- Australia

- /

- Capital Markets

- /

- ASX:QAL

Undiscovered Gems in Australia to Explore This October 2024

Reviewed by Simply Wall St

The Australian market has remained flat over the last week, yet it has experienced a notable 17% rise over the past 12 months with earnings forecasted to grow by 12% annually. In this promising environment, identifying stocks that offer unique potential and align with these growth trends can uncover opportunities for investors seeking to expand their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Qualitas (ASX:QAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qualitas is a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt acquisitions and restructuring, third-party capital raisings, and consulting services, with a market cap of A$749.45 million.

Operations: Qualitas generates revenue primarily through its direct lending segment, contributing A$26.79 million, and funds management segment, which adds A$13.61 million. The company has a market cap of A$749.45 million.

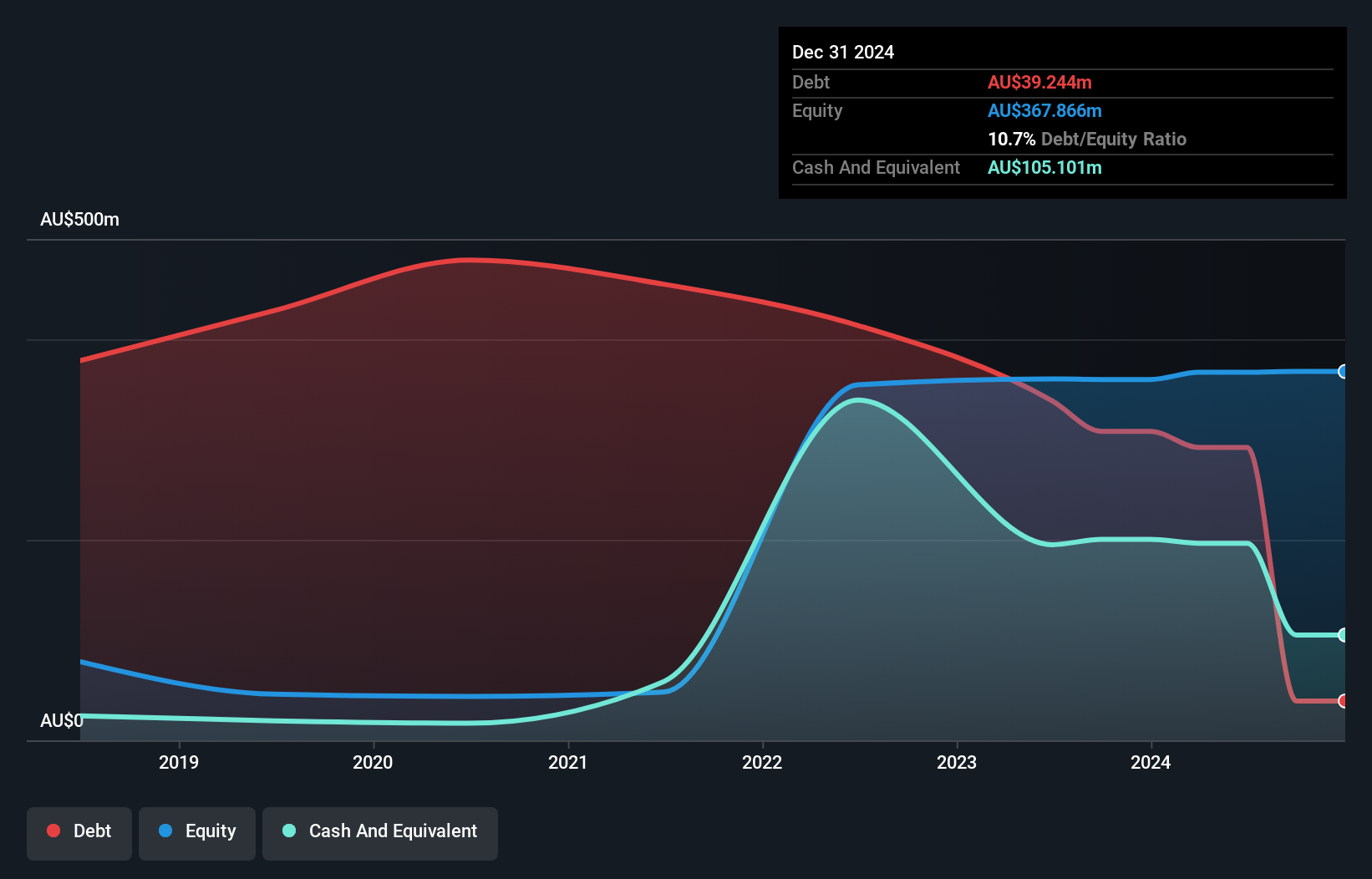

With earnings growth of 17.2% last year, Qualitas is outpacing the Capital Markets industry average of 16.4%. The company's net debt to equity ratio stands at a satisfactory 26.1%, down from a hefty 931.3% five years ago, showcasing significant financial improvement. Recent board changes include the appointment of Darren Steinberg, bringing extensive property and funds management experience. Earnings per share rose to A$0.09 from A$0.0768, reflecting solid performance and potential for future growth.

- Click to explore a detailed breakdown of our findings in Qualitas' health report.

Evaluate Qualitas' historical performance by accessing our past performance report.

Redox (ASX:RDX)

Simply Wall St Value Rating: ★★★★★★

Overview: Redox Limited is a company that supplies and distributes chemicals, ingredients, and raw materials across Australia, New Zealand, the United States, and internationally with a market capitalization of A$1.80 billion.

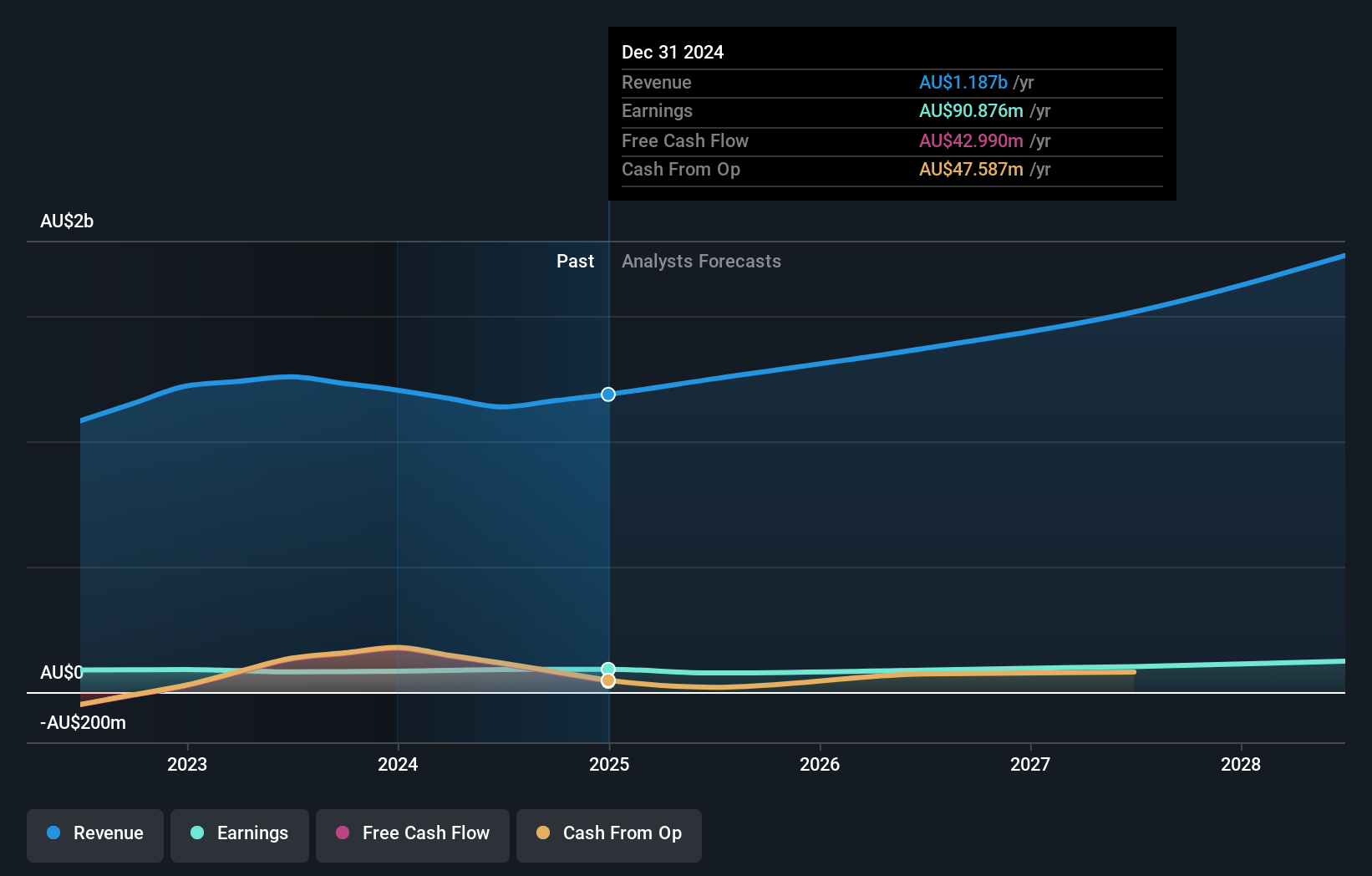

Operations: Redox generates revenue primarily from its wholesale drugs segment, amounting to A$1.14 billion.

Redox, a promising player in Australia, has shown robust earnings growth of 18.3% annually over the past five years. With more cash than total debt and a reduced debt to equity ratio from 69.6% to 2.6%, financial health seems solid. Despite sales dipping to A$1.14 billion from A$1.26 billion last year, net income rose to A$90.24 million from A$80.73 million, suggesting operational efficiency improvements amidst industry challenges where it grew slower than peers at 11.8%.

- Get an in-depth perspective on Redox's performance by reading our health report here.

Understand Redox's track record by examining our Past report.

Supply Network (ASX:SNL)

Simply Wall St Value Rating: ★★★★★★

Overview: Supply Network Limited is a company that supplies aftermarket parts to the commercial vehicle industry in Australia and New Zealand, with a market capitalization of approximately A$1.38 billion.

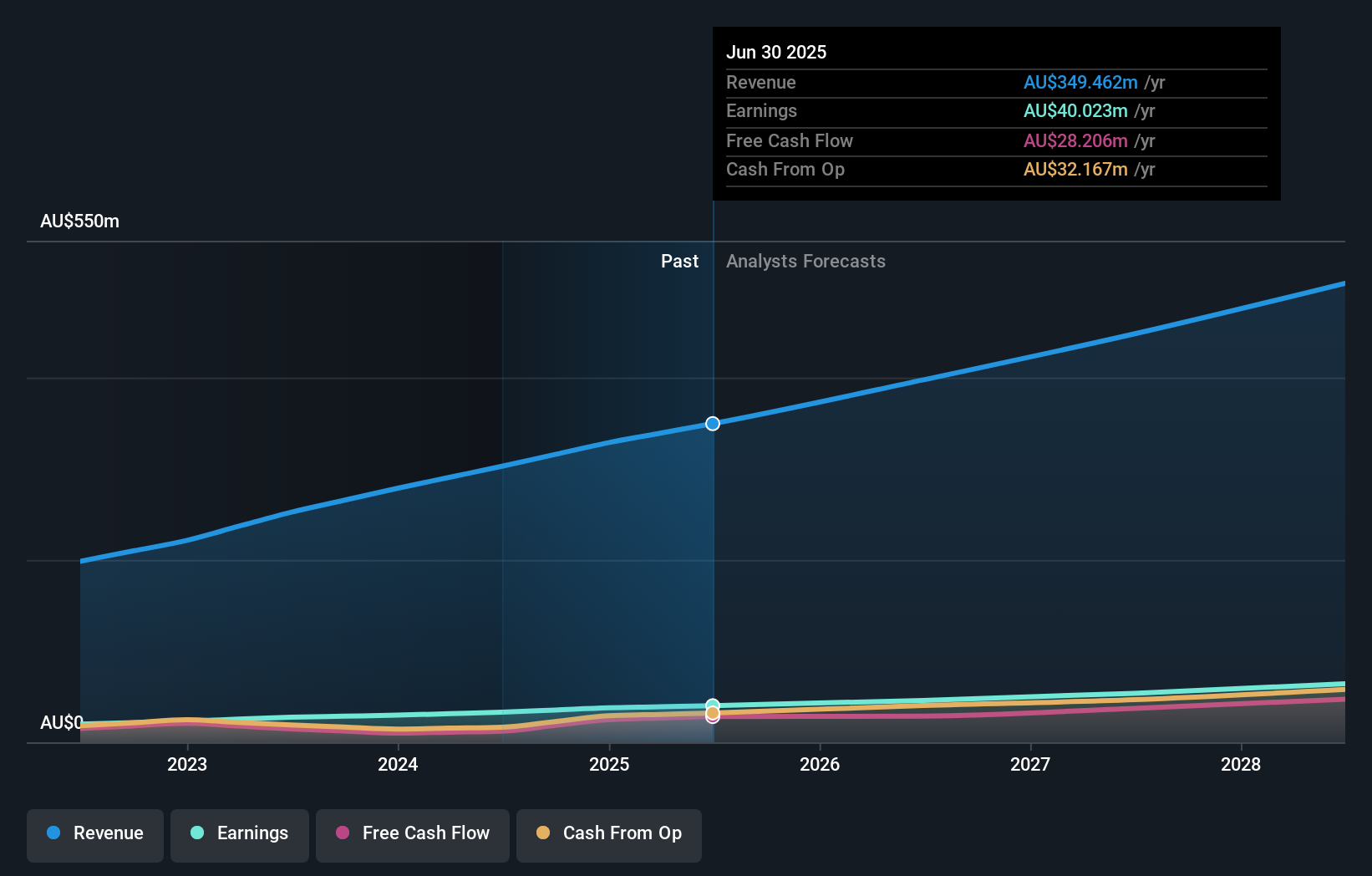

Operations: Supply Network generates revenue primarily through the provision of aftermarket parts for the commercial vehicle market, totaling A$302.72 million. The company has a market capitalization of approximately A$1.38 billion.

Supply Network, a nimble player in the Australian market, posted a robust net income of A$33.03 million for the year ended June 2024, up from A$27.41 million previously. The company’s debt to equity ratio has impressively shrunk to 9.3% over five years, reflecting prudent financial management. With earnings growth outpacing the industry at 20.5%, and interest payments well covered by EBIT at 22.6 times, Supply Network seems poised for continued stability despite recent insider selling activities.

- Delve into the full analysis health report here for a deeper understanding of Supply Network.

Explore historical data to track Supply Network's performance over time in our Past section.

Where To Now?

- Navigate through the entire inventory of 57 ASX Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qualitas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QAL

Qualitas

Qualitas is a real estate investment firm which focuses on direct investment in all real estate classes and geographies, acquisitions and restructuring of distressed debt, third party capital raisings and consulting services.

Excellent balance sheet with reasonable growth potential.