- Australia

- /

- Professional Services

- /

- ASX:RTH

Qube Holdings And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

As the ASX200 prepares for a flat opening, influenced by declines in US tech stocks and broader economic concerns, investors are keeping a close eye on market shifts. Amid these fluctuations, penny stocks remain an intriguing area of exploration for those interested in smaller or newer companies that may offer untapped potential. Although the term "penny stocks" might seem outdated, it continues to signify investment opportunities in companies with solid financials and promising prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.89 | A$104.27M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.98 | A$319.94M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.95 | A$242.1M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$485.47M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$1.99 | A$111.29M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.32 | A$61.65M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.08 | A$322.17M | ★★★★☆☆ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Qube Holdings (ASX:QUB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qube Holdings Limited, with a market cap of A$7.12 billion, offers logistics solutions for import and export supply chains across Australia, New Zealand, and Southeast Asia.

Operations: The company's revenue primarily comes from its Operating Division, which generated A$3.51 billion.

Market Cap: A$7.12B

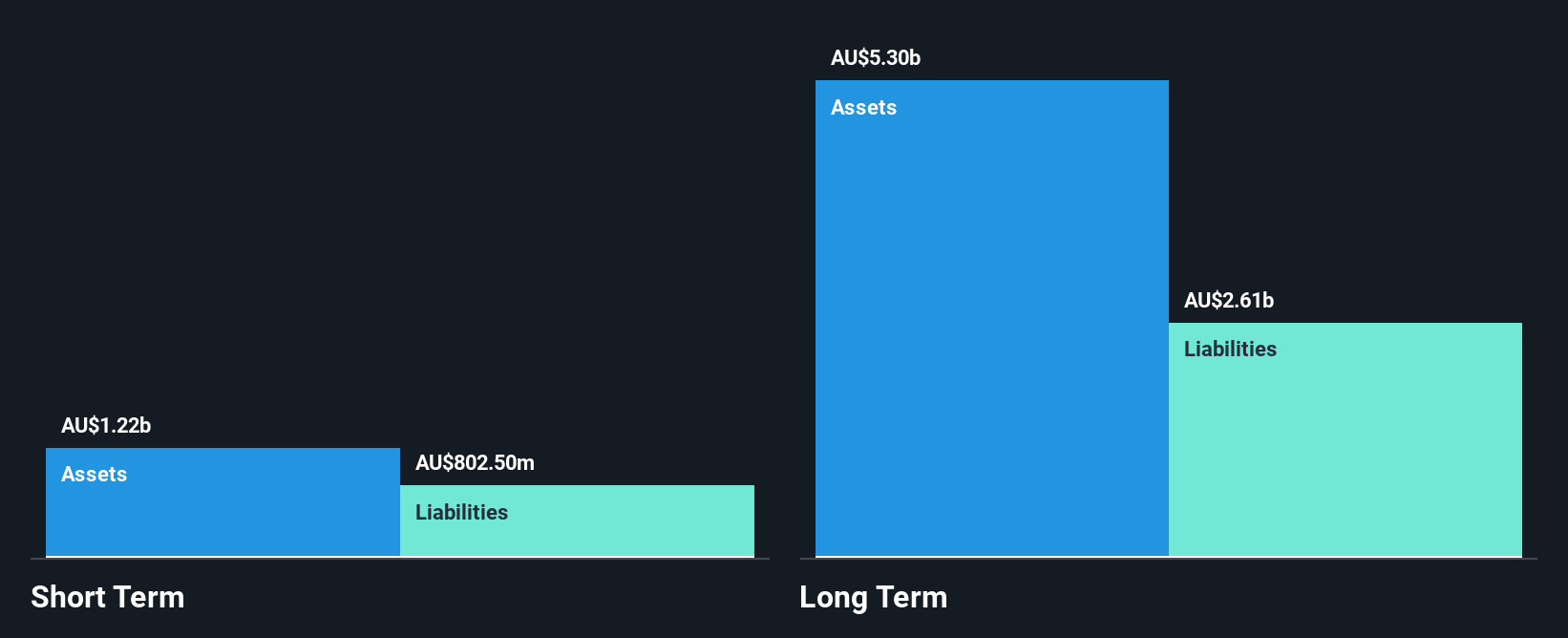

Qube Holdings Limited, with a market cap of A$7.12 billion, is notable for its robust financial health and strategic management changes. Its debt-to-equity ratio has improved over the past five years, and its operating cash flow adequately covers debt obligations. The company has high-quality earnings, with recent profit growth surpassing both its historical average and industry benchmarks. Qube's board is experienced, recently strengthened by the appointment of John Bevan. Additionally, it raised A$600 million through fixed-income offerings to support future initiatives. However, long-term liabilities exceed short-term assets despite strong coverage of short-term liabilities.

- Get an in-depth perspective on Qube Holdings' performance by reading our balance sheet health report here.

- Explore Qube Holdings' analyst forecasts in our growth report.

RAS Technology Holdings (ASX:RTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RAS Technology Holdings Limited offers data, content, SaaS solutions, and digital and media services to the racing and wagering industries across Australia, the UK, the US, and other international markets with a market cap of A$40.86 million.

Operations: The company generates revenue from its Entertainment Software segment, which amounted to A$16.18 million.

Market Cap: A$40.86M

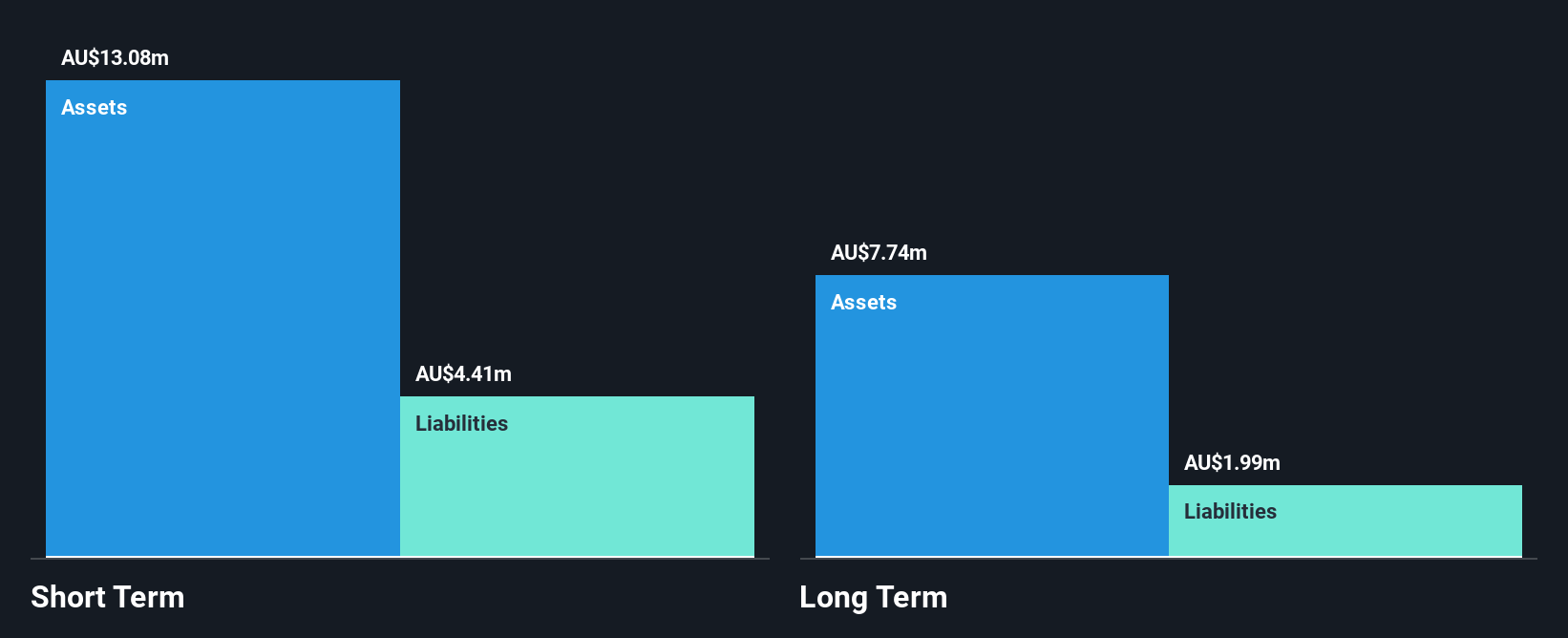

RAS Technology Holdings Limited, with a market cap of A$40.86 million, operates in the racing and wagering industries across several international markets. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a stable financial position with short-term assets of A$12.5 million exceeding both its long-term liabilities (A$2.1 million) and short-term liabilities (A$4.8 million). The company is debt-free and has an experienced board, averaging 3.6 years in tenure. With sufficient cash runway for more than three years under current conditions, RAS is positioned to support its operations without immediate financial distress while aiming for future earnings growth forecasted at 65.46% annually.

- Click here to discover the nuances of RAS Technology Holdings with our detailed analytical financial health report.

- Examine RAS Technology Holdings' earnings growth report to understand how analysts expect it to perform.

Southern Palladium (ASX:SPD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Palladium Limited, with a market cap of A$50.48 million, is involved in the exploration and development of platinum group metals through its subsidiaries.

Operations: Southern Palladium Limited currently does not report any revenue segments.

Market Cap: A$50.48M

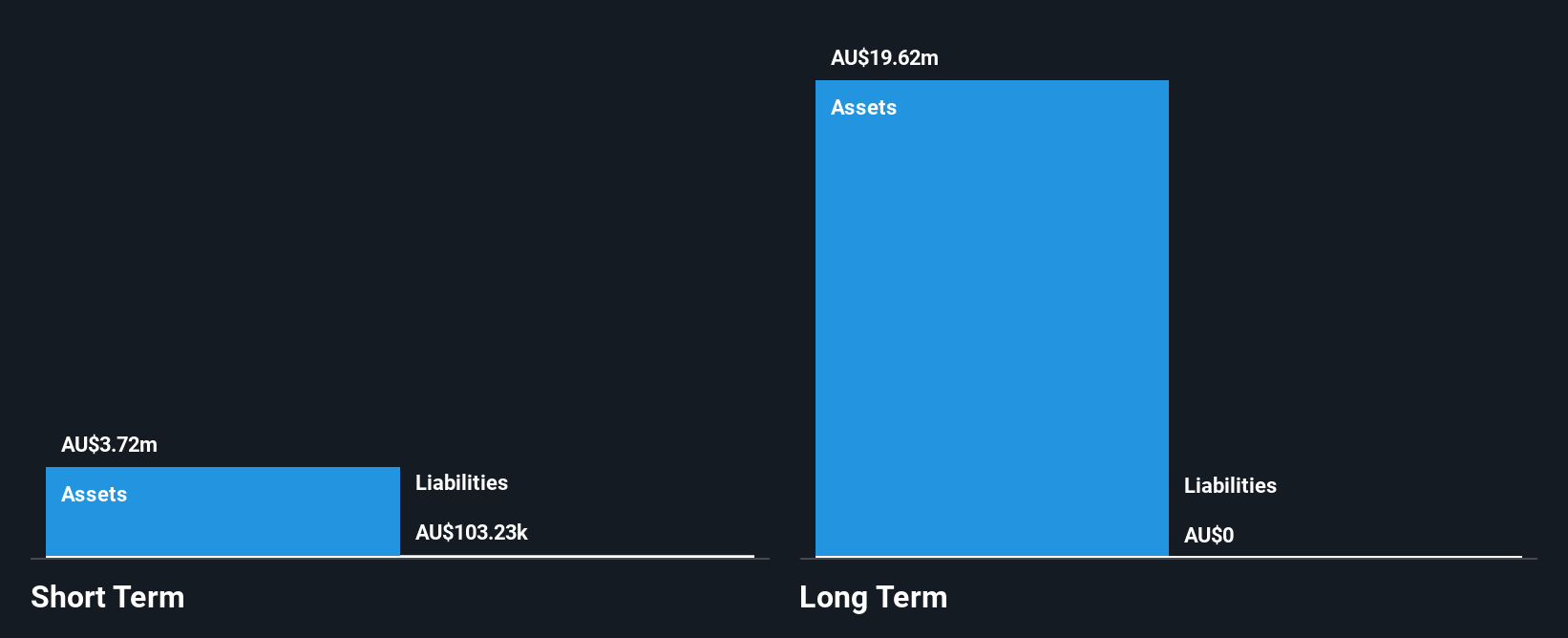

Southern Palladium Limited, with a market cap of A$50.48 million, remains pre-revenue and debt-free, focusing on the exploration and development of platinum group metals. Recent updates highlight significant progress in its Bengwenyama PGM Project, revealing a total combined Mineral Resource of 40.25Moz following successful drilling campaigns and resource estimation reviews by SRK Consulting. With short-term assets of A$5.5 million comfortably covering liabilities and an experienced management team averaging 2.7 years in tenure, Southern Palladium is positioned to leverage its substantial mineral resources while maintaining financial stability without immediate revenue streams.

- Click to explore a detailed breakdown of our findings in Southern Palladium's financial health report.

- Gain insights into Southern Palladium's past trends and performance with our report on the company's historical track record.

Make It Happen

- Access the full spectrum of 1,026 ASX Penny Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RTH

RAS Technology Holdings

Provides data, content, software as a service (SaaS) solution, and digital and media services to the racing and wagering industries in Australia, the United Kingdom, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives