- Australia

- /

- Metals and Mining

- /

- ASX:GMD

ASX Stocks Priced Below Estimated Value In October 2024

Reviewed by Simply Wall St

In the last week, the Australian market has stayed flat, yet it has experienced a robust 17% increase over the past year with earnings forecast to grow by 12% annually. In this context, identifying stocks priced below their estimated value can present potential opportunities for investors seeking to capitalize on these growth trends.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mader Group (ASX:MAD) | A$5.39 | A$10.44 | 48.4% |

| EZZ Life Science Holdings (ASX:EZZ) | A$4.63 | A$8.78 | 47.3% |

| Charter Hall Group (ASX:CHC) | A$15.88 | A$31.44 | 49.5% |

| Genesis Minerals (ASX:GMD) | A$2.02 | A$3.92 | 48.5% |

| Ingenia Communities Group (ASX:INA) | A$5.01 | A$9.42 | 46.8% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Little Green Pharma (ASX:LGP) | A$0.089 | A$0.17 | 47.4% |

| IperionX (ASX:IPX) | A$3.59 | A$6.71 | 46.5% |

| Aussie Broadband (ASX:ABB) | A$3.68 | A$6.74 | 45.4% |

| Superloop (ASX:SLC) | A$1.75 | A$3.31 | 47.2% |

Let's explore several standout options from the results in the screener.

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited is involved in the exploration, production, and development of gold deposits in Western Australia, with a market cap of A$2.28 billion.

Operations: The company generates revenue of A$438.59 million from its mineral production, exploration, and development activities.

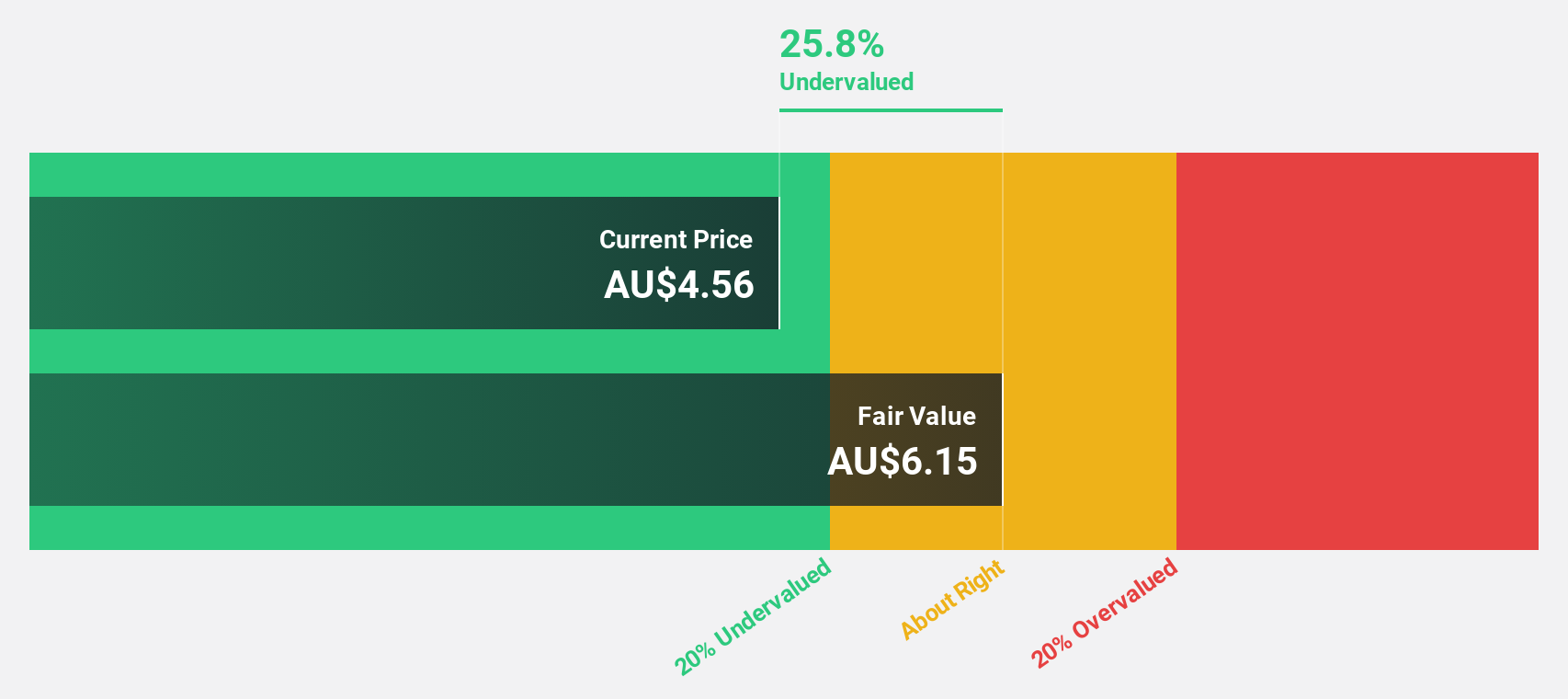

Estimated Discount To Fair Value: 48.5%

Genesis Minerals appears undervalued, trading at A$2.02 compared to a fair value estimate of A$3.92, suggesting significant upside potential. The company has transitioned to profitability with net income of A$84 million for the year ending June 2024, reversing a prior loss. Although revenue growth is forecasted at 17.8% annually—below the 20% threshold—it still outpaces the Australian market average of 5.5%. Analyst consensus supports potential price appreciation by nearly 29%.

- The growth report we've compiled suggests that Genesis Minerals' future prospects could be on the up.

- Navigate through the intricacies of Genesis Minerals with our comprehensive financial health report here.

Ingenia Communities Group (ASX:INA)

Overview: Ingenia Communities Group (ASX:INA) is a prominent operator, owner, and developer of quality residential communities and holiday accommodations with a market cap of A$2.04 billion.

Operations: Ingenia Communities Group generates revenue from several segments, including Tourism - Ingenia Holidays (A$134.84 million), Residential - Ingenia Gardens (A$23.67 million), Residential - Lifestyle Rental (A$86.50 million), and Residential - Lifestyle Development (A$205.81 million).

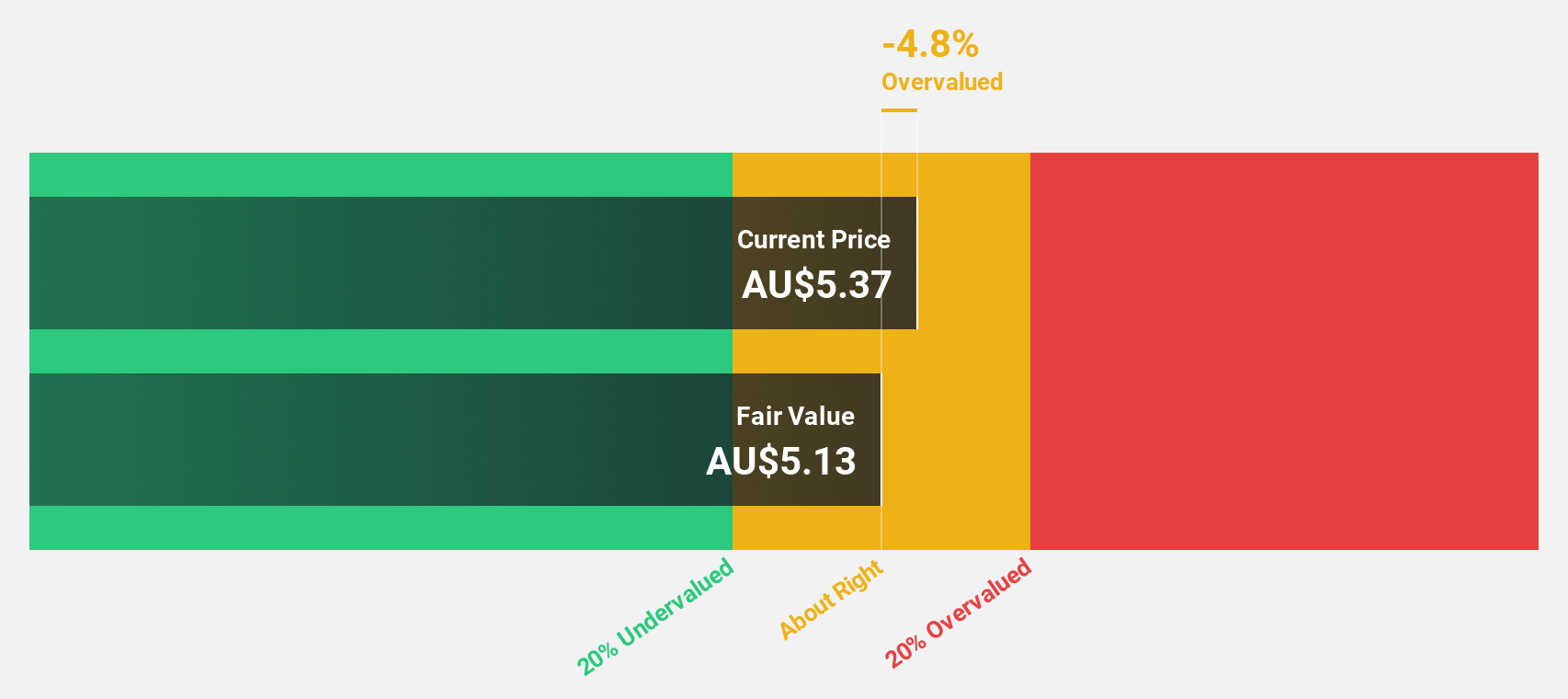

Estimated Discount To Fair Value: 46.8%

Ingenia Communities Group is trading at A$5.01, significantly below its estimated fair value of A$9.42, indicating potential undervaluation based on cash flows. Despite a drop in net income to A$14.02 million from A$64.37 million last year, earnings are forecasted to grow 25.6% annually, surpassing the Australian market average of 12.2%. However, profit margins have decreased and debt coverage by operating cash flow remains inadequate, posing financial challenges.

- Upon reviewing our latest growth report, Ingenia Communities Group's projected financial performance appears quite optimistic.

- Take a closer look at Ingenia Communities Group's balance sheet health here in our report.

Vault Minerals (ASX:VAU)

Overview: Vault Minerals Limited is involved in the exploration, production, and mining of gold and gold/copper concentrates in Canada and Australia with a market cap of A$2.11 billion.

Operations: Vault Minerals Limited generates revenue through its activities in the exploration, production, and mining of gold and gold/copper concentrates across Canada and Australia.

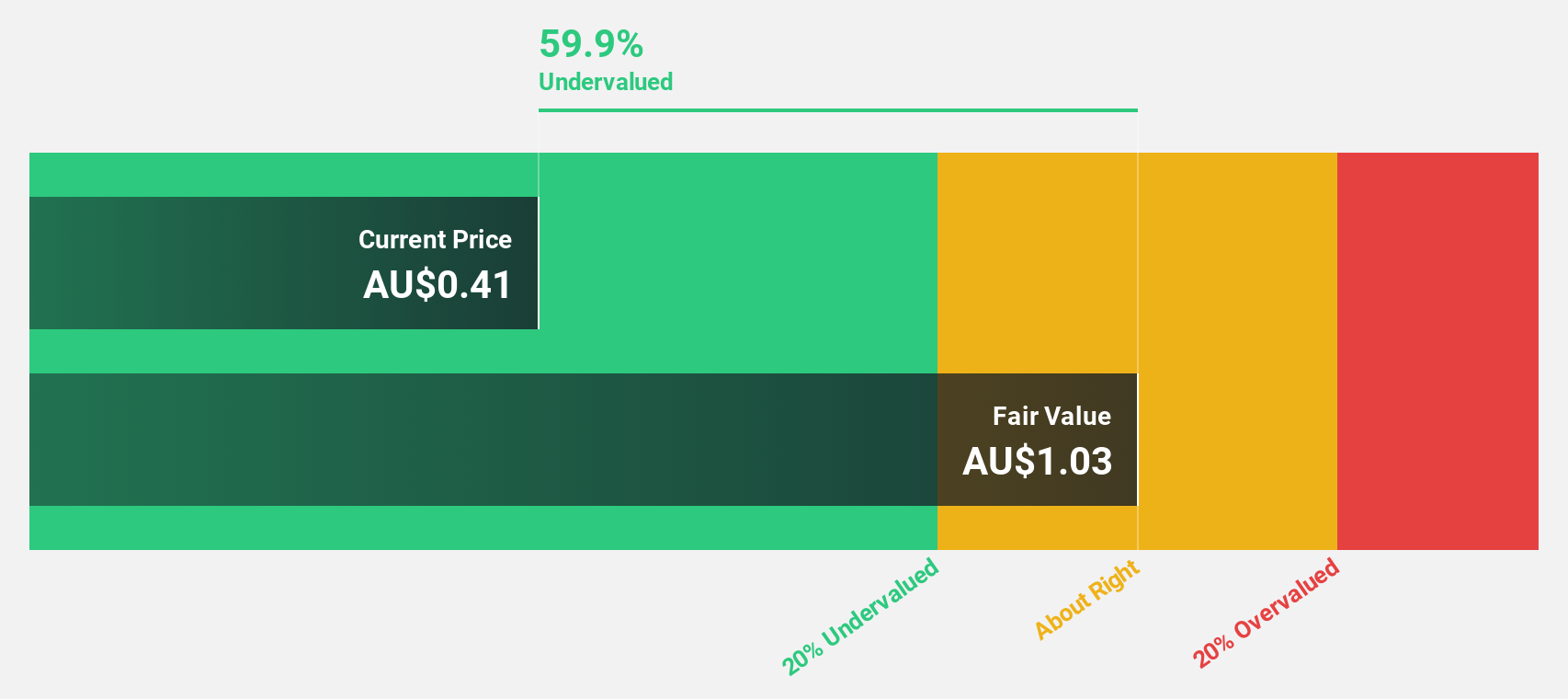

Estimated Discount To Fair Value: 40.4%

Vault Minerals is trading at A$0.31, below its estimated fair value of A$0.52, suggesting undervaluation based on cash flows. Earnings have grown 2.4% annually over five years, with revenue increasing to A$620 million from A$422.75 million last year, despite a net loss of A$5.44 million improving from the previous year's loss of A$8.73 million. However, substantial shareholder dilution and forecasted low return on equity remain concerns for investors seeking value opportunities.

- Our growth report here indicates Vault Minerals may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Vault Minerals' balance sheet health report.

Where To Now?

- Reveal the 49 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GMD

Genesis Minerals

Engages in the exploration, production, and development of gold deposits in Western Australia.

Excellent balance sheet with reasonable growth potential.