- Australia

- /

- Metals and Mining

- /

- ASX:VAU

Vault Minerals (ASX:VAU) Reports Surge In Sales To A$1.43 Billion

Reviewed by Simply Wall St

Vault Minerals (ASX:VAU) recently announced a buyback program and robust fiscal results, including sales surging to AUD 1.43 billion and net income recovering to AUD 237 million from a prior loss. These financial achievements likely supported the company's share price increase of 51% over the last month. This rise occurred amidst a backdrop of broader market gains, with the S&P 500 and Nasdaq reaching new highs. While the company's results and buyback plan would have bolstered investor sentiment, the broader market trend of ascending indices also played a supporting role in the share price upturn.

Buy, Hold or Sell Vault Minerals? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Over the last three years, Vault Minerals (ASX:VAU) achieved a total shareholder return of 159.18%, a remarkable gain from its long-term price trajectory. This substantial growth has outpaced both the Australian market and the Metals and Mining industry over the past year, as Vault's returns exceeded the market's 10.3% rise and the industry's 23.5% increase in the same period. The company's robust fiscal results, highlighted by revenue of A$1.43 billion and net income of A$236.98 million, alongside the share buyback program, have likely contributed to positive investor sentiment.

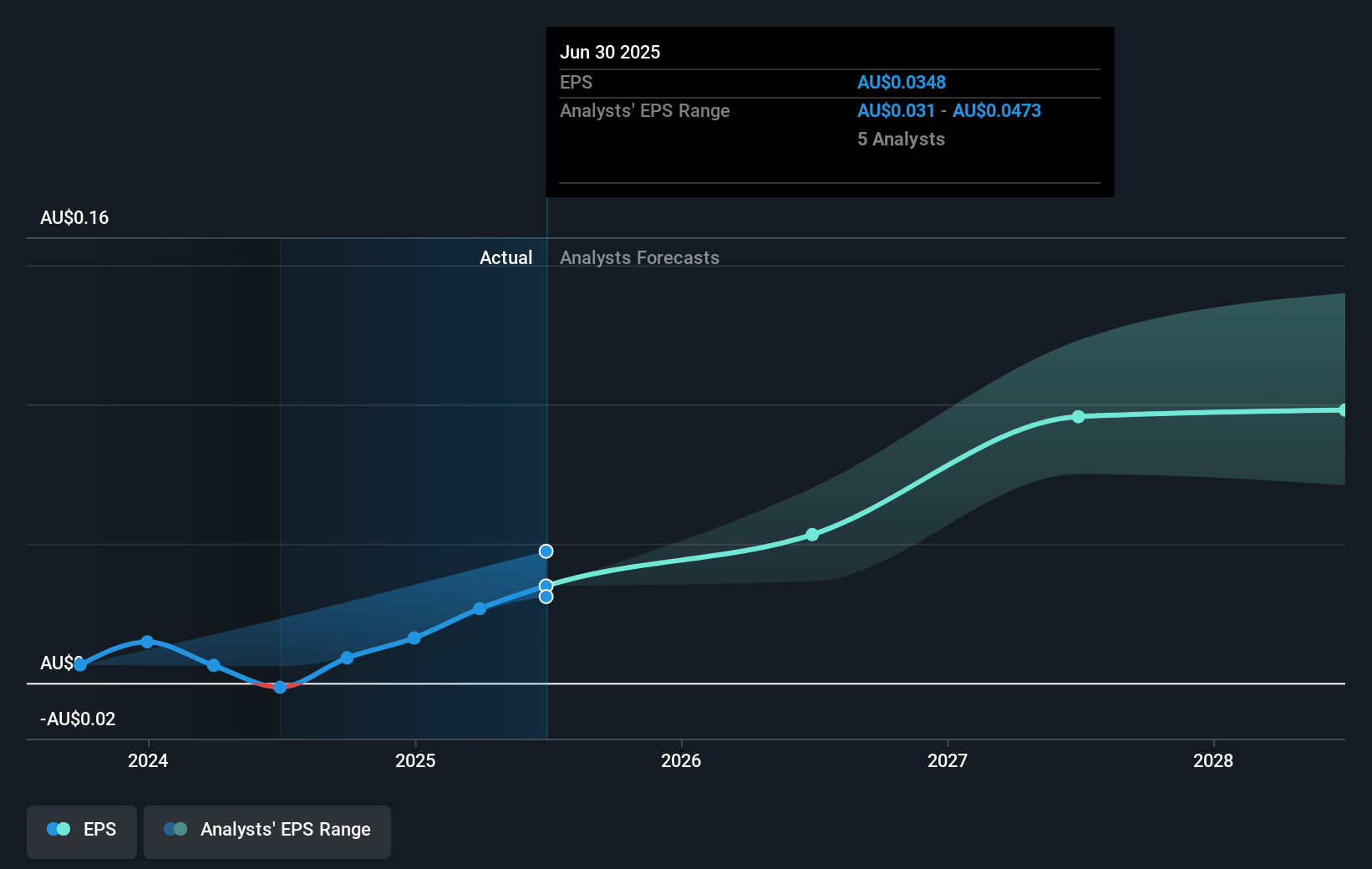

While the share price has risen in the short term, currently valued at A$0.635, it surpasses the consensus analyst price target of A$0.607. This suggests potential overvaluation, considering the future earnings forecast of slower growth compared to the benchmark. Additionally, though the company's announcement and recent financial performance were key drivers of its price increase, its forecast revenue and earnings growth rate are expected to trail the market, indicating cautious optimism. The context of the price movement and its comparison with the price target suggest investors may need to weigh expected growth against potential valuation concerns.

Examine Vault Minerals' past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, mine development, mine operations and the sale of gold and gold/copper concentrate in Australia and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives