- Australia

- /

- Hospitality

- /

- ASX:HLO

ASX Penny Stock Highlights: Ai-Media Technologies And Two Other Noteworthy Picks

Reviewed by Simply Wall St

As the ASX 200 started the new financial year trading flat, with sectors like Utilities and IT showing positive intra-day gains, investors are closely watching for opportunities amid mixed performances across various industries. Penny stocks, although an older market term, continue to represent smaller or less-established companies that may present value and growth potential. By focusing on those with solid financials and a clear path forward, investors can uncover promising opportunities in these under-the-radar stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.375 | A$107.47M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.46 | A$116.05M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$120.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.85 | A$439.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.785 | A$471.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.66 | A$862.38M | ✅ 4 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.695 | A$830.68M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.74 | A$234.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.54 | A$167.97M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.755 | A$141.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 477 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers technology-driven captioning, transcription, and translation services across Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom with a market cap of A$116.94 million.

Operations: The company's revenue is derived from its Internet Software & Services segment, amounting to A$65.30 million.

Market Cap: A$116.94M

Ai-Media Technologies Limited, with a market cap of A$116.94 million and revenue of A$65.30 million, is leveraging its LEXI platform to expand accessibility in multilingual broadcasting. Recent partnerships with Lightning International and AudioShake enhance its real-time translation capabilities, opening new revenue streams by breaking language barriers across global markets. While currently unprofitable, Ai-Media has improved its financial position over the past five years and maintains a sufficient cash runway for more than three years due to positive free cash flow growth. Despite these strengths, the company faces challenges such as an inexperienced board and ongoing unprofitability.

- Take a closer look at Ai-Media Technologies' potential here in our financial health report.

- Review our growth performance report to gain insights into Ai-Media Technologies' future.

Helloworld Travel (ASX:HLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helloworld Travel Limited is a travel distribution company operating in Australia, New Zealand, and internationally with a market cap of A$243.36 million.

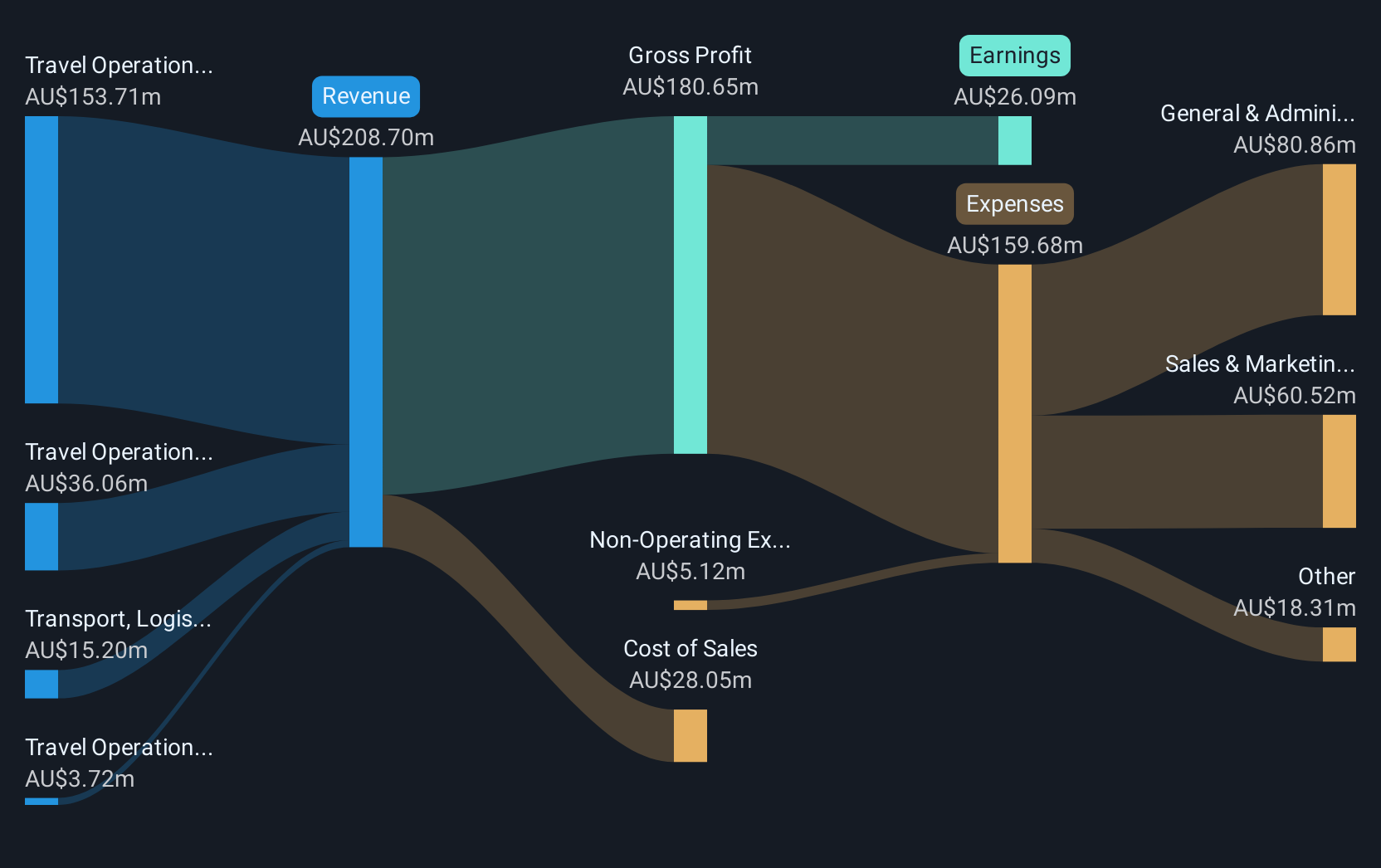

Operations: The company's revenue is primarily generated from its Travel Operations in Australia (A$153.71 million), New Zealand (A$36.06 million), and the Rest of the World (A$3.72 million), along with contributions from its Transport, Logistics and Warehousing segment (A$15.20 million).

Market Cap: A$243.36M

Helloworld Travel Limited, with a market cap of A$243.36 million, is strategically positioned in the travel industry but faces challenges such as declining net profit margins and negative earnings growth over the past year. Despite this, it remains debt-free and offers a dividend yield of 7.38%, though not fully covered by free cash flows. Recent M&A activity suggests potential consolidation with Webjet Group, which could enhance its online booking capabilities if pursued successfully. The company trades at a favorable price-to-earnings ratio of 9.3x compared to the broader Australian market and has shown stable weekly volatility over the past year.

- Dive into the specifics of Helloworld Travel here with our thorough balance sheet health report.

- Gain insights into Helloworld Travel's outlook and expected performance with our report on the company's earnings estimates.

SciDev (ASX:SDV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SciDev Limited offers environmental solutions for water-intensive industries across Australia, the United States, Asia, and other international markets, with a market cap of A$68.43 million.

