- Australia

- /

- Metals and Mining

- /

- ASX:RMS

Will Ramelius Resources' (ASX:RMS) Conference Insights Reveal a Shift in Management Credibility?

Reviewed by Simply Wall St

- Ramelius Resources recently announced it will report its Q4 2025 results pre-market on July 29, 2025, following company presentations by CEO Mark Zeptner at the Noosa Mining Investor Conference on July 24, 2025.

- Investor focus has increased as stakeholders await operational and financial updates that could emerge from both the upcoming conference and earnings call.

- With the company’s senior leadership presenting new insights at a major mining conference, we’ll consider how this may influence the investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ramelius Resources Investment Narrative Recap

Shareholders in Ramelius Resources are essentially backing the long-term potential of its expanded gold resource base and operational efficiency, especially as the company integrates new assets and invests heavily in exploration. The upcoming Q4 2025 results and insights from CEO Mark Zeptner’s appearance at the Noosa Mining Investor Conference are not expected to materially change the main short-term catalyst, successful integration of the Spartan Resources acquisition, but investors should watch for near-term updates on execution and cost management. The greatest business risk remains ongoing ore grade decline and resource depletion at key sites, which could pressure margins if discoveries or extensions don’t keep pace.

Among the recent announcements, the advanced Q4 2025 results date (pre-market July 29) stands out as most relevant given current market focus on operational progress and integration. Timely and transparent updates here may clarify management’s stance on both capital allocation and how resource quality is tracking, informing the market’s view on whether the integration risk and exploration spend can be effectively managed in the near term.

Yet with increased exploration spend brings heightened expectations, and if new resource discoveries don’t land, investors should be aware that...

Read the full narrative on Ramelius Resources (it's free!)

Ramelius Resources' outlook expects revenue of A$1.0 billion and earnings of A$286.2 million by 2028. This is based on a forecast annual revenue decline of 0.7% and a decrease in earnings of A$59.5 million from the current A$345.7 million.

Uncover how Ramelius Resources' forecasts yield a A$3.19 fair value, a 27% upside to its current price.

Exploring Other Perspectives

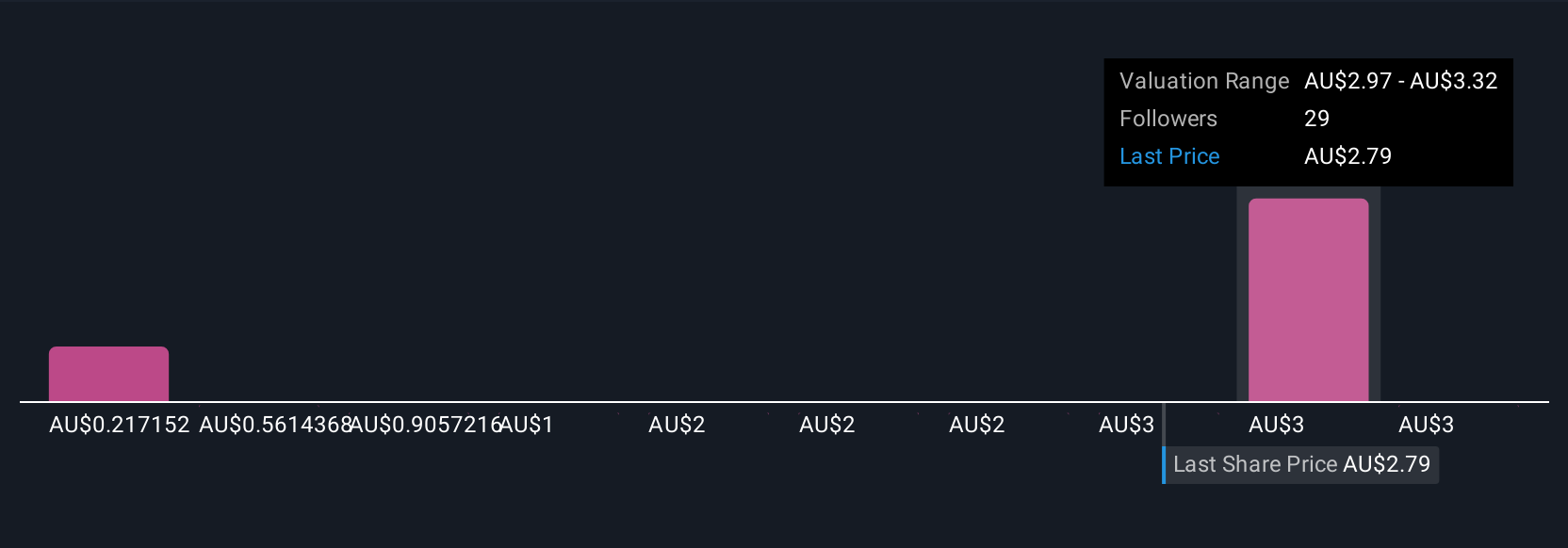

Simply Wall St Community members have estimated Ramelius’s fair value anywhere from A$0.41 to A$3.66 across five different views. While these opinions vary widely, the company’s recent focus on successful integration of acquired assets may prove critical for future performance.

Explore 5 other fair value estimates on Ramelius Resources - why the stock might be worth less than half the current price!

Build Your Own Ramelius Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ramelius Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ramelius Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ramelius Resources' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RMS

Ramelius Resources

Engages in the exploration, evaluation, mine development and operation, production, and sale of gold.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives