- Australia

- /

- Metals and Mining

- /

- ASX:TAR

Indiana Resources And 2 Other Top Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX200 rising by 0.85% to 8,470 points, buoyed by favorable CPI data and strong sector performances in IT and Real Estate. Amid these positive conditions, investors often look for stocks that can offer both stability and growth potential. Penny stocks, though an older term, still represent a unique opportunity; they often involve smaller or newer companies that can provide value when supported by solid financials. In this article, we explore three such penny stocks on the ASX that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.98 | A$247.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$322.38M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.89 | A$104.55M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.53 | A$104.08M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.14 | A$331.46M | ★★★★☆☆ |

| Servcorp (ASX:SRV) | A$4.98 | A$491.43M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$235.35M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Indiana Resources (ASX:IDA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Indiana Resources Limited is an Australian company focused on exploring rare earth elements, gold, and base metals, with a market capitalization of A$43.88 million.

Operations: The company generates revenue from its exploration activities, amounting to A$0.21 million.

Market Cap: A$43.88M

Indiana Resources, with a market cap of A$43.88 million, is pre-revenue and focuses on rare earth elements and gold exploration. Recent assays from its Minos Gold Prospect in South Australia show promising high-grade gold intersections, potentially expanding the resource footprint. Despite having no debt and covering both short- and long-term liabilities with assets of A$1.8 million, the company faces financial challenges with less than a year of cash runway if current free cash flow trends persist. The stock has experienced increased volatility recently, though shareholders have not faced significant dilution over the past year.

- Get an in-depth perspective on Indiana Resources' performance by reading our balance sheet health report here.

- Gain insights into Indiana Resources' past trends and performance with our report on the company's historical track record.

ReadCloud (ASX:RCL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ReadCloud Limited offers eLearning software and industry-based training solutions to schools and educational institutions in Australia, with a market cap of A$13.29 million.

Operations: The company generates revenue from two main segments: Ebook Solutions, contributing A$4.75 million, and Vocational Education and Training, which brings in A$7.16 million.

Market Cap: A$13.29M

ReadCloud Limited, with a market cap of A$13.29 million, reported revenue growth to A$12.27 million for the year ending September 2024, reducing its net loss to A$1.02 million from the previous year. The company benefits from strong short-term asset coverage over liabilities and maintains a cash runway exceeding three years based on stable free cash flow. Despite being unprofitable with negative return on equity and an inexperienced management team, ReadCloud trades at a significant discount to estimated fair value and has not diluted shareholders recently. The board's experience may offer stability amid high weekly volatility in stock performance.

- Take a closer look at ReadCloud's potential here in our financial health report.

- Evaluate ReadCloud's prospects by accessing our earnings growth report.

Taruga Minerals (ASX:TAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taruga Minerals Limited is an Australian company focused on mineral exploration and development, with a market capitalization of A$7.77 million.

Operations: The company's revenue is primarily derived from its mineral exploration activities, amounting to A$0.08 million.

Market Cap: A$7.77M

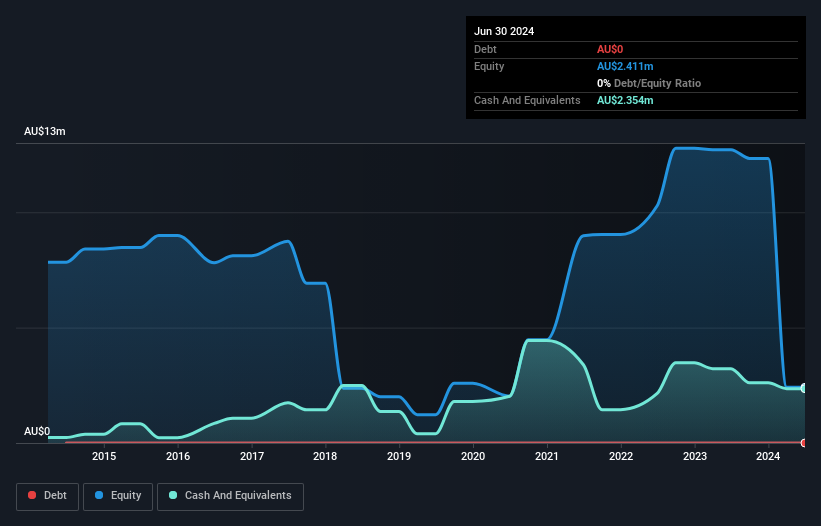

Taruga Minerals Limited, with a market cap of A$7.77 million, is pre-revenue and currently unprofitable. The company maintains a debt-free status and has not incurred any long-term liabilities over the past five years. Taruga's cash runway is less than a year if free cash flow continues to grow at historical rates but sufficient for more than a year based on current levels. Shareholders have not faced meaningful dilution recently, although the stock remains highly volatile compared to most Australian stocks. The board of directors is considered experienced with an average tenure of 4.5 years, providing some stability amidst financial challenges.

- Dive into the specifics of Taruga Minerals here with our thorough balance sheet health report.

- Explore historical data to track Taruga Minerals' performance over time in our past results report.

Next Steps

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,028 more companies for you to explore.Click here to unveil our expertly curated list of 1,031 ASX Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taruga Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TAR

Taruga Minerals

Engages in the mineral exploration and development activities in Australia.

Excellent balance sheet moderate.

Market Insights

Community Narratives