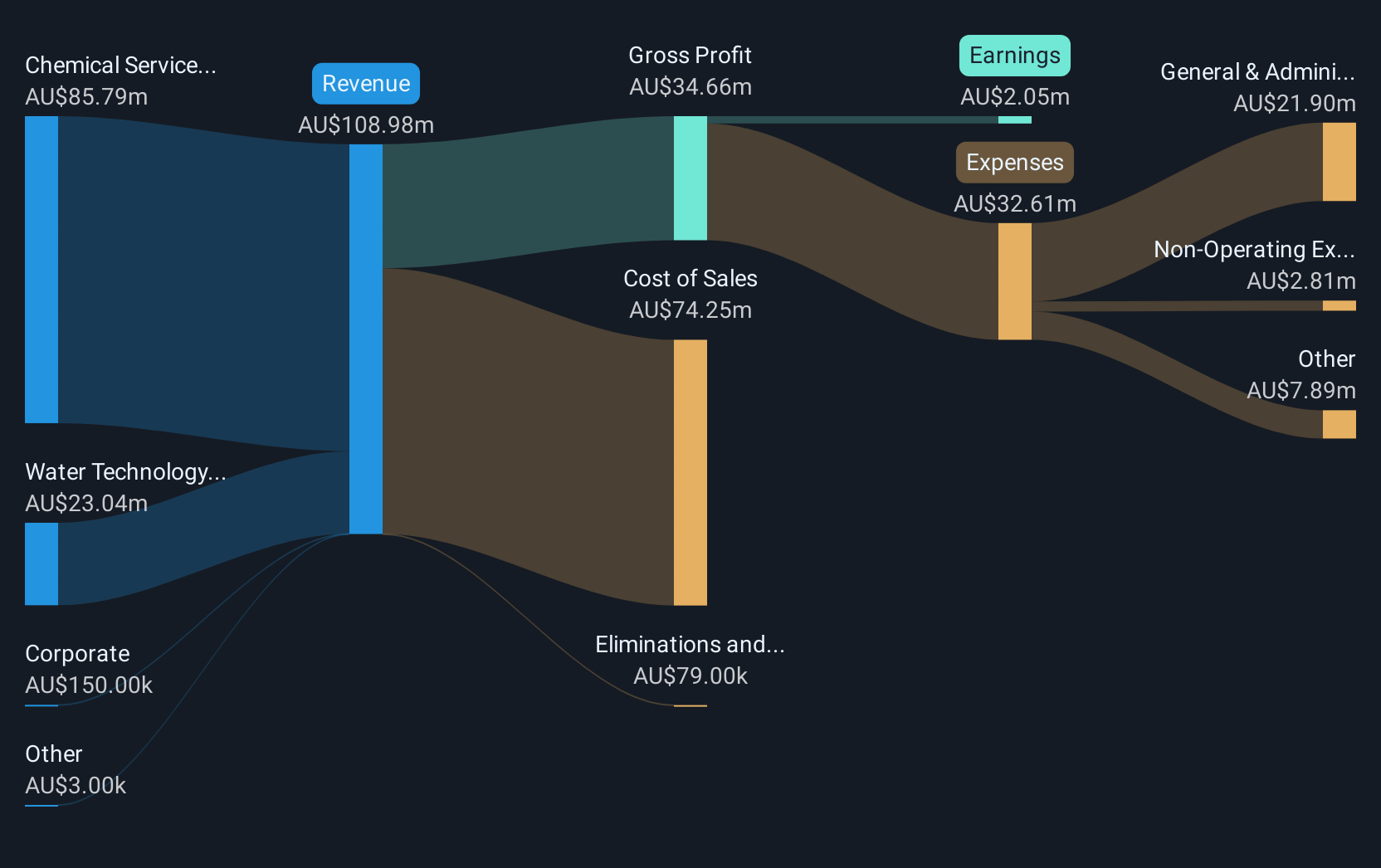

Operations: The company's revenue is primarily derived from its Chemical Services segment, which generated A$85.79 million, followed by the Water Technology segment with A$23.04 million.

Market Cap: A$68.43M

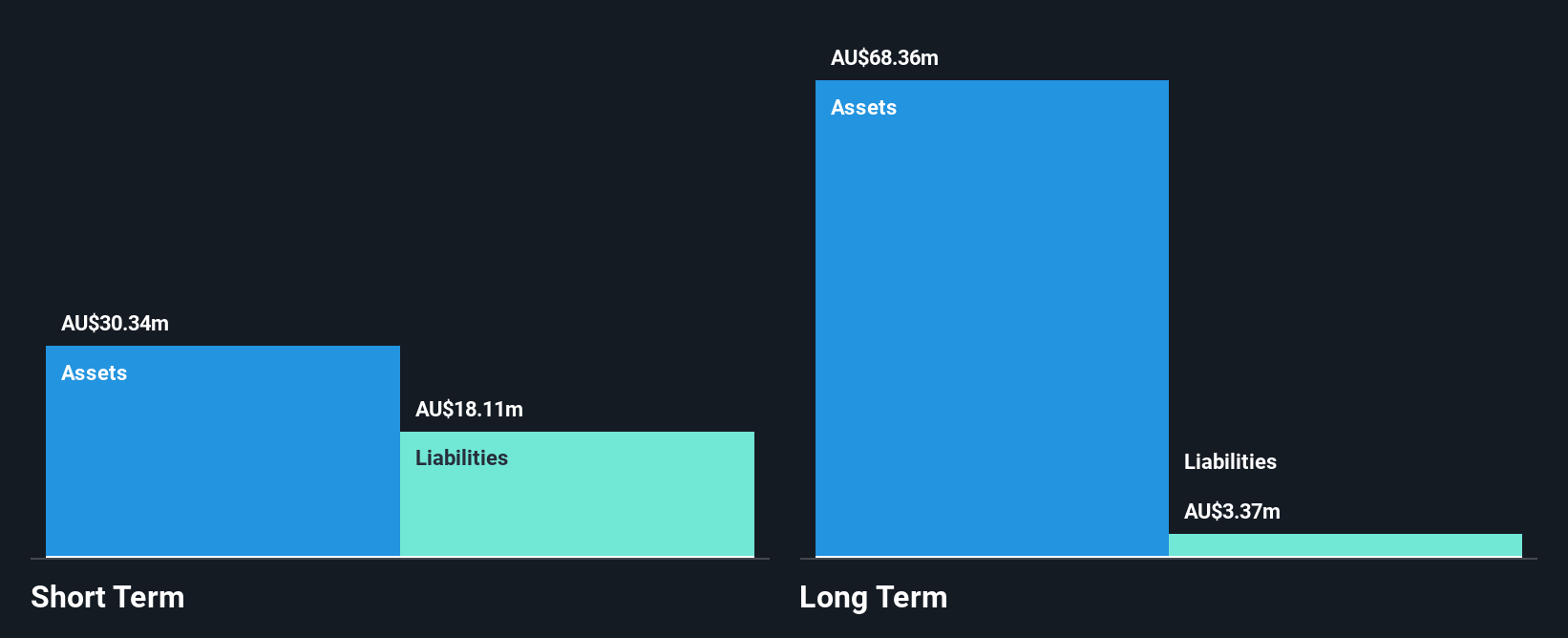

SciDev Limited, with a market cap of A$68.43 million, is trading at 51% below its estimated fair value, indicating potential undervaluation in the penny stock segment. The company has transitioned to profitability over the past year and forecasts suggest earnings growth of 45.4% annually. SciDev's financial health appears robust with short-term assets covering both short and long-term liabilities, while its interest payments are well covered by EBIT at 7.2x coverage. However, despite having more cash than total debt and stable weekly volatility (10%), the company's Return on Equity remains low at 4%.

- Navigate through the intricacies of SciDev with our comprehensive balance sheet health report here.

- Assess SciDev's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Click this link to deep-dive into the 477 companies within our ASX Penny Stocks screener.

- Ready For A Different Approach? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helloworld Travel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLO

Helloworld Travel

Operates as a travel distribution company in Australia, New Zealand, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives