- Australia

- /

- Metals and Mining

- /

- ASX:SGQ

Could St George Mining's (ASX:SGQ) Major Fundraise Signal a Shift in Its Capital Deployment Strategy?

Reviewed by Sasha Jovanovic

- St George Mining Limited recently completed a follow-on equity offering, raising A$50 million through the issuance of 500,000,000 ordinary shares at A$0.10 each, accompanied by subsequent share transactions involving its investors.

- This influx of capital and increased trading activity highlights mounting market attention on the company's funding efforts and share structure decisions in October 2025.

- We'll examine how St George Mining's sizeable capital raise and shifting share ownership shape its investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is St George Mining's Investment Narrative?

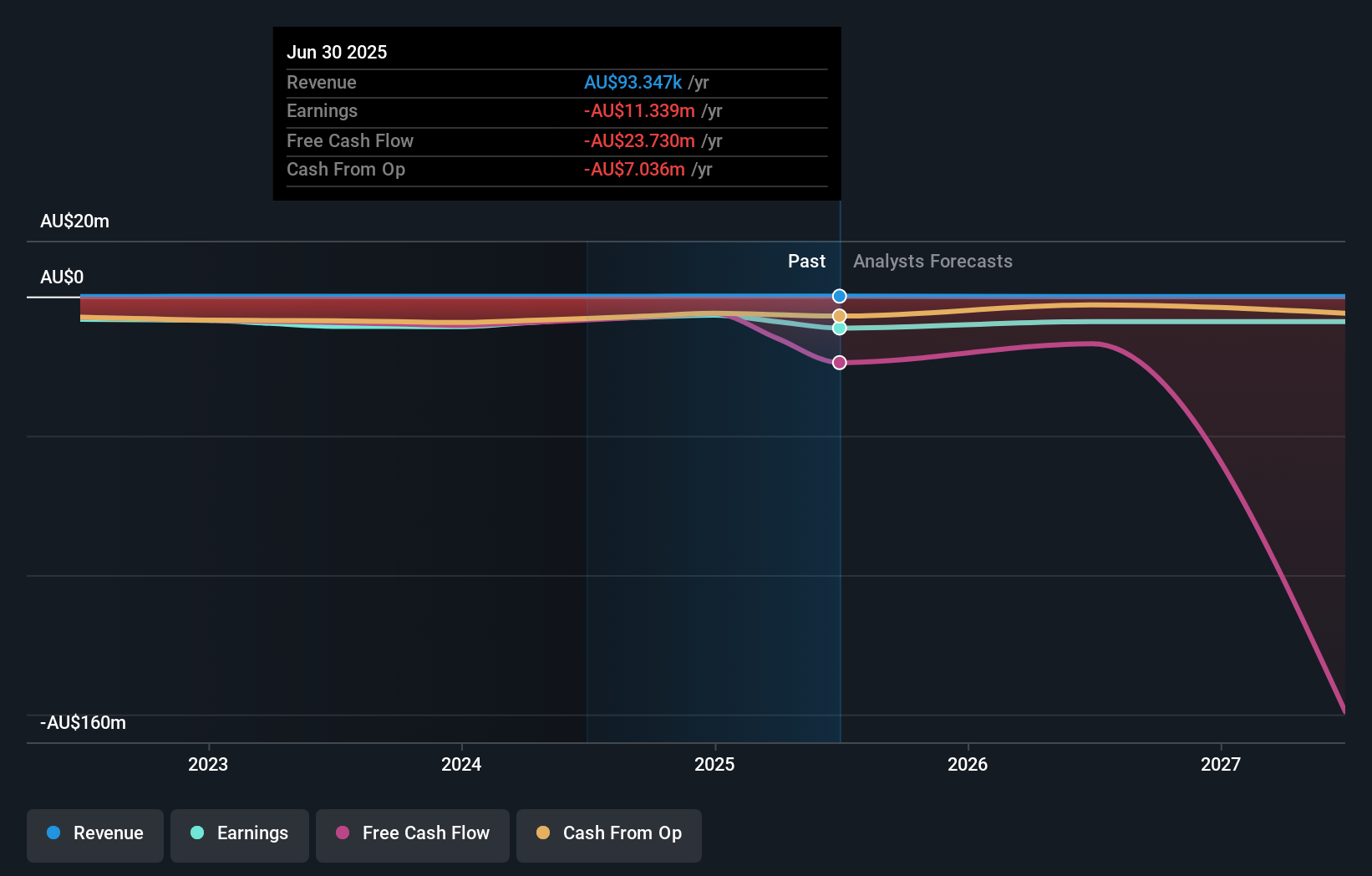

To back St George Mining, you really need to believe in the company’s ability to turn recent capital raises into clear progress at its mineral projects, especially Araxa. The latest A$50 million equity raise is substantial and gives St George breathing space, which could amplify near-term catalysts like resource updates or commercialisation steps. However, with such a large influx of shares and continued losses, the dilution may weigh on future per-share outcomes. The new capital has likely eased some funding concerns, for now, but doesn’t fully erase the company’s dependence on investor support, given ongoing cash burn and the auditor’s going concern comment. The short-term narrative is a balance: fresh funding could unlock key project news, but persistent losses and management turnover remain top risks. The heightened market activity after the raise shows this shift is front of mind for shareholders.

But the company still faces doubt around its ability to keep operating without ongoing new funds. In light of our recent valuation report, it seems possible that St George Mining is trading beyond its estimated value.Exploring Other Perspectives

Explore another fair value estimate on St George Mining - why the stock might be worth as much as 30% more than the current price!

Build Your Own St George Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your St George Mining research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free St George Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate St George Mining's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGQ

St George Mining

Engages in the exploration for mineral properties in Australia.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success