- Australia

- /

- Consumer Finance

- /

- ASX:FPR

Unveiling 3 Undervalued Asian Small Caps With Insider Buying

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by Japan's significant interest rate hike and China's mixed economic signals, small-cap stocks present intriguing opportunities amidst broader market fluctuations. In this context, identifying promising small-cap companies often involves looking at those with strong fundamentals and insider buying activity, which can indicate confidence in the company's potential despite current market challenges.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.1x | 0.9x | 28.66% | ★★★★★★ |

| East West Banking | 3.1x | 0.7x | 20.83% | ★★★★★☆ |

| Paragon Care | 16.1x | 0.1x | 27.83% | ★★★★★☆ |

| Centurion | 3.7x | 3.1x | -55.06% | ★★★★☆☆ |

| Chinasoft International | 21.2x | 0.7x | -1189.74% | ★★★★☆☆ |

| BWP Trust | 11.0x | 14.4x | 11.25% | ★★★★☆☆ |

| Dicker Data | 22.3x | 0.8x | -46.39% | ★★★☆☆☆ |

| Nickel Asia | 11.8x | 1.8x | 15.63% | ★★★☆☆☆ |

| PSC | 9.8x | 0.4x | 19.71% | ★★★☆☆☆ |

| Nufarm | NA | 0.3x | -126.94% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

