- Australia

- /

- Metals and Mining

- /

- ASX:RVR

With EPS Growth And More, Red River Resources (ASX:RVR) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Red River Resources (ASX:RVR), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Red River Resources

Red River Resources's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Red River Resources's EPS has grown 24% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

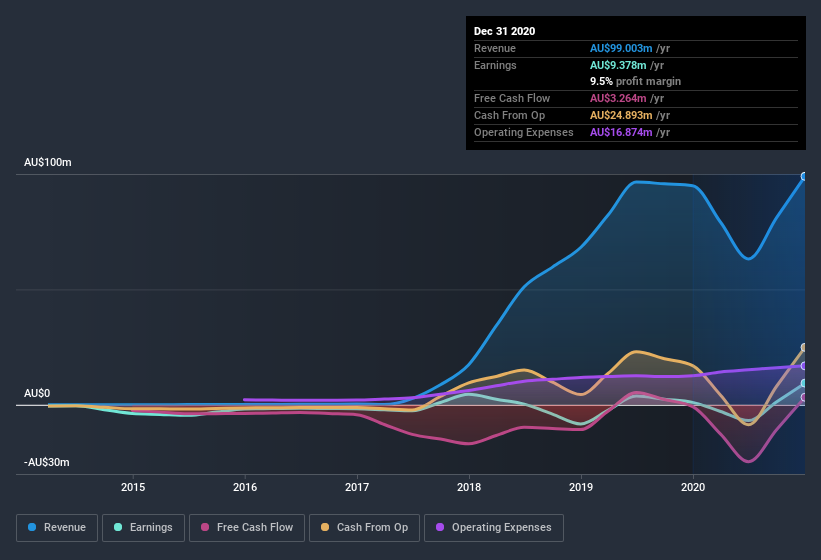

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Red River Resources shareholders can take confidence from the fact that EBIT margins are up from 2.3% to 11%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Since Red River Resources is no giant, with a market capitalization of AU$129m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Red River Resources Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Red River Resources shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Independent Non-Executive Director Timothy Stephen Hanlon bought AU$35k worth of shares at an average price of around AU$0.24.

Is Red River Resources Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Red River Resources's strong EPS growth. Not only is that growth rate rather juicy, but the insider buying makes my mouth water. To put it succinctly; Red River Resources is a strong candidate for your watchlist. Still, you should learn about the 2 warning signs we've spotted with Red River Resources .

The good news is that Red River Resources is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Red River Resources or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:RVR

Red River Resources

Red River Resources Limited, together with its subsidiaries, explores for and develops mineral projects in Australia.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives