- Australia

- /

- Metals and Mining

- /

- ASX:RSG

Why Resolute Mining (ASX:RSG) Is Up 5.4% After La Debo's Initial 643,000-Ounce Gold Estimate

Reviewed by Sasha Jovanovic

- On November 18, 2025, Resolute Mining Limited announced its initial Mineral Resource Estimate for the La Debo Project in Côte d'Ivoire, outlining 17.6 million tonnes at 1.14 g/t gold for 643,000 ounces of contained gold at a 0.5 g/t cut-off grade.

- This marks a significant jump from La Debo’s historic resource and showcases the company’s potential to expand resources further through ongoing and future exploration, particularly with notable gold anomalies identified at additional prospect areas.

- With the first Mineral Resource Estimate at La Debo and resource expansion plans underway, we’ll examine how these developments influence Resolute Mining’s investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

Resolute Mining Investment Narrative Recap

To take a position in Resolute Mining today, I think you need to believe that ongoing resource discoveries and reserve expansions, like the recent results at La Debo, support the company’s ambition to materially grow production over the next several years. However, while this initial resource upgrade is a positive indicator for future exploration success, it does not immediately alleviate the most pressing near-term risk: Resolute’s operational and permitting challenges at Syama in Mali, which continue to weigh on production stability and costs.

The September 2025 updated Mineral Resource Estimate at the Doropo Gold Project is especially relevant. With Doropo’s resource base lifted to 4.4 million ounces and ongoing drilling in Côte d’Ivoire, Resolute is aiming to extend mine life and diversify beyond its legacy Syama asset, potentially reducing reliance on any single jurisdiction and aligning with key growth catalysts.

On the other hand, information investors should be aware of is how persistent supply chain disruptions in Mali may still put short-term...

Read the full narrative on Resolute Mining (it's free!)

Resolute Mining's narrative projects $1.2 billion in revenue and $338.5 million in earnings by 2028. This requires 11.0% yearly revenue growth and a $329 million earnings increase from the current $9.5 million.

Uncover how Resolute Mining's forecasts yield a A$1.38 fair value, a 29% upside to its current price.

Exploring Other Perspectives

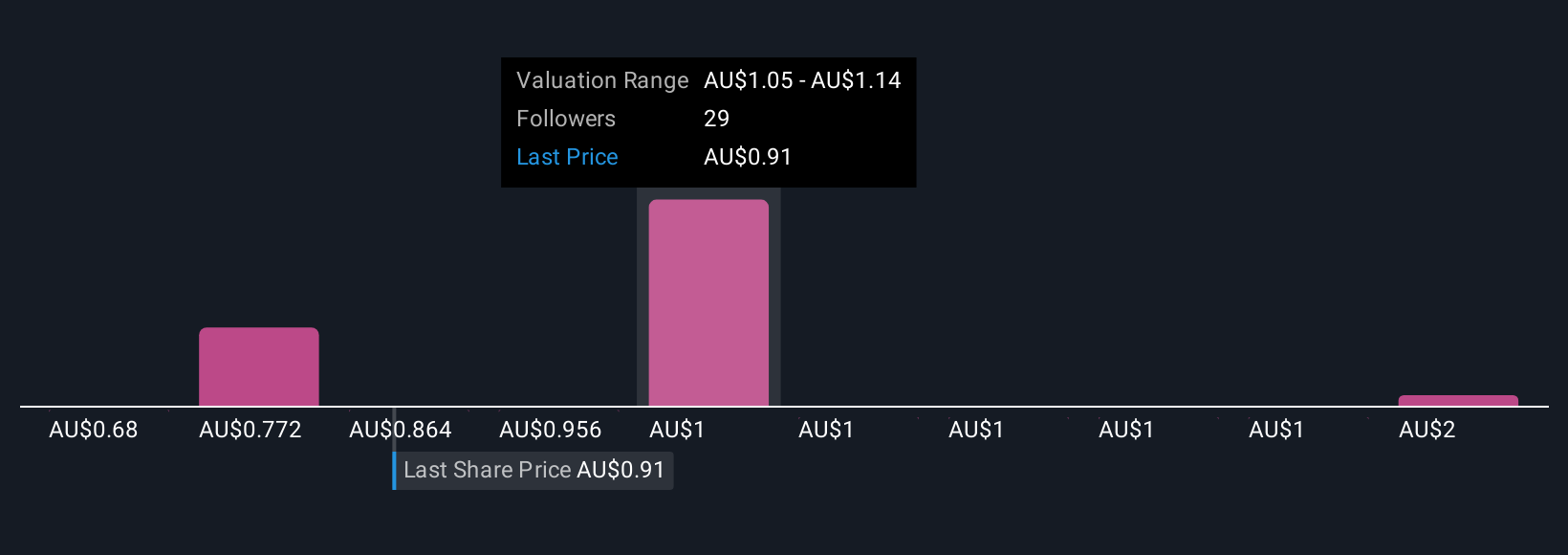

Nine members of the Simply Wall St Community see fair value for Resolute Mining ranging from just A$0.68 up to A$25.90 per share. With such a wide spread in independent estimates, remember that future production outcomes and country risks remain central in shaping your own expectations.

Explore 9 other fair value estimates on Resolute Mining - why the stock might be a potential multi-bagger!

Build Your Own Resolute Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Resolute Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Resolute Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Resolute Mining's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RSG

Resolute Mining

Engages in mining, prospecting, and exploration of mineral properties in Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives