market cap of A$854.64 million, has shown promising financial trends despite challenges. The company's earnings grew significantly by 104.8% over the past year, outpacing the broader food industry and improving net profit margins to 8.9%. Although its debt level remains high with a net debt to equity ratio of 78.6%, interest payments are well covered by EBIT at 4.6 times coverage, and operating cash flow covers debt adequately at 24%. Recent earnings reported for H1 showed sales growth to A$124.77 million, though the company still posted a net loss of A$4.46 million compared to last year's larger loss.

- Take a closer look at Cobram Estate Olives' potential here in our financial health report.

- Evaluate Cobram Estate Olives' prospects by accessing our earnings growth report.

CleanSpace Holdings (ASX:CSX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CleanSpace Holdings Limited designs, manufactures, and sells respiratory protection products and services for healthcare and industrial markets globally, with a market cap of A$37.04 million.

Operations: CleanSpace Holdings Limited has not reported any specific revenue segments.

Market Cap: A$37.04M

CleanSpace Holdings Limited, with a market cap of A$37.04 million, recently reported H1 sales of A$9.2 million, an improvement from the previous year's A$7.3 million, while reducing net losses to A$0.4 million from A$2.1 million. Despite its unprofitability and high share price volatility over the past three months, CleanSpace has a strengthened financial position with short-term assets exceeding both long-term and short-term liabilities significantly and more cash than total debt. The company benefits from a stable cash runway exceeding three years under current free cash flow conditions but faces challenges with an inexperienced management team averaging 1.5 years tenure.

- Unlock comprehensive insights into our analysis of CleanSpace Holdings stock in this financial health report.

- Assess CleanSpace Holdings' previous results with our detailed historical performance reports.

Volt Resources (ASX:VRC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Volt Resources Limited is a company focused on critical minerals and battery materials, with a market cap of A$21.07 million.

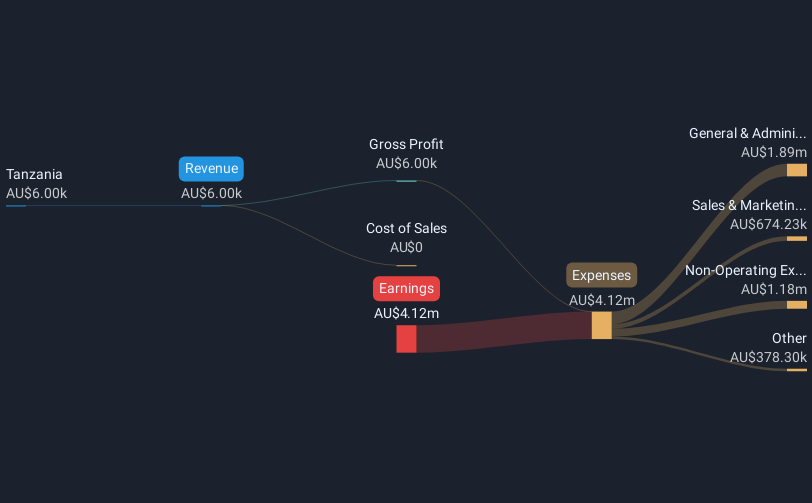

Operations: The company generates revenue from its operations in Tanzania, amounting to A$0.006 million.

Market Cap: A$21.07M

Volt Resources Limited, with a market cap of A$21.07 million, is pre-revenue, generating only A$0.006 million from its Tanzanian operations. The company recently completed a follow-on equity offering raising A$1.226 million to bolster its financial position amid high volatility and unprofitability challenges. Despite a satisfactory net debt-to-equity ratio of 0.5%, Volt's short-term assets (A$133K) fall significantly short of covering liabilities (A$6.5M). While the management team is experienced with an average tenure of 2.1 years, the board remains relatively new at 1.7 years on average, suggesting potential governance instability.

- Click here and access our complete financial health analysis report to understand the dynamics of Volt Resources.

- Evaluate Volt Resources' historical performance by accessing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 1,033 ASX Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CBO

Cobram Estate Olives

Engages in olive farming and the production and marketing of olive oil in Australia, the United States, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives