- Australia

- /

- Metals and Mining

- /

- ASX:ELV

Sayona Mining Full Year 2025 Earnings: AU$0.027 loss per share (vs AU$0.01 loss in FY 2024)

Sayona Mining (ASX:SYA) Full Year 2025 Results

Key Financial Results

- Revenue: AU$223.4m (up 11% from FY 2024).

- Net loss: AU$294.3m (loss widened by 190% from FY 2024).

- AU$0.027 loss per share (further deteriorated from AU$0.01 loss in FY 2024).

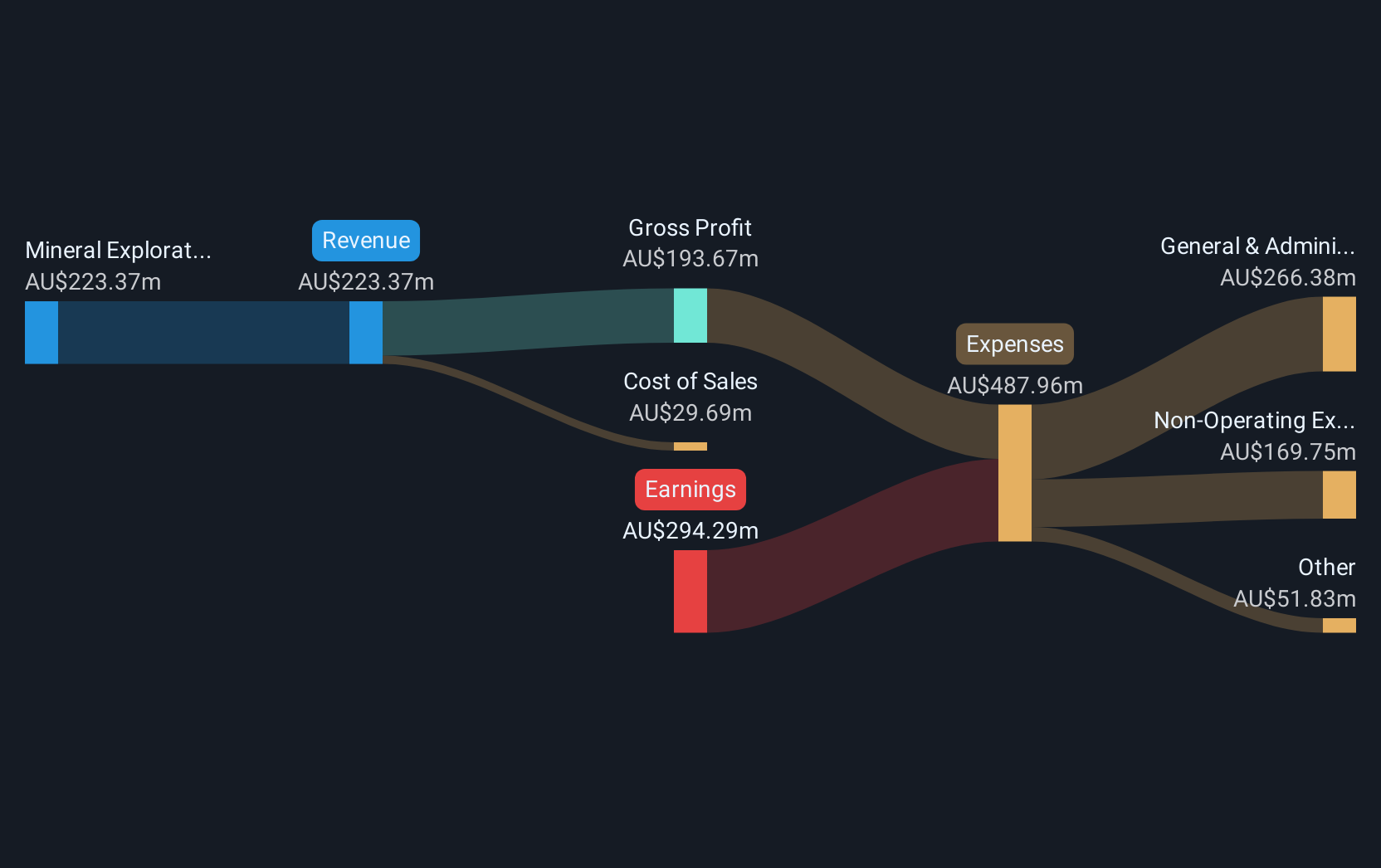

All figures shown in the chart above are for the trailing 12 month (TTM) period

Sayona Mining Earnings Insights

In the last 12 months, the only revenue segment was Mineral Exploration contributing AU$223.4m. The largest operating expense was General & Administrative costs, amounting to AU$266.4m (55% of total expenses). Explore how SYA's revenue and expenses shape its earnings.

Looking ahead, revenue is forecast to grow 2.9% p.a. on average during the next 2 years, compared to a 5.3% growth forecast for the Metals and Mining industry in Australia.

Performance of the Australian Metals and Mining industry.

The company's shares are down 3.7% from a week ago.

Risk Analysis

Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Sayona Mining that you should be aware of.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elevra Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ELV

Elevra Lithium

Engages in the identification, acquisition, exploration, and development of mineral assets in Australia and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion