- Australia

- /

- Metals and Mining

- /

- ASX:SMI

Santana Minerals (ASX:SMI) Is Up 24.0% After Securing Full Bendigo-Ophir Land Ownership and Ending Royalties

Reviewed by Sasha Jovanovic

- In recent news, Santana Minerals secured freehold ownership of all land encompassing its Bendigo-Ophir Gold Project in Otago, New Zealand, including the extinguishing of certain net smelter return royalties, for a total consideration of NZ$50 million paid in stages.

- This move gives Santana direct control over key gold deposits and vital infrastructure, significantly simplifying future project development and operational planning.

- We’ll explore how gaining full land ownership and eliminating royalties at Bendigo-Ophir could reshape Santana Minerals’ investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Santana Minerals' Investment Narrative?

For someone considering Santana Minerals, the big picture has always been about the promise of turning a large-scale Otago gold resource into future production. The latest move, securing freehold ownership of all Bendigo-Ophir land while eliminating net smelter return royalties, significantly smooths the path for near-term project approvals and longer-term operational control. Until now, key risks for shareholders included dilution, project uncertainty, and possible cost escalations tied to royalty payments and third-party land access. The ownership deal addresses royalty costs and de-risks land access, which could influence short-term catalysts by making project financing and approvals more straightforward. However, with the business still unprofitable on zero revenue, core risks linger: future dilution, the need to raise significant capital, and execution risk if development timelines slip. Investors may see this as materially shifting the company's risk-reward balance. On the other hand, securing land doesn't erase financing or execution risk, details matter for anyone eyeing the next phase.

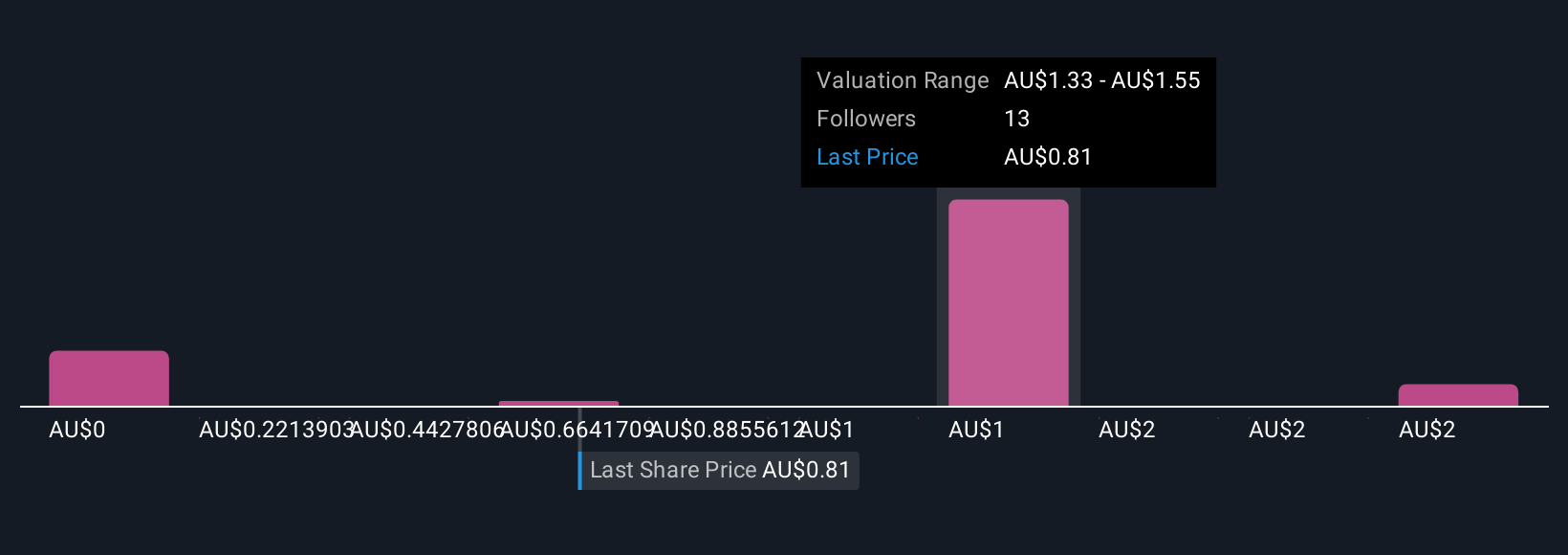

Santana Minerals' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 7 other fair value estimates on Santana Minerals - why the stock might be worth less than half the current price!

Build Your Own Santana Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santana Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Santana Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santana Minerals' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SMI

Santana Minerals

Engages in the exploration and evaluation of gold properties in New Zealand, Cambodia, and Mexico.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives