- Australia

- /

- Metals and Mining

- /

- ASX:SRK

We Think Strike Resources Limited's (ASX:SRK) CEO Compensation Package Needs To Be Put Under A Microscope

Key Insights

- Strike Resources' Annual General Meeting to take place on 30th of November

- Total pay for CEO William Johnson includes AU$300.0k salary

- Total compensation is similar to the industry average

- Strike Resources' three-year loss to shareholders was 55% while its EPS was down 68% over the past three years

Strike Resources Limited (ASX:SRK) has not performed well recently and CEO William Johnson will probably need to up their game. At the upcoming AGM on 30th of November, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Strike Resources

How Does Total Compensation For William Johnson Compare With Other Companies In The Industry?

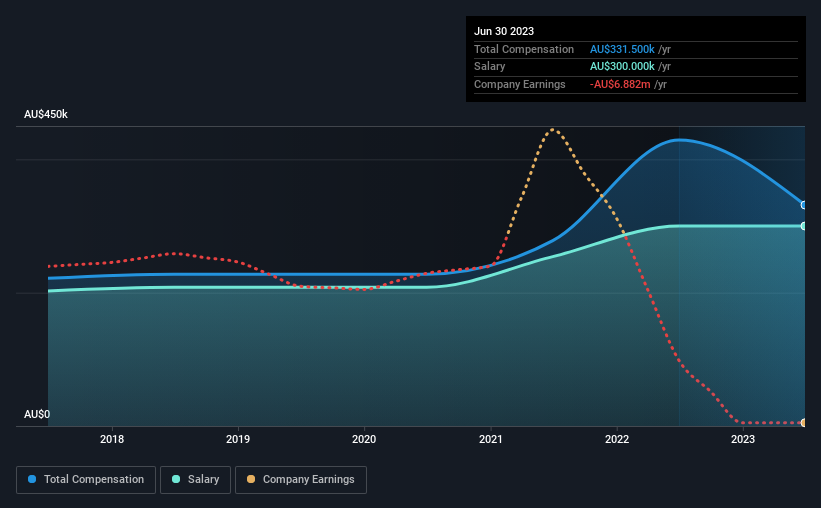

At the time of writing, our data shows that Strike Resources Limited has a market capitalization of AU$16m, and reported total annual CEO compensation of AU$332k for the year to June 2023. That's a notable decrease of 23% on last year. In particular, the salary of AU$300.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Australian Metals and Mining industry with market capitalizations under AU$305m, the reported median total CEO compensation was AU$386k. This suggests that Strike Resources remunerates its CEO largely in line with the industry average.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$300k | AU$300k | 90% |

| Other | AU$32k | AU$129k | 10% |

| Total Compensation | AU$332k | AU$429k | 100% |

Speaking on an industry level, nearly 62% of total compensation represents salary, while the remainder of 38% is other remuneration. It's interesting to note that Strike Resources pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Strike Resources Limited's Growth Numbers

Strike Resources Limited has reduced its earnings per share by 68% a year over the last three years. In the last year, the company lost virtually all of its revenue.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Strike Resources Limited Been A Good Investment?

The return of -55% over three years would not have pleased Strike Resources Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 5 warning signs (and 3 which are concerning) in Strike Resources we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SRK

Strike Resources

Operates as a mineral exploration company in Australia, Argentina, and Peru.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives