- Australia

- /

- Metals and Mining

- /

- ASX:VAU

Vault Minerals (ASX:VAU): How Early Hedge Unwinding Impacts Valuation and Growth Potential

Reviewed by Simply Wall St

Vault Minerals (ASX:VAU) has settled its gold forward sales contracts for the second half of FY26 earlier than planned. This positions the company to benefit directly from changes in spot gold prices and allows it to increase its focus on shareholder returns.

See our latest analysis for Vault Minerals.

Vault Minerals’ move to unwind its gold hedges early follows a robust rally, with the 1-year total shareholder return now at 120% and the three-year figure topping 316%. Investors have taken notice, especially after the company continued its buy-back program and executed a stock split this November. This has built momentum for potential long-term value as sentiment shifts toward greater growth exposure and less risk management.

If you’re keen to widen your search beyond the usual suspects, it’s a good time to explore fast growing stocks with high insider ownership.

Yet with its stock up over 120% in a year and trading at a notable discount to analyst and intrinsic value targets, investors have to wonder: is there still a buying opportunity here, or is the market already factoring in Vault Minerals’ next leg of growth?

Price-to-Earnings of 21.5x: Is it justified?

Vault Minerals’ shares trade at a price-to-earnings (P/E) ratio of 21.5x, just above its estimated fair P/E of 20.7x. With the stock rising over 120% in a year, this signals that the market currently values the company highly, perhaps reflecting improved profitability and future growth expectations.

The price-to-earnings ratio captures how much investors are willing to pay for each dollar of earnings, making it a staple valuation tool for mining stocks like Vault Minerals. This ratio is particularly relevant as the company has only recently turned profitable, leading investors to weigh the sustainability of this earnings profile.

Compared to the Australian Metals and Mining industry average of 22.3x, Vault Minerals looks slightly cheaper than peers. Yet, when judged against its own fair P/E of 20.7x, the current valuation stands a touch above where the market might move if expectations reset. The peer average and fair P/E provide different benchmarks, but both indicate the stock is not a bargain at today’s price.

Explore the SWS fair ratio for Vault Minerals

Result: Price-to-Earnings of 21.5x (OVERVALUED)

However, slower revenue growth or unexpected shifts in gold prices could quickly challenge market optimism around Vault Minerals' recent gains.

Find out about the key risks to this Vault Minerals narrative.

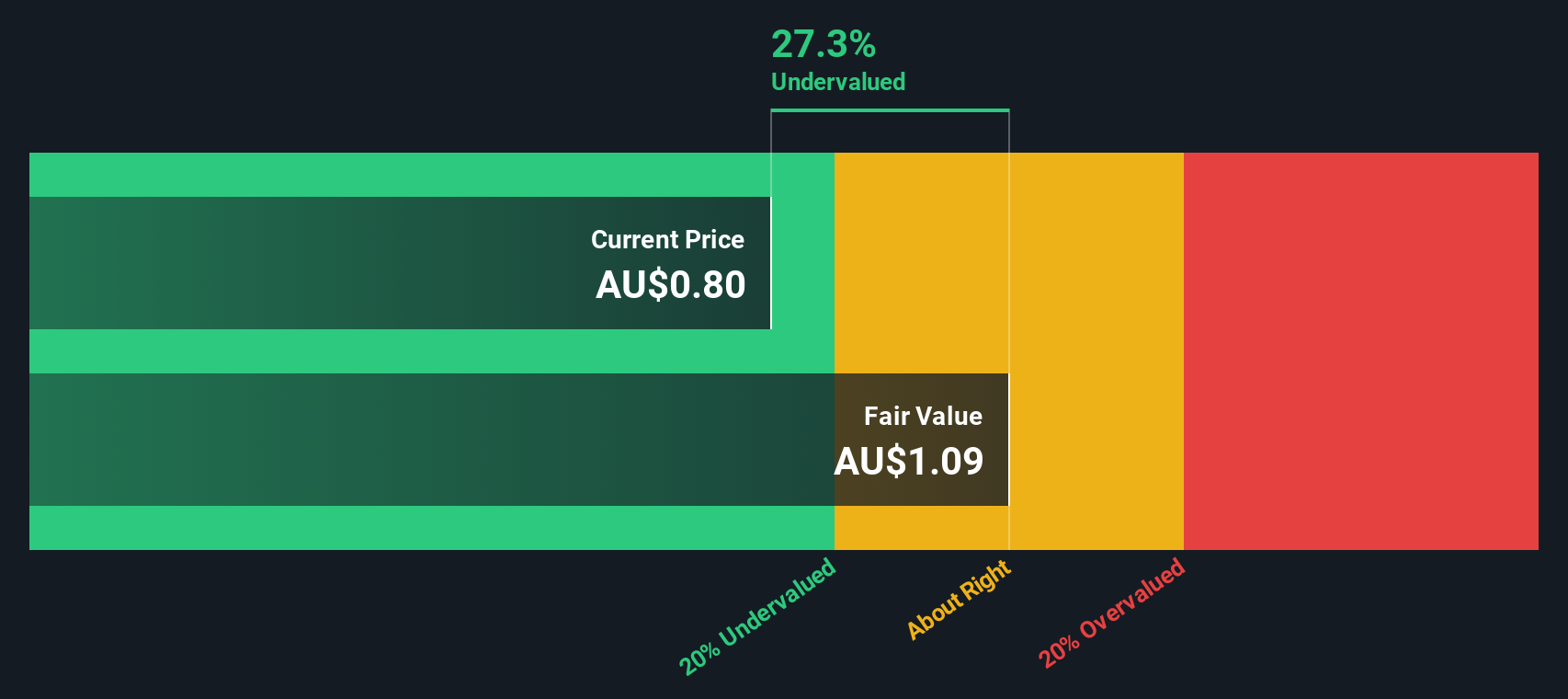

Another View: The SWS DCF Model Suggests Undervaluation

Looking at things from a different angle, our DCF model estimates Vault Minerals' fair value at A$7.17 per share, compared to the current market price of A$4.87. This signals the stock may be undervalued and could present a potential opportunity. But does the market see something the model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vault Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vault Minerals Narrative

If you see the numbers differently or want to pursue your own research path, you can build your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vault Minerals.

Ready for More Opportunities?

Smart investors always keep an eye out for their next edge. Put the odds in your favor by checking out hand-picked stock ideas beyond Vault Minerals using the Simply Wall Street Screener.

- Tap into the future of healthcare innovation by reviewing these 30 healthcare AI stocks companies leading advancements in medical breakthroughs and AI-driven solutions.

- Capitalize on high yield potential by exploring these 15 dividend stocks with yields > 3% with attractive income streams and strong financials.

- Ride the next wave in digital assets as you scan these 82 cryptocurrency and blockchain stocks involved in cryptocurrency and blockchain technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VAU

Vault Minerals

Engages in the exploration, mine development, mine operations and the sale of gold and gold/copper concentrate in Australia and Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success