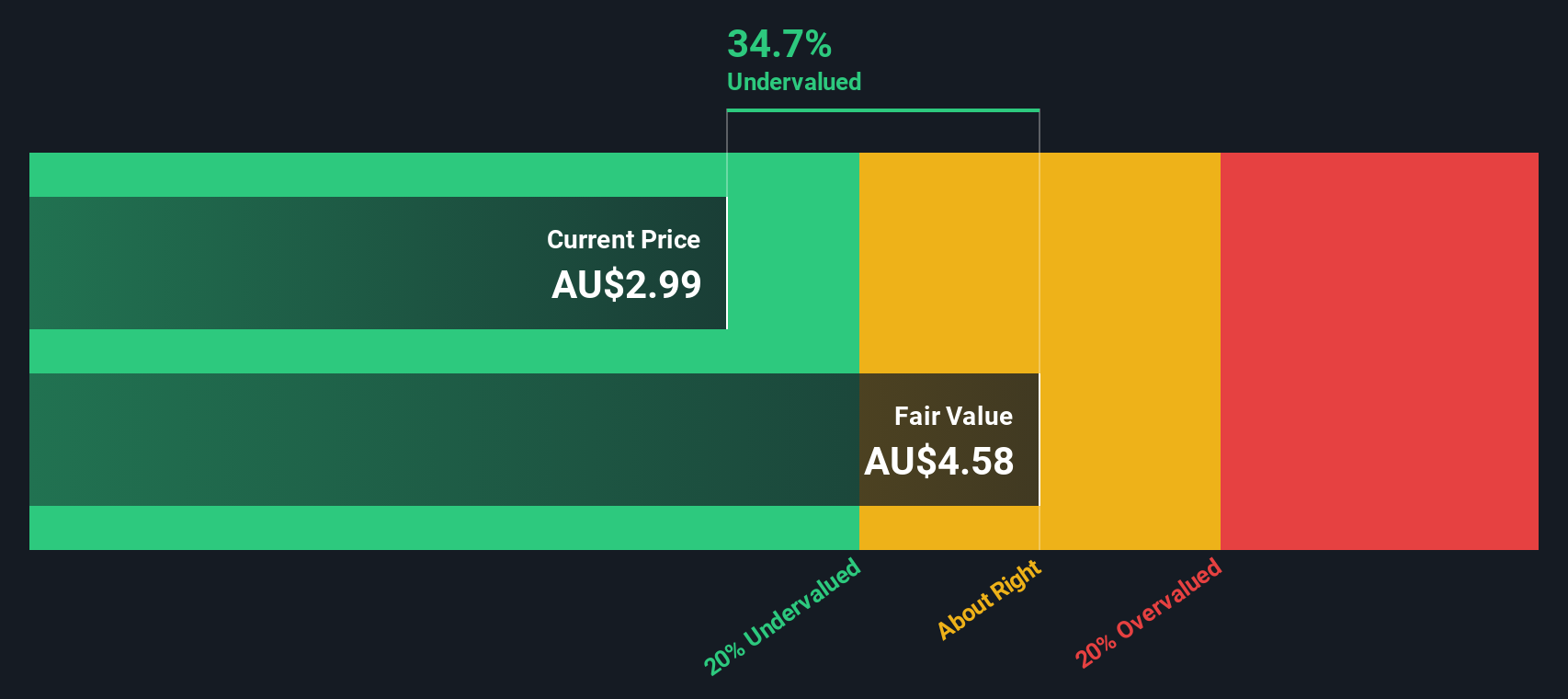

FleetPartners Group (ASX:FPR)

Simply Wall St Value Rating: ★★★★★★

Overview: FleetPartners Group specializes in vehicle leasing and fleet management services, with a market capitalization of A$1.2 billion.

Operations: FleetPartners Group generates revenue primarily through its operations, with a notable focus on managing costs associated with goods sold and operating expenses. The company has experienced fluctuations in its gross profit margin, which reached 42.28% in September 2017 before declining to 28.44% by December 2025. Operating expenses are consistently significant, often exceeding A$100 million per period, impacting overall profitability. The net income margin showed improvement from negative figures in early periods to positive margins over recent years, peaking at 15% in June 2022 before gradually decreasing to around 9.58% by the end of December 2025.

PE: 8.3x

FleetPartners Group, a small company in Asia, has demonstrated insider confidence with recent share purchases. Between April and September 2025, the company repurchased 8.8 million shares for A$25.3 million. Despite a slight decline in net income to A$75.34 million from A$77.88 million last year and earnings forecasted to decrease by 4% annually over the next three years, FleetPartners maintains strong cash flow management and offers dividends of A$0.136 per share, indicating stable shareholder returns amidst growth challenges.

- Click here to discover the nuances of FleetPartners Group with our detailed analytical valuation report.

Explore historical data to track FleetPartners Group's performance over time in our Past section.

