- Australia

- /

- Metals and Mining

- /

- ASX:VAU

Vault Minerals (ASX:VAU): Assessing Valuation After Buy-Back Update and Broker Appointment

Reviewed by Simply Wall St

Vault Minerals (ASX:VAU) just shook things up with an update to its on-market buy-back program, announcing the appointment of a broker to help streamline the process. For investors, moves like this suggest management’s commitment to enhancing shareholder value and fine-tuning capital structure. These are always popular topics when deciding whether to hold, buy, or sell. That said, while a buy-back can spark short-term optimism, it does not resolve bigger questions around how steady the company’s growth really is.

Stepping back, Vault Minerals has seen its share price climb rapidly over the past year, with a rise of 119% and momentum still going strong into this quarter. While the buy-back is now making headlines, investors have not forgotten other recent signals, like modest annual revenue and income growth. These moves have driven growing interest, but the sustainability of that run is still a hot topic.

So, after such a lively run, is investors’ enthusiasm justified by underlying value, or is the market already pricing in future growth well ahead of reality?

Price-to-Earnings of 17.9x: Is it justified?

Vault Minerals is currently trading at a price-to-earnings (P/E) ratio of 17.9x, which is above the Australian Metals and Mining industry average of 16.2x. This suggests that investors are willing to pay a premium for its earnings relative to peers in the sector.

The price-to-earnings ratio is a key metric investors use to measure how much they are paying for each dollar of company earnings. It is especially relevant for metals and mining companies, where earnings volatility and growth prospects play a central role in how the market assigns value.

While Vault Minerals is more expensive than its industry average based on P/E, the premium pricing may indicate the market's optimism for sustained earnings or higher future growth. However, this valuation comes at a time when the company is still establishing its track record of profitability.

Result: Fair Value of $0.63 (OVERVALUED)

See our latest analysis for Vault Minerals.However, slower revenue and net income growth rates could challenge the market’s optimism, especially if recent momentum proves difficult to sustain.

Find out about the key risks to this Vault Minerals narrative.Another View: What Does the SWS DCF Model Say?

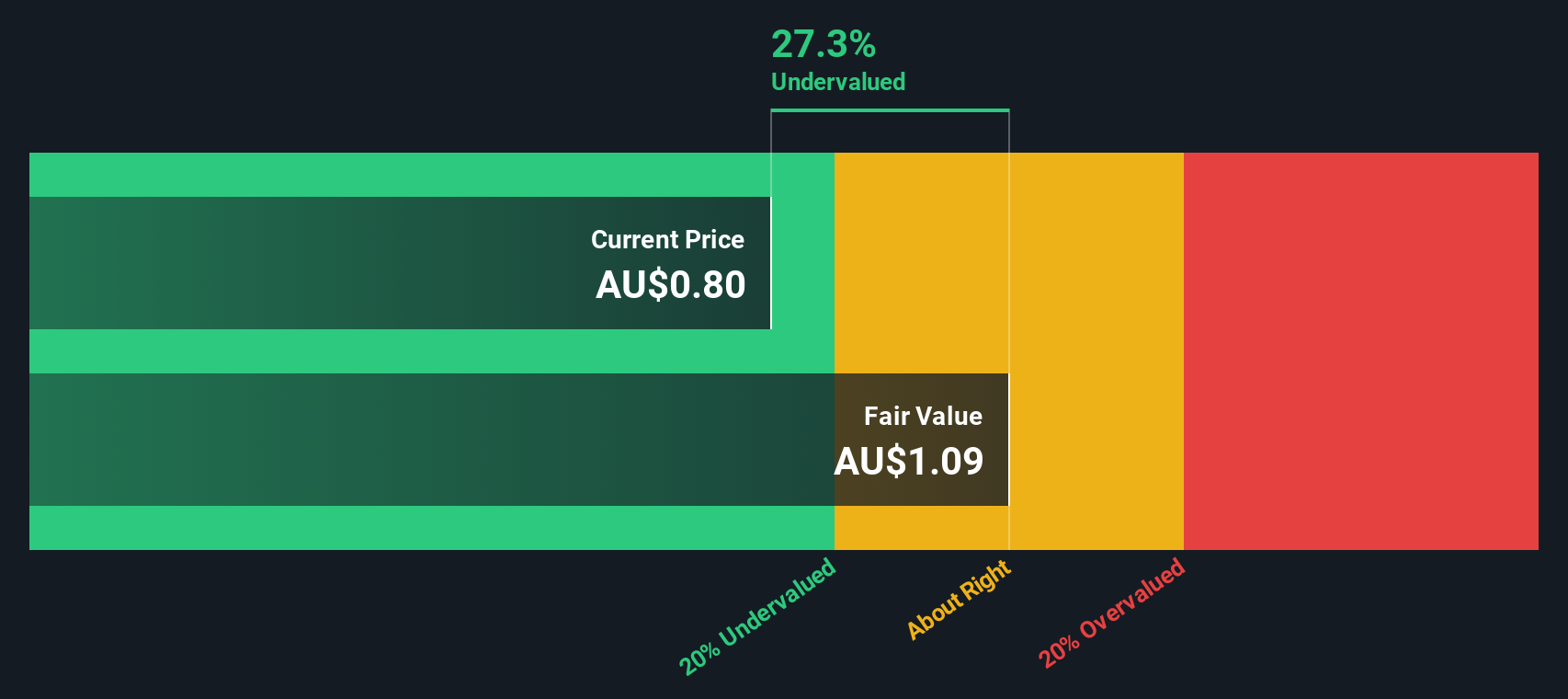

Looking at Vault Minerals through the lens of our DCF model tells a different story. This approach suggests the company might actually be undervalued, which challenges the earlier multiple-based outlook. Which perspective will prove right as results unfold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vault Minerals Narrative

If you have a different perspective or want to dig into the numbers yourself, putting together your own view on Vault Minerals only takes a few minutes. So why not give it a try? Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vault Minerals.

Looking for more investment ideas?

Unlock your edge in today's market by seeking out fresh opportunities that others might miss. Don't let standout growth stories or unique sectors pass you by. Shape a stronger portfolio with help from these powerful strategies:

- Target unbeatable potential with penny stocks with strong financials. These options balance accessible prices and robust financial health, making them suitable for investors craving high-reward opportunities with lower entry costs.

- Catch the next wave in healthcare advancements by checking out healthcare AI stocks. Here, innovation meets smarter medicine and artificial intelligence is transforming patient outcomes.

- Power up your portfolio’s income by pursuing dividend stocks with yields > 3%. Find consistently high-yield companies that can put more cash back in your pocket.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:VAU

Vault Minerals

Engages in the exploration, mine development, mine operations and the sale of gold and gold/copper concentrate in Australia and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives