- Australia

- /

- Metals and Mining

- /

- ASX:SRN

Top ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Australian market has shown modest growth, with the ASX200 up 0.45% and sectors like IT and Financials leading the way, despite a generally weak economic backdrop. As investors navigate these mixed signals, penny stocks—often smaller or newer companies—remain an intriguing area for those seeking potential growth opportunities. While the term "penny stocks" might seem outdated, these investments can still offer unique value propositions when backed by strong financial health and strategic positioning in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.6075 | A$71.21M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.93 | A$314.24M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.645 | A$806.18M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.17 | A$1.08B | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.49 | A$1.7B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.00 | A$133.27M | ★★★★★★ |

Click here to see the full list of 1,036 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

ClearVue Technologies (ASX:CPV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ClearVue Technologies Limited, with a market cap of A$70.55 million, provides building-integrated photovoltaic solutions in Australia through its subsidiaries.

Operations: The company generates revenue from its semiconductors segment, amounting to A$0.04 million.

Market Cap: A$70.55M

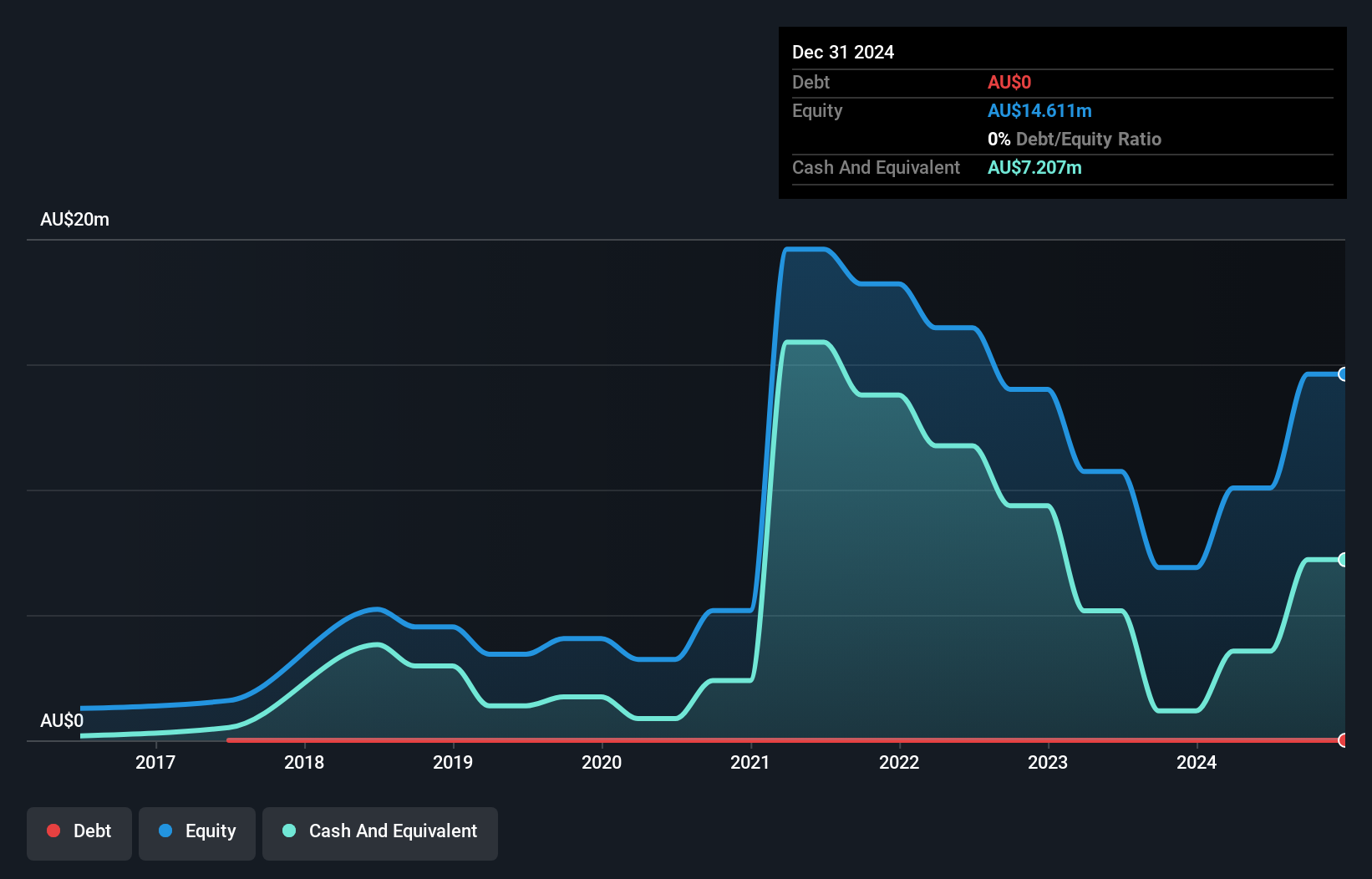

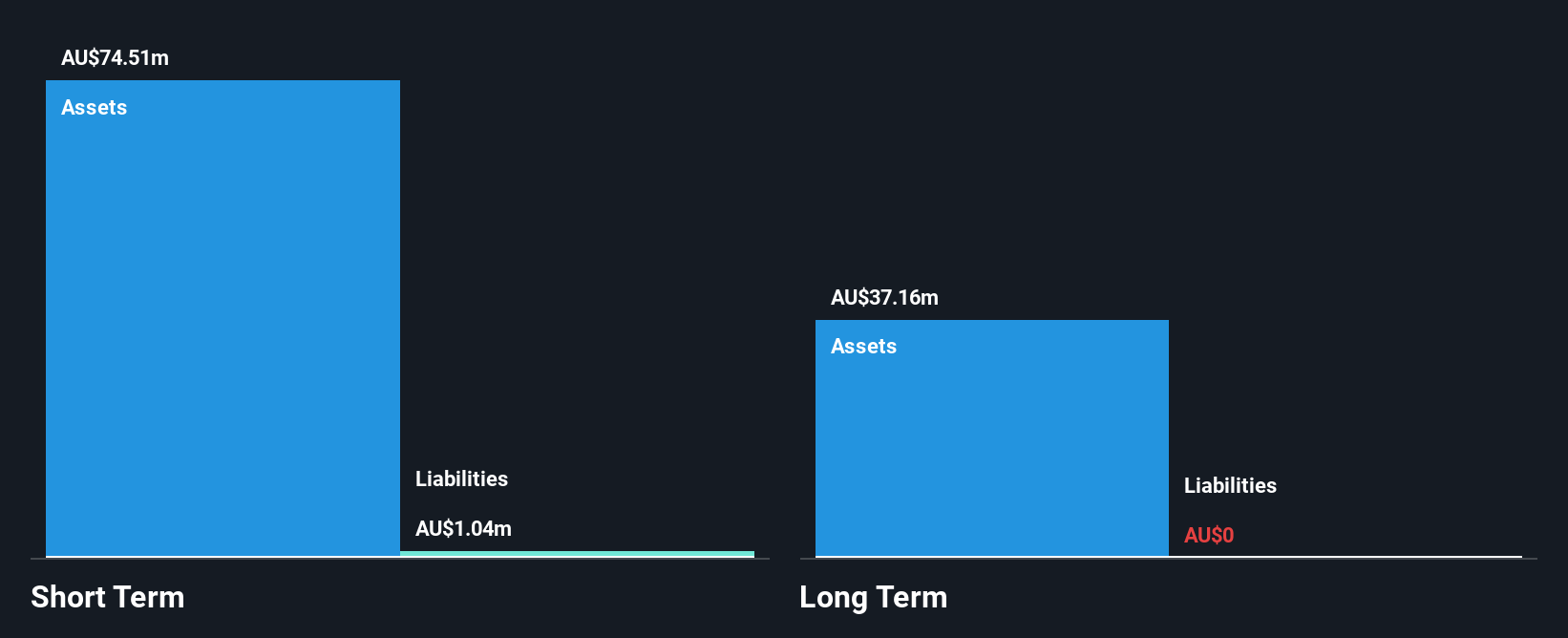

ClearVue Technologies Limited, with a market cap of A$70.55 million, is pre-revenue and currently unprofitable, reporting minimal revenue of A$0.04 million for the past year. The company recently completed a follow-on equity offering raising A$7.5 million to bolster its cash runway, which previously stood at five months based on free cash flow estimates. Despite being debt-free and having short-term assets exceeding liabilities, ClearVue faces challenges with shareholder dilution and an inexperienced board averaging 1.6 years tenure. Earnings have declined significantly over the past five years, reflecting ongoing financial hurdles in its operations.

- Jump into the full analysis health report here for a deeper understanding of ClearVue Technologies.

- Learn about ClearVue Technologies' historical performance here.

Surefire Resources (ASX:SRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Surefire Resources NL, along with its subsidiaries, is engaged in exploring and evaluating mineral tenement holdings in Western Australia, with a market capitalization of A$9.93 million.

Operations: The company generates revenue from mineral exploration amounting to A$0.65 million.

Market Cap: A$9.93M

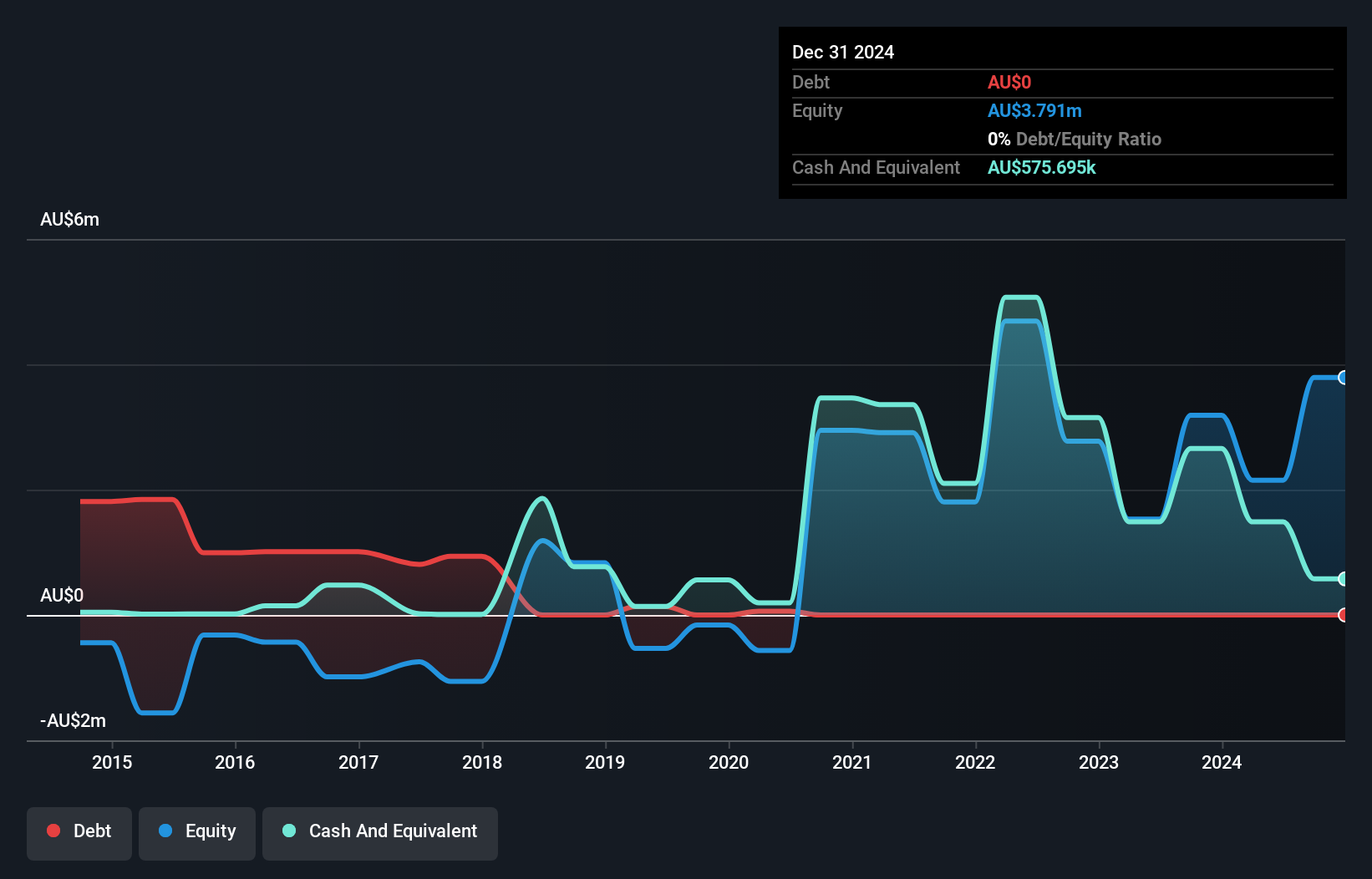

Surefire Resources, with a market cap of A$9.93 million, is pre-revenue, generating only A$0.65 million from mineral exploration activities. The company recently secured a loan facility of up to A$500,000 to address its short-term cash needs, as its cash runway was limited to two months based on free cash flow estimates before the capital raise. While debt-free and possessing experienced board members averaging seven years tenure, Surefire faces challenges with shareholder dilution and high volatility in its share price. Its short-term assets do not cover liabilities, reflecting financial constraints despite no long-term debt obligations.

- Click here and access our complete financial health analysis report to understand the dynamics of Surefire Resources.

- Evaluate Surefire Resources' historical performance by accessing our past performance report.

Thorney Technologies (ASX:TEK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thorney Technologies Ltd, with a market cap of A$57.72 million, invests in technology-related companies.

Operations: The company generates revenue from its investment activities, which amounted to -A$11.70 million.

Market Cap: A$57.72M

Thorney Technologies Ltd, with a market cap of A$57.72 million, is pre-revenue, generating less than US$1 million. The company recently announced a share buyback program to repurchase up to 19,658,848 shares by October 2025, aiming to enhance shareholder value. Despite being debt-free and having sufficient cash runway for over three years based on current free cash flow levels, Thorney remains unprofitable with losses increasing at an average rate of 50.2% annually over the past five years. Its experienced board members have an average tenure of 7.9 years, providing stable governance amidst financial challenges.

- Navigate through the intricacies of Thorney Technologies with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Thorney Technologies' track record.

Seize The Opportunity

- Investigate our full lineup of 1,036 ASX Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SRN

Surefire Resources

Explores for and reviews mineral tenement holdings in Western Australia.

Excellent balance sheet moderate.

Market Insights

Community Narratives