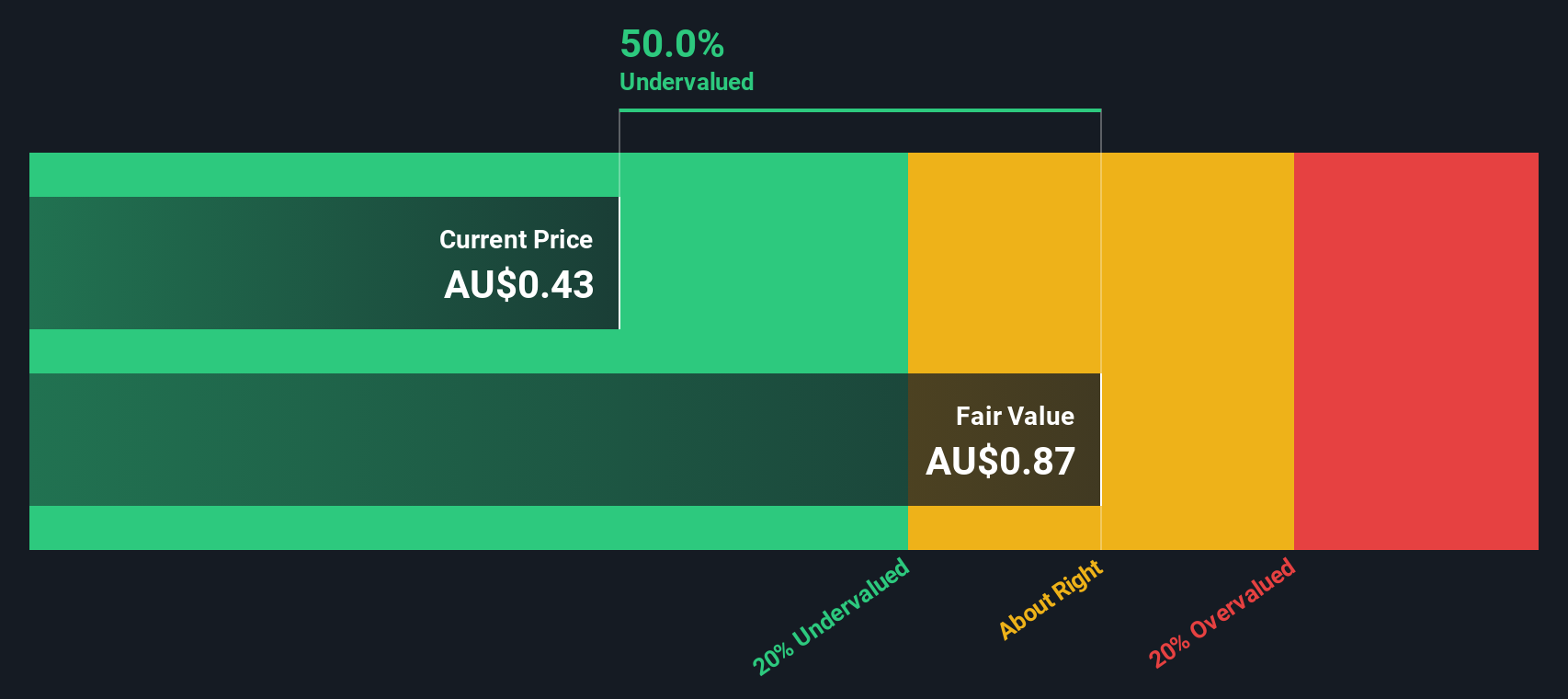

MGX Resources (ASX:MGX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MGX Resources is involved in the mining sector with operations primarily focused on Koolan Island, and it has a market cap of A$1.25 billion.

Operations: MGX Resources generates revenue primarily from its Koolan Island operations, with recent figures showing a revenue of A$330.53 million. The company's cost of goods sold closely aligns with its revenue, leading to minimal gross profit margins, such as 0.07% in the latest period. Operating expenses and non-operating expenses further impact net income, resulting in a negative net income margin of -24.87%.

PE: -6.4x

MGX Resources, operating in a challenging environment with earnings declining by 32.5% annually over the past five years, has caught attention due to insider confidence. Brett Smith's purchase of 170,000 shares for A$59,500 reflects belief in potential despite risks from external borrowing. Recent board changes and a new share repurchase program announced on November 12, 2025 highlight strategic shifts. With sales guidance targeting up to 3.2 million tonnes at competitive costs for FY2026, MGX aims to navigate its financial landscape with cautious optimism.

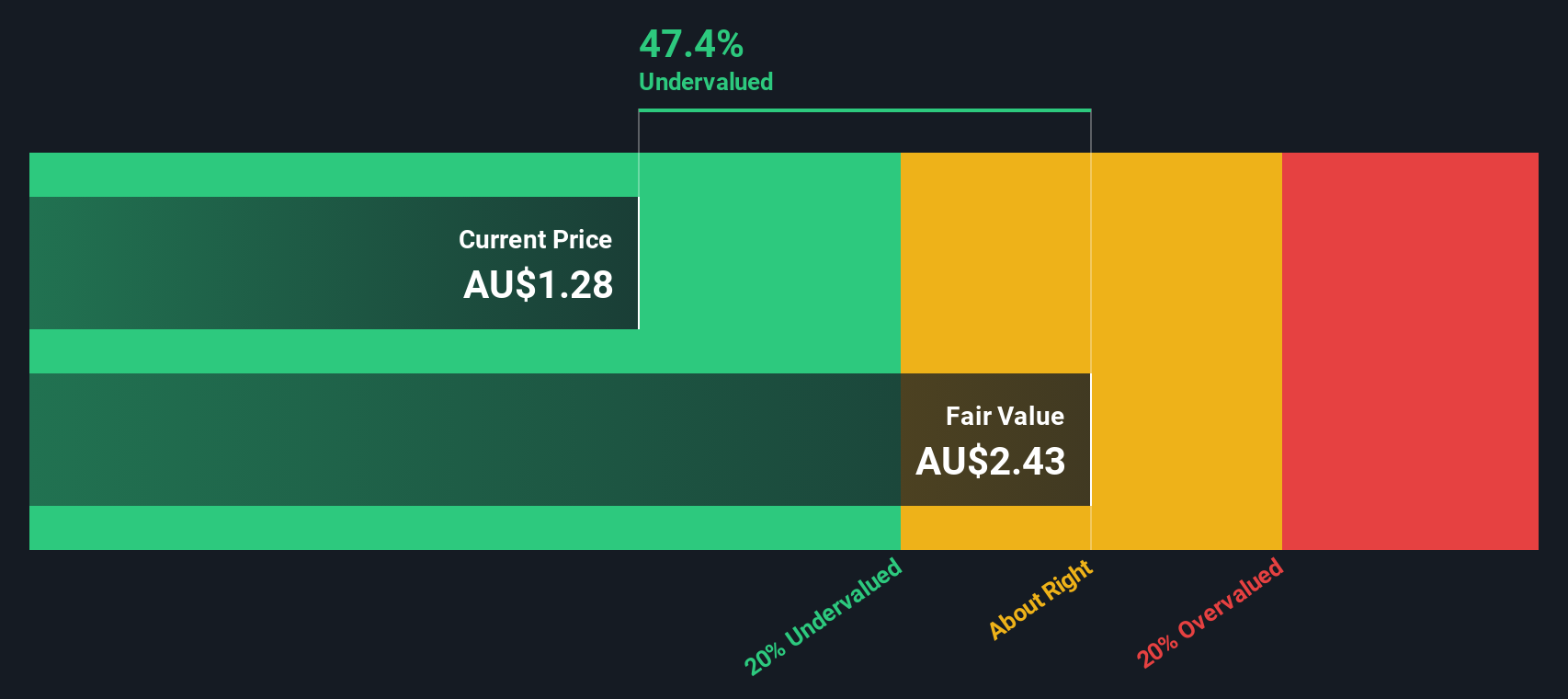

Resolute Mining (ASX:RSG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Resolute Mining is a gold mining company with operations primarily in Mali and Senegal, and it has a market cap of approximately A$0.51 billion.

Operations: Resolute Mining generates revenue primarily from its Syama and Mako operations, with recent quarterly revenues reaching $906.98 million. The company's cost of goods sold (COGS) was recorded at $460.20 million, contributing to a gross profit margin of 49.26%. Operating expenses have been significant, impacting net income margins, which recently showed a slight positive trend at 1.05%.

PE: 190.2x

Resolute Mining, a smaller company in the mining sector, recently joined the S&P/ASX 200 Index and Materials Sector Index on December 19, 2025. The updated feasibility study for their Doropo Gold Project in Cote d'Ivoire shows increased capital costs of A$142 million due to plant capacity expansion and other factors. Despite a decrease in gold production to 211,318 ounces for the first nine months of 2025 compared to last year, insider confidence is evident with share purchases from October through December. Earnings are projected to grow at an annual rate of over 50%, indicating potential for future value creation amidst current challenges.

Where To Now?

- Unlock more gems! Our Undervalued Asian Small Caps With Insider Buying screener has unearthed 49 more companies for you to explore.Click here to unveil our expertly curated list of 52 Undervalued Asian Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FPR

FleetPartners Group

Provides fleet management services in Australia and New Zealand.

Very undervalued second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion