- Australia

- /

- Metals and Mining

- /

- ASX:TLM

ASX Penny Stocks To Consider In November 2024

Reviewed by Simply Wall St

The Australian market is navigating a complex landscape, with the ASX 200 expected to rise despite global uncertainties such as renewed tariff concerns and geopolitical tensions. For investors considering opportunities beyond the major indices, penny stocks can present intriguing possibilities. Although the term "penny stocks" may seem outdated, these smaller or newer companies often offer surprising value and potential for growth when selected based on strong financial fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$147.7M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$322.38M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.695 | A$830.68M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.54 | A$112.83M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$65.35M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.71 | A$464.71M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Boom Logistics (ASX:BOL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Boom Logistics Limited offers lifting solutions to sectors such as mining, resources, infrastructure, construction, wind energy, utilities, industrial maintenance, and telecommunications in Australia and the Pacific region with a market cap of A$5.90 million.

Operations: The company's revenue is derived from its Lifting Solutions segment, which generated A$259.23 million.

Market Cap: A$5.9M

Boom Logistics Limited, with a market cap of A$5.90 million, has shown significant financial resilience by becoming profitable in the past year and maintaining high-quality earnings. The company's debt is well covered by operating cash flow, and it has reduced its debt-to-equity ratio over five years. However, interest coverage remains an area of concern with EBIT not sufficiently covering interest payments. Recent corporate actions include a 1:10 stock split and completion of a share buyback program aimed at capital management. The company also adopted a new constitution at its recent AGM, reflecting strategic governance adjustments.

- Get an in-depth perspective on Boom Logistics' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Boom Logistics' track record.

Tanami Gold (ASX:TAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tanami Gold NL, along with its subsidiaries, focuses on the exploration and evaluation of gold properties in Australia, with a market cap of A$35.25 million.

Operations: No revenue segments are reported for this company.

Market Cap: A$35.25M

Tanami Gold NL, with a market cap of A$35.25 million, is pre-revenue and unprofitable, reporting a net loss of A$6.15 million for the year ended June 30, 2024. Despite this, the company is debt-free and has sufficient cash runway for over three years based on current free cash flow levels. Its short-term assets significantly exceed both short- and long-term liabilities, providing some financial stability amidst ongoing losses. The board boasts seasoned experience with an average tenure of 12.3 years; however, earnings have consistently declined over the past five years at a very large rate annually.

- Dive into the specifics of Tanami Gold here with our thorough balance sheet health report.

- Gain insights into Tanami Gold's past trends and performance with our report on the company's historical track record.

Talisman Mining (ASX:TLM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Talisman Mining Limited focuses on the exploration and development of mineral properties in Western Australia, with a market cap of A$43.31 million.

Operations: The company does not currently have any specified revenue segments.

Market Cap: A$43.31M

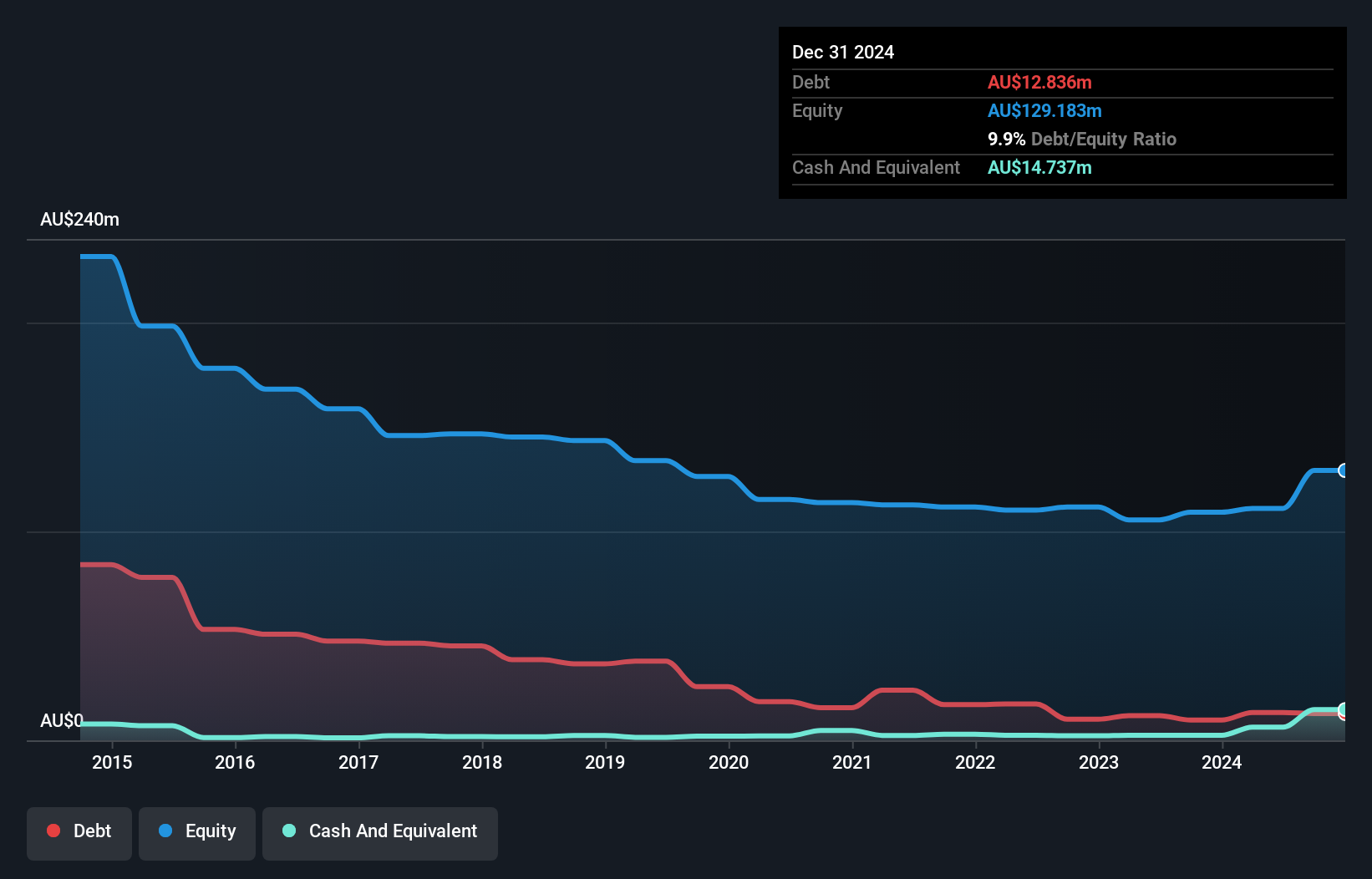

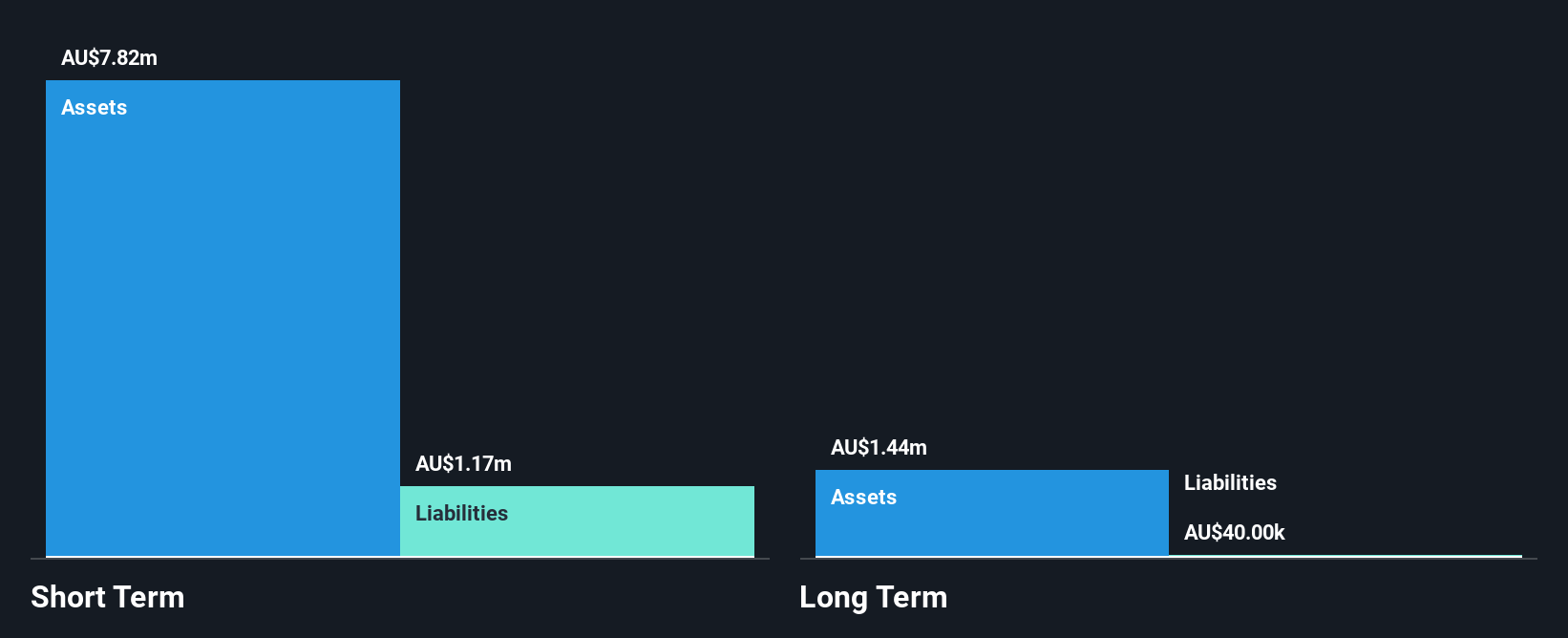

Talisman Mining, with a market cap of A$43.31 million, is pre-revenue and unprofitable, reporting a net loss of A$2.92 million for the year ended June 30, 2024. The company remains debt-free and has more than a year of cash runway based on current free cash flow levels. Short-term assets of A$7.9 million comfortably cover both short- and long-term liabilities. Despite reducing losses over the past five years at a notable rate annually, Talisman's management team is relatively new with an average tenure of 1.3 years, while its board demonstrates seasoned experience averaging 5.3 years in tenure.

- Take a closer look at Talisman Mining's potential here in our financial health report.

- Learn about Talisman Mining's historical performance here.

Summing It All Up

- Access the full spectrum of 1,047 ASX Penny Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talisman Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TLM

Talisman Mining

Engages in the exploration and development of mineral properties in Western Australia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives